What message could the bond market be communicating?

Are the “bond vigilantes” back, demanding higher yields to protest the Federal Reserve’s policies, as they supposedly did during the early 1980s according to economist Ed Yardeni, who coined the “bond vigilante” phrase?

Are the “bond vigilantes” back like they supposedly were during the 1994 Great Bond Massacre, protesting concerns about federal government spending levels? During the 1994 crisis, Clinton Administration political adviser James Carville referenced the “bond vigilantes” when he said, "I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody."

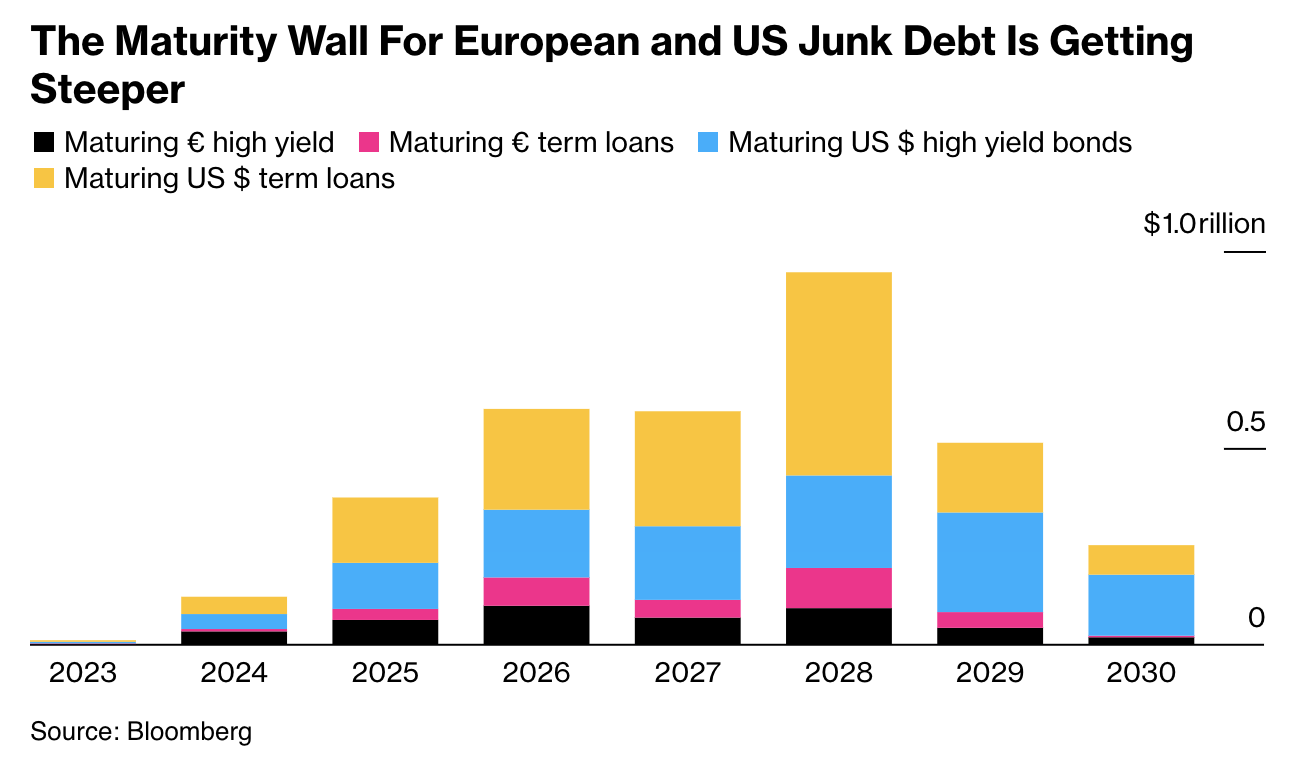

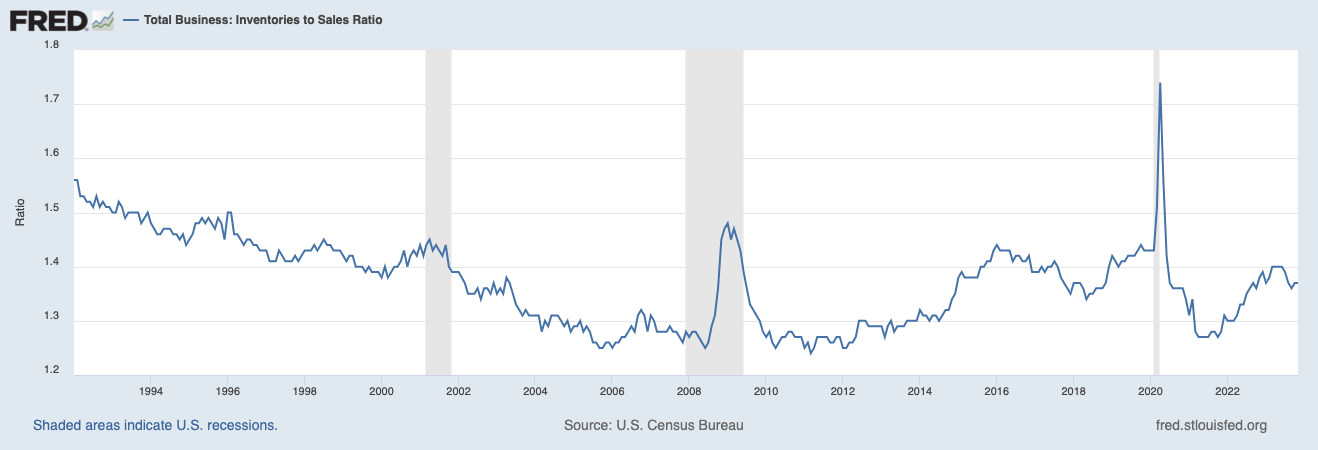

We argue the current situation is a straightforward supply and demand issue. The bond market sees ongoing large auctions of Treasury notes and bonds on the horizon, as federal government spending remains at elevated relative to a few years ago, federal tax revenues have been in decline since the end of 2022, and the U.S. Treasury Department shifts away from its reliance on Treasury bill issuance. There will be a jump in the supply of longer maturity notes and bonds.

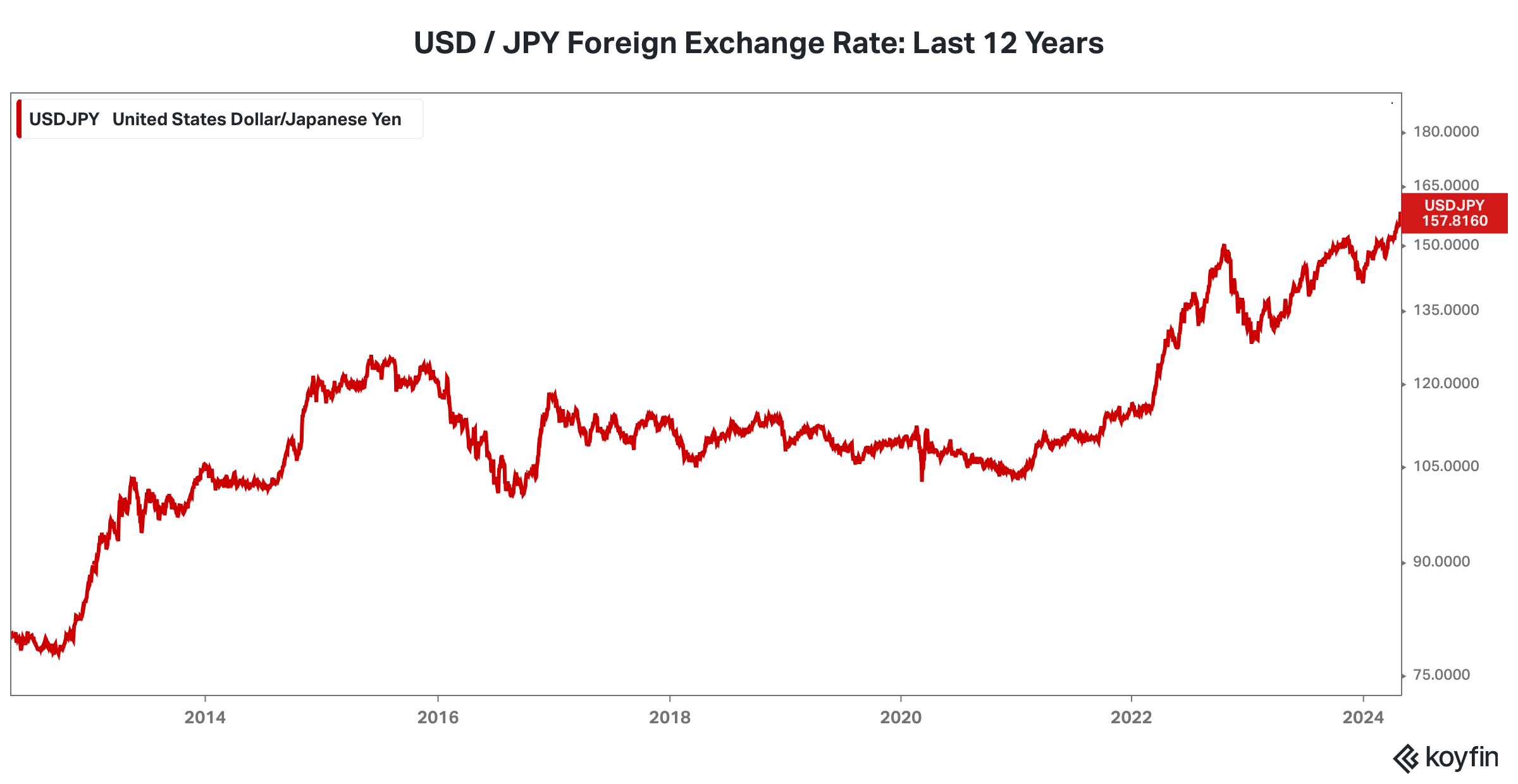

What about buyers, i.e., demand, for the increased supply? Most importantly, the Federal Reserve ended its Quantitative Easing program and is reducing the size of its balance sheet. It was a big buyer of Treasuries, and a price insensitive one at that. China and Japan have curtailed their purchases of Treasuries, whether for geo-political or domestic reasons. U.S. banks already have too much interest rate duration as the regional bank crisis highlighted in March 2023. Defined benefit pension funds and traditional life insurers, once large natural buyers of long maturity Treasuries, are in decline.

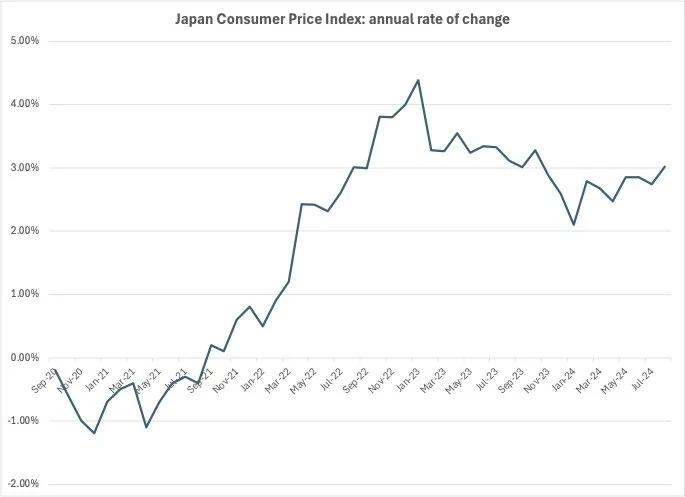

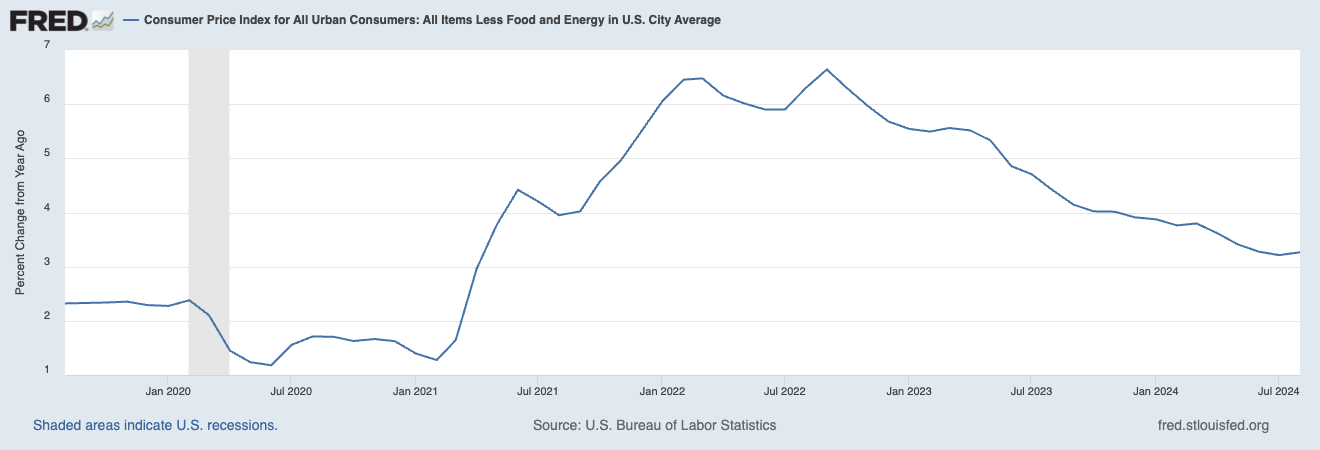

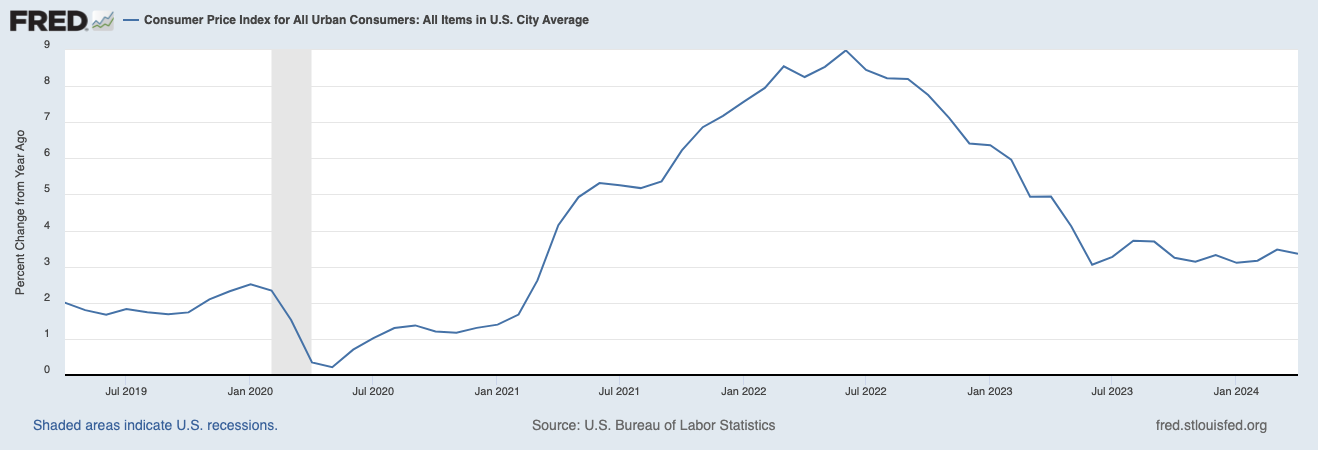

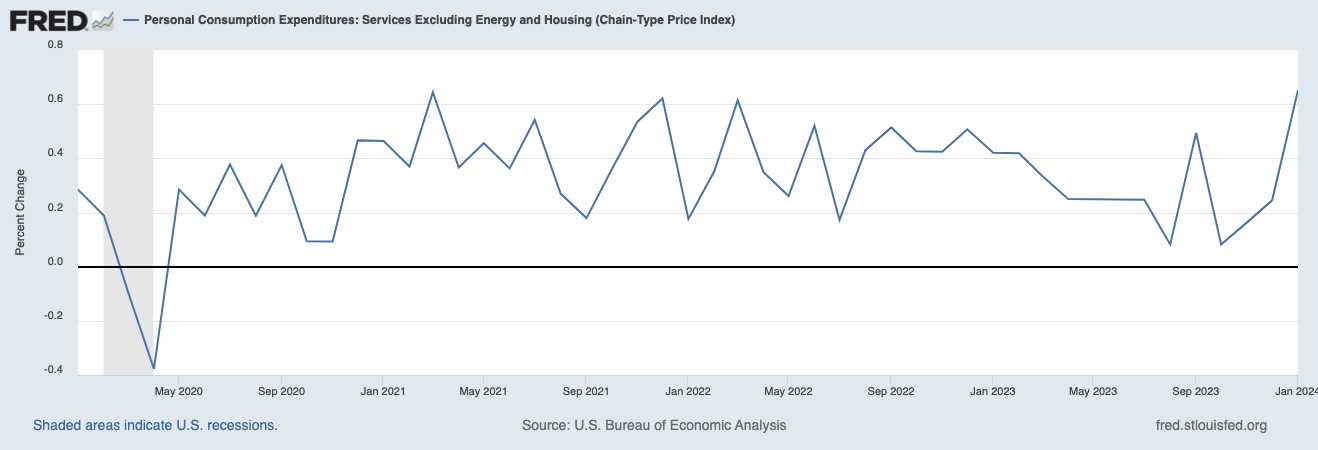

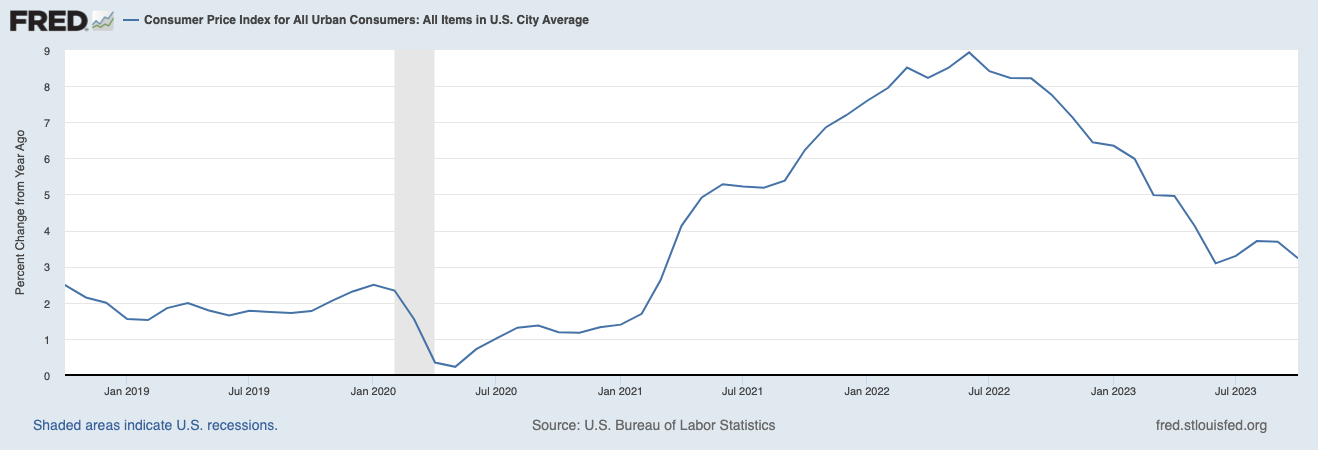

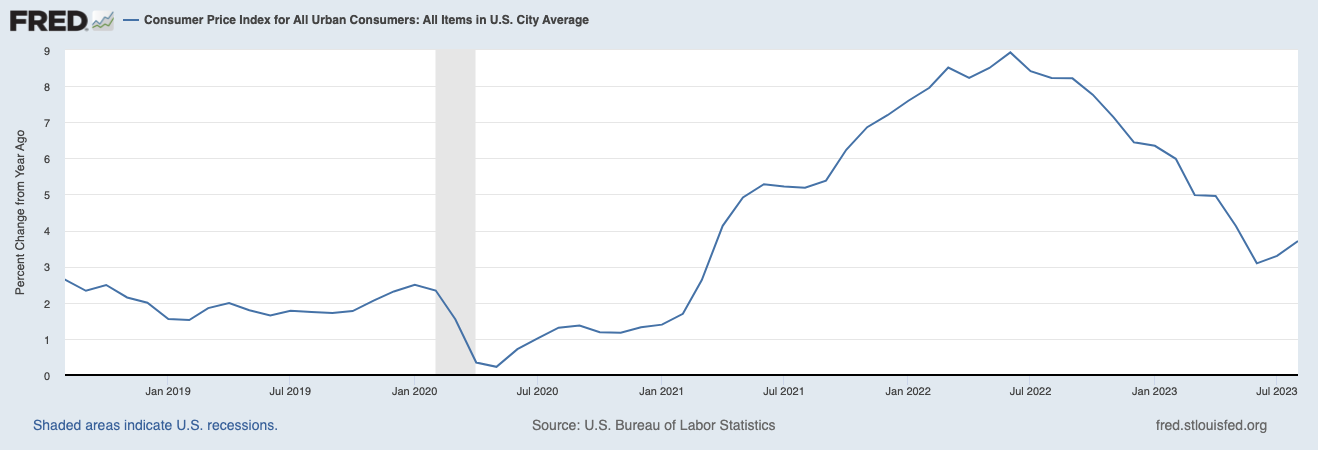

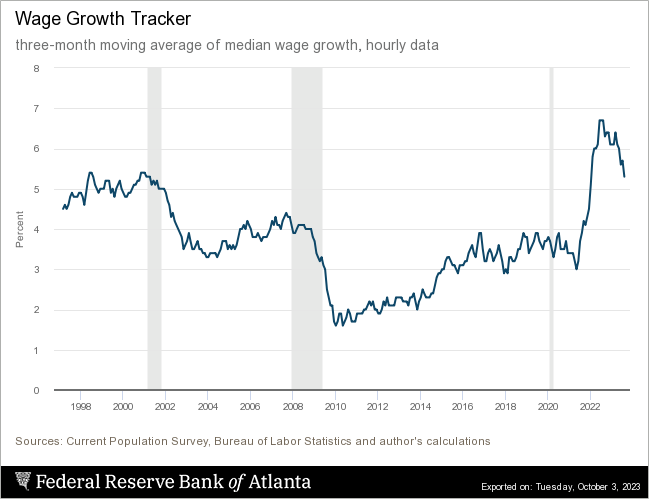

Price sensitive buyers realized they can garner more income on Treasury bills and short-term Treasury notes than longer maturity Treasury notes and bonds. A 5+% rate also feels good after years of near zero short term rates. Yes, cash equivalents pose reinvestment risk, but the other side of the coin is assuming considerable duration risk when inflation is not yet back to its low and stable pre-pandemic levels.

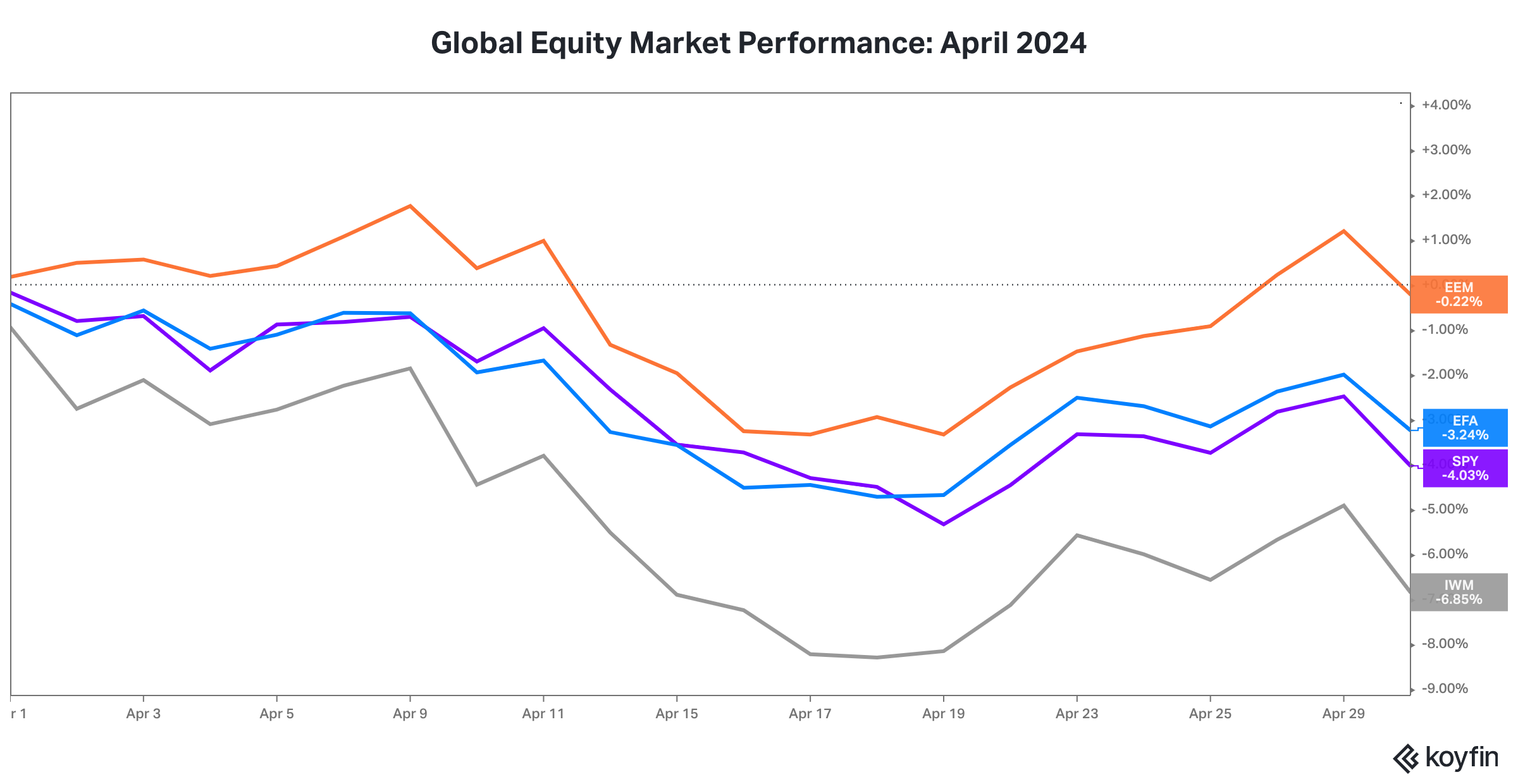

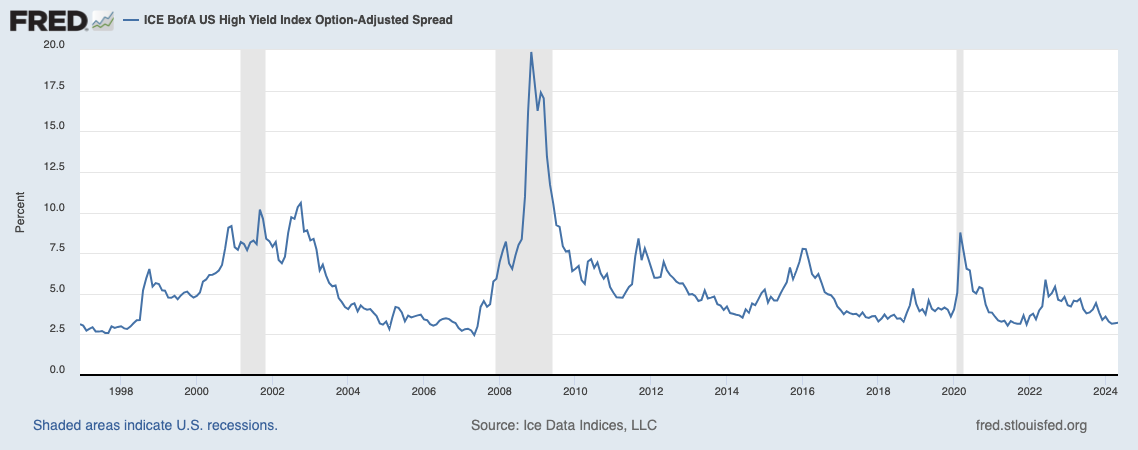

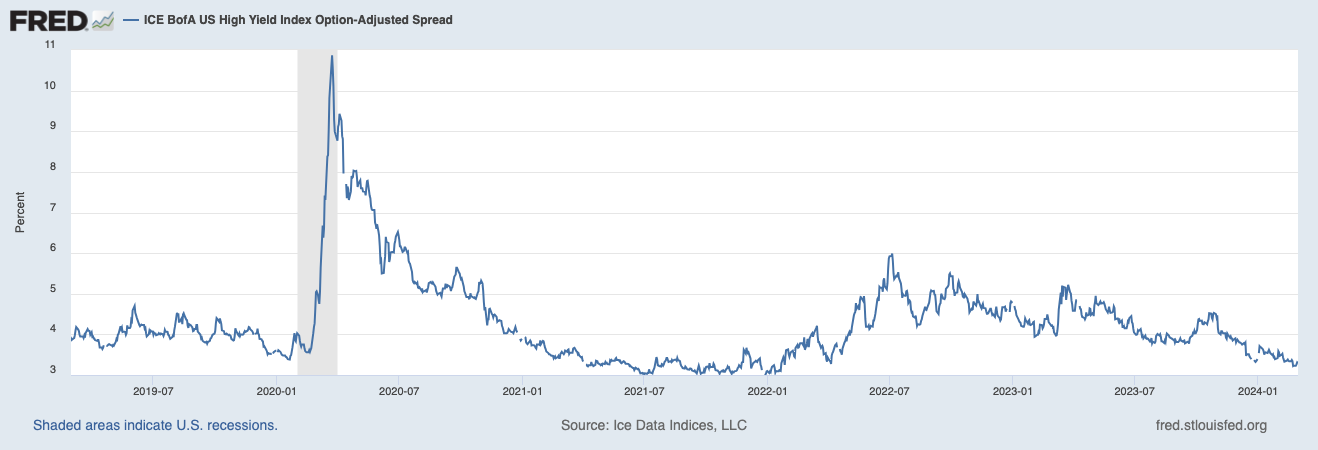

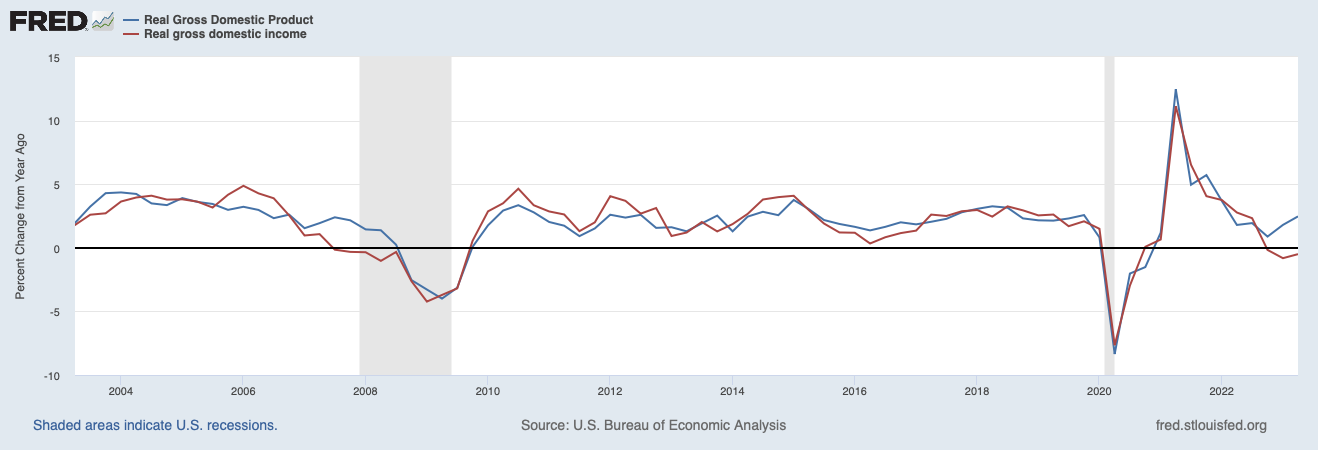

In summary, the bond market is likely communicating a supply digestion concern, The problem is higher long maturity interest rates at this stage of the economic cycle create tighter financial conditions, especially for the housing market which is largely financed by fifteen-year and thirty-year mortgage loans. Home construction and renovation have been large contributors to economic growth. In summary, the incremental tightening of financial conditions reduces the probability of a soft landing for the economy.

3. As we keep repeating, what lies ahead for financial markets will likely be driven by the path and composition of inflation.

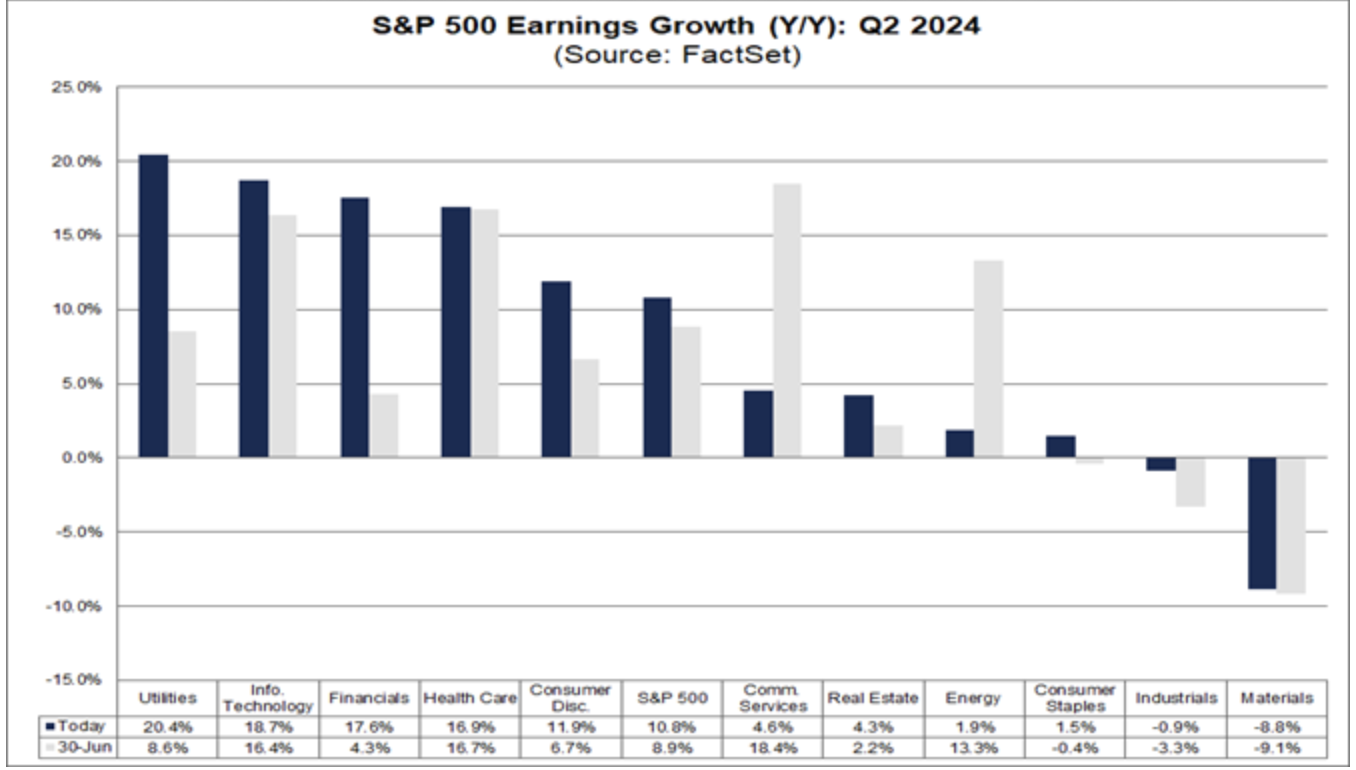

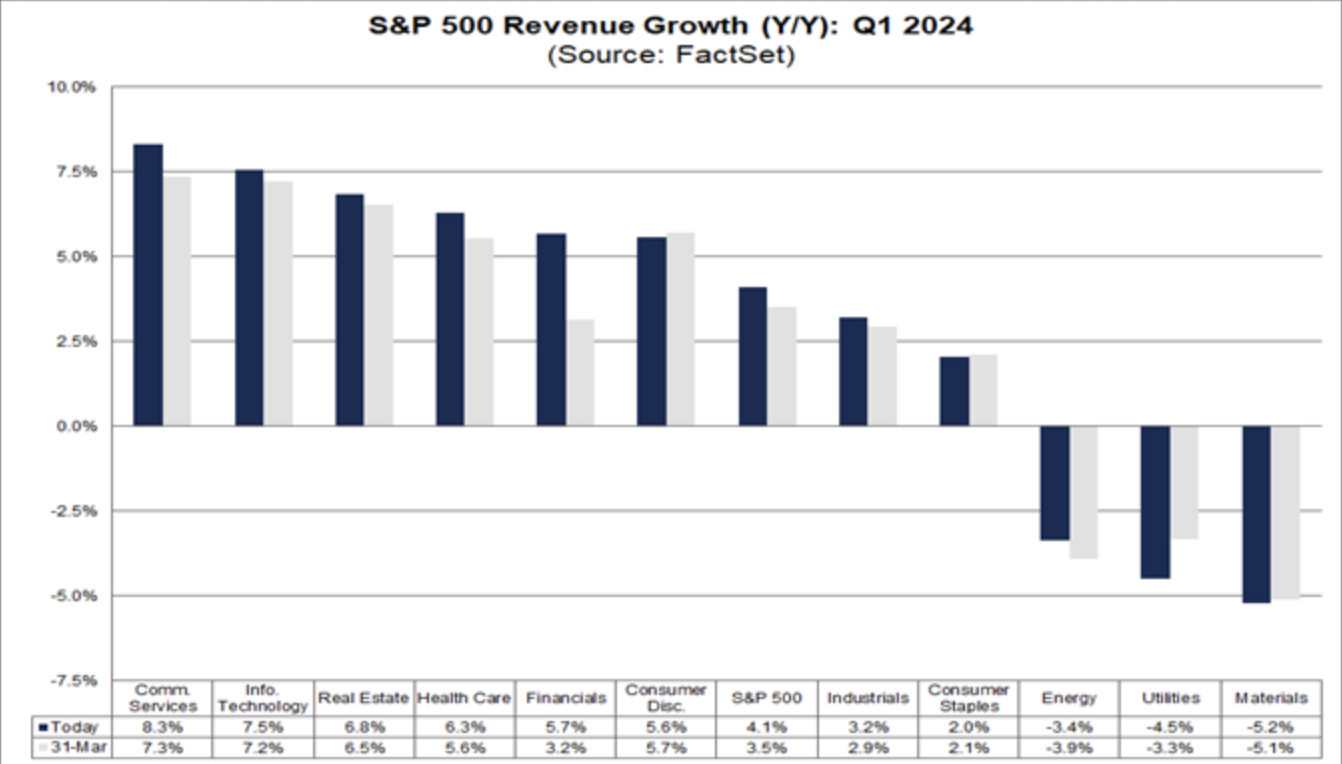

The concern about inflation has likely contributed to the bear steepening of the yield curve and the tighter financial conditions. Inflation has historically impacted equity valuation multiples. High inflation has led to lower multiples and thus lower investment returns. The composition of inflation will also impact earnings. The last few decades have been a period of low growth in labor costs and low energy costs, both major drivers of rising corporate profit margins.