1. China’s equity market surged in late September with the announcement of monetary and fiscal stimulus.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in purple), EEM (iShares MSCI Emerging Markets ETF in orange), and MCHI (iShares MSCI China ETF in dotted red).

China’s stock market rose over 20% in September.

The People’s Bank of China (PBOC) eased monetary policy and the fiscal authorities announced new spending initiatives with the objectives of boosting the economy and supporting the stock market.

Lowered the benchmark seven-day reverse repo rate from 1.7 % to 1.5%.

Lowered the one-year medium-term lending facility loan rate to some financial institutions 2.3% to 2.0%.

Aimed to reduce existing mortgage rates by 0.5%.

Reduced the Required Reserve Ratio applicable to banks by 0.5%.

Established a 500 billion yuan (US$70.9 billion) facility to allow security houses, fund-management firms and insurance companies to tap liquidity when purchasing stocks.

Established a lending facility of 300 billion yuan, with an interest rate of 1.75% to incentivize banks to support listed companies’ stock buy-backs and purchases.

Reduced down payment ratio on second-home purchases from 25% to 15%.

Over the last fifteen years, China’s economy has slowed from a 10% growth rate in 2009 to a growth rate of less than 5% currently. The slowdown raises concerns about sustaining employment and social unrest.

China did an amazing job of marshaling labor and physical capital to create the second largest economy in the world and significantly boost the living standards of its citizens. However, China has struggled to expand its services sector, boost domestic consumption and increase total factor productivity via innovation.

Public equity shareholders have suffered. Productivity gains did not accrue to shareholders. The magnitude of underperformance of China’s equity market to the U.S. equity market is astounding.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in purple), and MCHI (iShares MSCI China ETF in red).

Monetary easing, amplified by fiscal stimulus, is the “easy” first step. For China to sustainably boost economic activity, boost the stock market, and support the real estate market, China will need to consider rebalancing its economy and altering many regulations and incentives.

2. On September 18th, the Federal Reserve lowered the target for the federal funds rate by 50 basis points, to a range of 4.75% to 5.00%, despite inflation rate still exceeding the Fed’s 2% target, solid employment data, and mixed signals about economic activity.

While the Federal Reserve beat the PBOC to the monetary easing punch bowl, the Fed’s less aggressive easing and bullish sentiment towards U.S. equities produced a more muted bounce for U.S. equities.

Interestingly, the ten-year Treasury yield rose 15 basis points in the days subsequent to the Fed’s announcement and finished the month only 10 basis points lower than it started the month.

The optimistic interpretation is the Fed is facilitating a soft landing and giving a boost to future economic growth. If the ten-year yield continues to rise it will be a concerning sign that the bond market is losing faith in the Fed’s inflation fighting credentials.

3. The European Central Bank will likely cut rates in October as inflation has moderated and the real economic growth rate hovers around a miniscule 0.6%.

Source: Eurostat

Eurozone inflation dipped below 2% for the first time since mid-2021.

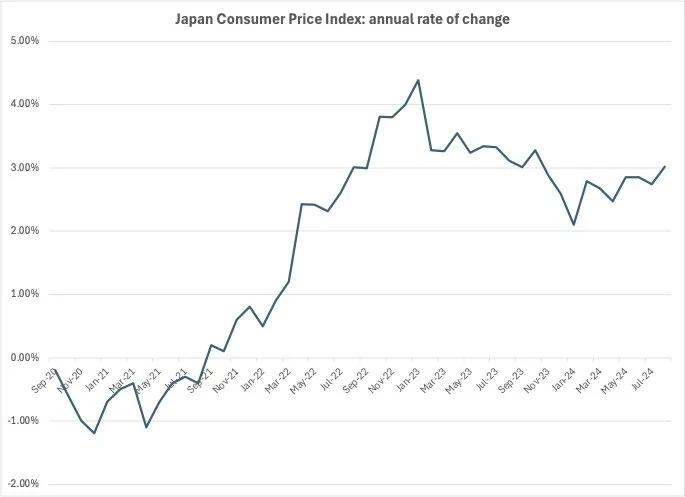

4. The BOJ (Bank of Japan) faces a dilemma with the PBOC, the Fed and the ECB in easing mode.

Source: Japan Government Statistics

The BOJ raised its policy rate 20 basis points in March and 15 basis points in July. Its current rate of 0.25% reflects Japan’s unique situation, namely a few decades of no inflation and a post-pandemic bounce in inflationary pressure that was muted compared to the spikes in the U.S. and Europe.

The BOJ was the last major central bank to raise its policy rate to fight inflation. Its tightening of monetary policy in July with the threat of more to come was the likely catalyst for the global equity market volatility in early August.

The challenge for the BOJ is the inflation rate in Japan has halted its decline and started rising again. The most likely course for the BOJ is to sit on the sidelines for now. It is unlikely BOJ is unlikely to raise its policy rate any time soon with synchronized monetary easing occurring in the other major economic blocs.

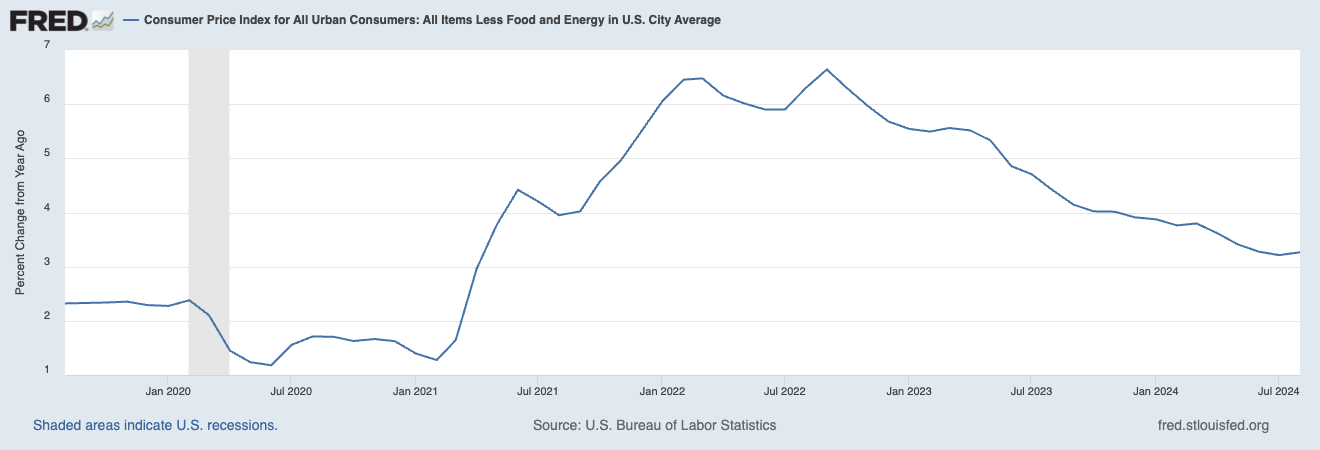

5. In the U.S., inflationary pressures also continued to ease.

In the U.S., the headline inflation rate has plateaued over 1% above pre-pandemic levels. In the last five months it has started to creep down.

The “core” inflation rate (excludes food and energy) has continued to creep down but also remains over 1% above pre-pandemic levels.

6. U.S. high yield credit spreads remain well below levels that signal a brewing recession.

High yield credit spreads were a hair above 3% at the end of September.