Despite all the existing evidence, it is fascinating to see fresh evidence that a simple version of the Value factor has consistently helped to identify outperforming companies for 200+ years

Value and Momentum have been the most beautiful market phenomena out there and I will feel sad in a world without them.

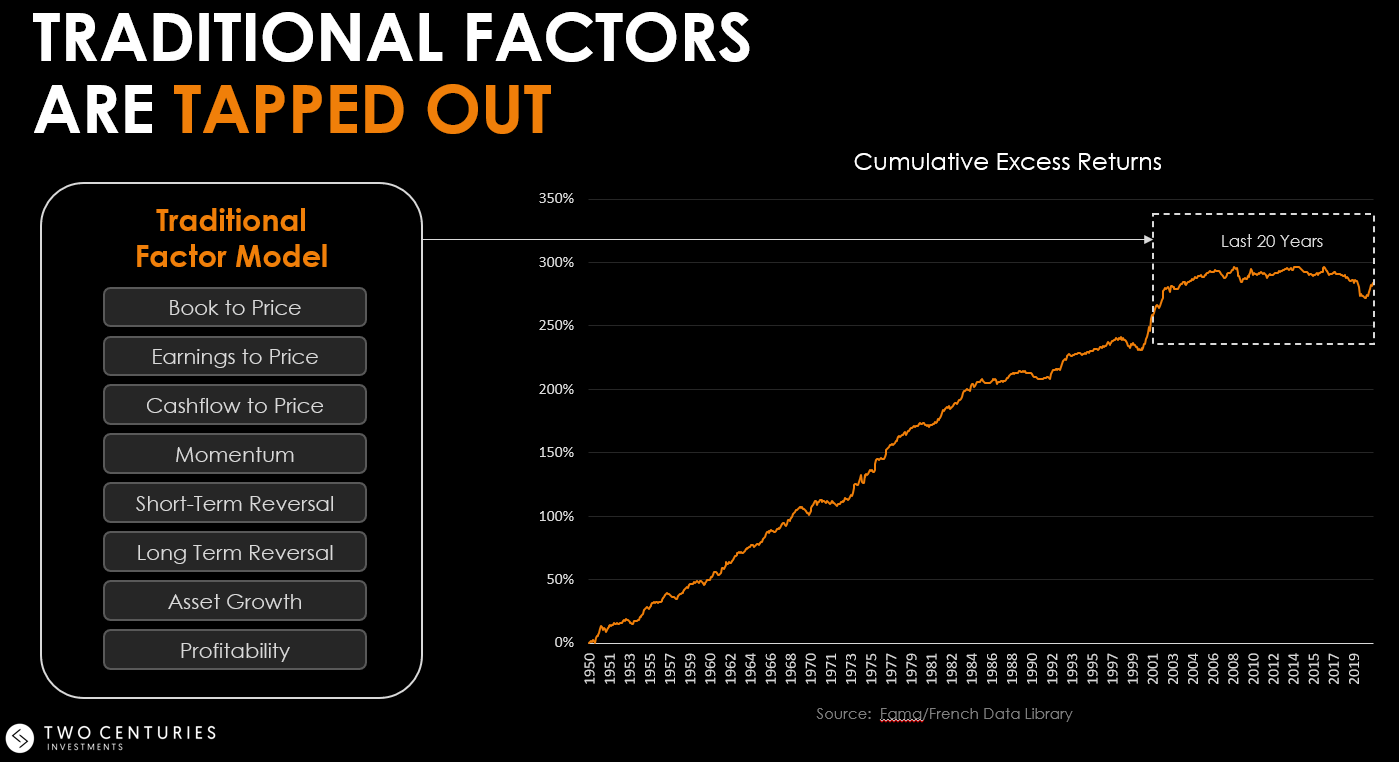

Separate factor risk from return; Use the longest history to set expectations; Allocate significant organization resources to innovation.

Looking at March 2020 returns, the existence of a one-factor-world becomes a real possibility.

So what is the Cone Chart telling us about Value and Momentum?

Do not give up on them yet!

Use a longer history to set expectations

Today’s quantitative investors seem split between innovation on the one hand and engineering on the other. This blog is about how we got here.

In last week’s post, I made a strong assertion that has caused some great feedback and comments. When I first heard Mark Kritzman make a similar point at a UBS conference a few years ago, I had a similar reaction: “Hey, I’m a quant and I love my factors. They are definitely real!”.

The question I get asked the most during the past twelve months is “Why are factors not working?” Here are my top 12 personal thoughts on the topic—informed by 15+ years of successfully “factor investing”.

Here are my 8-thoughts and 1 solution idea about Campbell Harvey and Yan Liu recently released paper on their influential concept of the factor zoo.

There is a growing trend of academic papers that study large sets of factor anomalies at a time. Here are my top 10.

We use hand-collected futures data to extend the well-known cross-sectional Value, Momentum and Basis factors in commodity futures back to 1877.

While there exists a well-established (at least a century-old) academic interest in the long-run properties of asset class returns, only during the past decade has there emerged literature studying the cross-sectional factors over the long-run.

Many people ask why I look at long historical data when today is very different from distant past.

Here are some of the best free sites that I recommend for factor investing:

Quantitative Portfolio Management by Edward Qian, Ronald Hua, Eric Sorensen

Expected Returns by Antti Ilmanen

Quantitative Value by Wesley Gray and Tobias Carlisle