“That escalated quickly” is a phrase uttered by Ron Burgundy in the 2004 movie, Anchorman: The Legend of Ron Burgundy. By “that de-escalated quickly”, we mean the burgeoning U.S. Treasury bond market crisis de-escalted quickly in November.

1. Global equity markets rebounded after three months of declines, boosted by the sharp reversal in U.S. long-term Treasury bond yields.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange) and IWM (iShares Russell 2000 ETF in grey), and TLT (iShares 20+ Year Treasury Bond ETF in dashed green).

2. The burgeoning Treasury bond market crisis de-escalated quickly. The bear steepening ceased after three and half months, and long matured Treasury yields declined sharply, approaching the levels of August month end.

Source: www.treasury.gov, Two Centuries Investments

A bear steepening is commonly defined as a double-digit basis point increase in the difference between the 10-year Treasury and 2-year Treasury yield. A bear steepening is a rare occurrence, especially when the yield curve is inverted like it is currently.

The table below from Janus Henderson illustrates the historical rarity.

· The orange highlighted rows map to bear steepening off inverted yield curves.

· The blue highlighted rows map to bear steepening off relatively flat curves.

· The green highlighted rows map to bear steepening off very steep curves.

Our hypothesis remains the bond market was likely communicating a supply digestion concern. We are not certain the supply digestion problem is fully resolved. However, in November the bond market took notice of the continuing moderation of inflation and a downtrend in real economic growth. Odds increased the FOMC will cut the Federal Funds Rate multiple times in 2024.

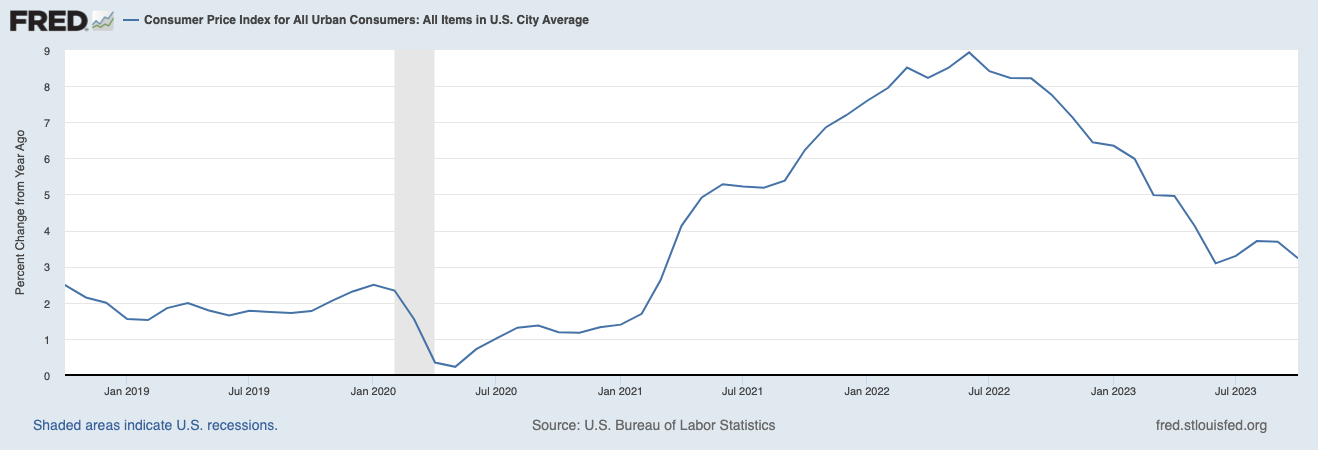

3. As we keep repeating, what lies ahead for financial markets will likely be driven by the path and composition of inflation.

The concern about inflation has likely contributed to the bear steepening of the yield curve. Inflation has historically impacted equity valuation multiples. High inflation has led to lower multiples and thus lower investment returns. The composition of inflation will also impact earnings. The last few decades have been a period of low growth in labor costs and low energy costs, both major drivers of rising corporate profit margins.

The headline inflation rate has dropped to about 1% above pre-pandemic levels but has risen over the last three months.

The concern is the “core” inflation rate (excludes food and energy) has proven stickier and remains 2% above pre-pandemic levels.

4. Despite the Federal Reserve raising the federal funds rate by 5% over the last eighteen months, real economic growth has not collapsed, though it remains muted.

Real gross domestic product (GDP) and real gross domestic income (GDI) have diverged over the last few quarters. GDP data shows the economy humming along, while GDI data points to an economic slowdown.

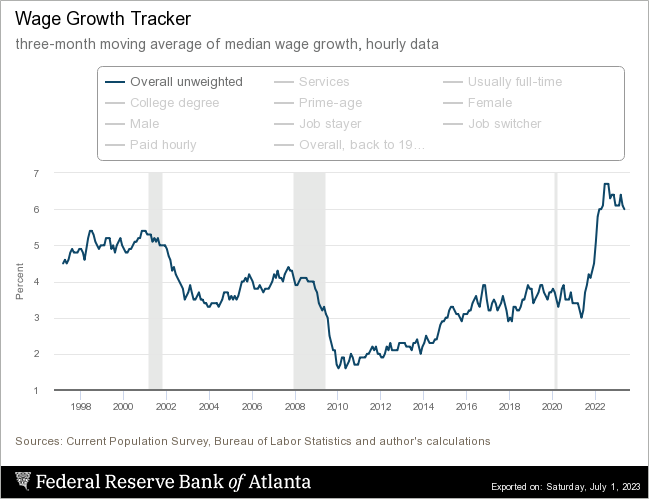

5. The challenge the Federal Reserve faces is how to balance its dual mandate of maximum employment and stable (2% target) inflation.

In the current economic environment. the Federal Reserve cannot achieve its inflation target without risking a significant rise in unemployment and a recession. Because of structural supply shortages, most notably in the labor market, tighter monetary policy is less effective in reducing inflationary pressures. Tighter monetary policy operates by increasing the cost of debt capital and thus, with a lag, puts downward pressure on the demand for goods and services. The dilemma is the Federal Reserve may have to risk crushing real GDP growth (the volume of goods and services being transacted) in order to crush inflationary pressures (price of goods and services being transacted).

While the Federal Reserve Bank of Atlanta data shows wage growth across all industries continues to slow, there are many industries facing supply shortages. Over the last several months, United Airlines and American Airlines pilots were able to negotiate 40% wage increases over the next four years. UPS union employees negotiated wage increases near 20% over five years and the UAW (United Auto Workers) negotiated 25% general pay increases plus cost-of-living adjustments over the next four years for the Big 3 auto workers.

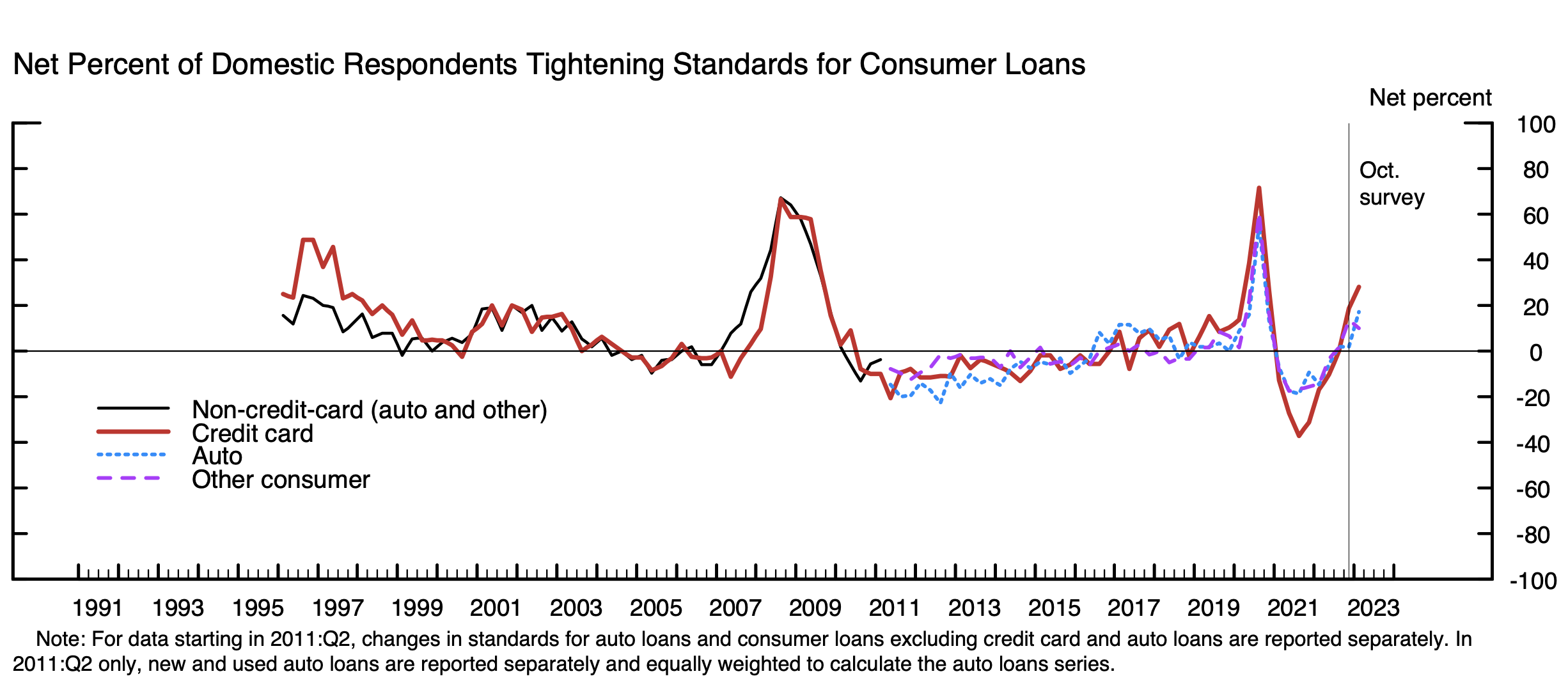

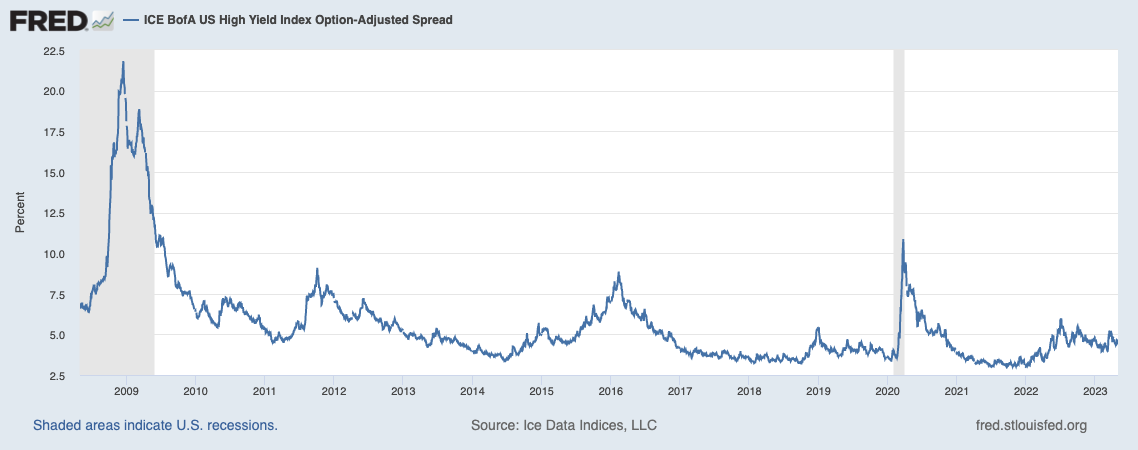

6. Credit markets remain sanguine despite the Federal Reserve’s actions to tighten monetary policy and the multi-month bear steepening of the yield curve.

7. Over the last two months, one of the best performing asset classes has been gold, which traded at all time highs recently and currently sits at over $2,000 per ounce.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange) and IWM (iShares Russell 2000 ETF in grey), and GLD (SPDR Gold Trust in dashed gold).