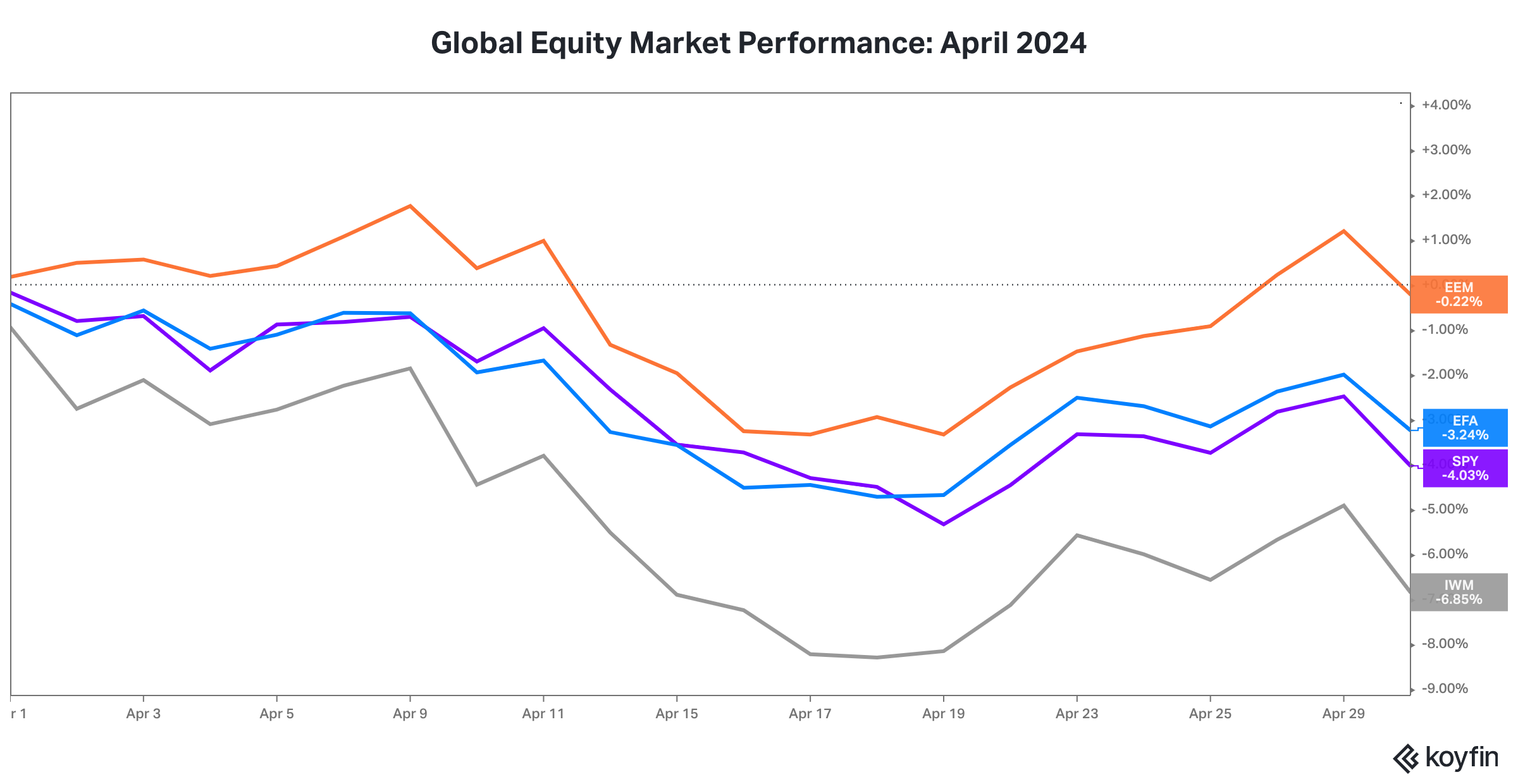

1. In April, the multi-month rally in global equity markets stalled.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange), and IWM (iShares Russell 2000 ETF in grey).

2. Over the last two months, gold has shined brightly relative to other asset classes.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange), IWM (iShares Russell 2000 ETF in grey), GLD (SPDR Gold Trust in yellow), TLT (iShares 20+ Year Treasury Bond ETF in red) and DXY (U.S. Dollar Index in green).

The strong performance of gold over the last two months is surprisingly given both the increase in U.S. Treasury yields of between 40 and 45 basis points at the 5-year, 10-year, and 30-year maturities, and the increase in the U.S. dollar versus other currencies. Gold almost always underperforms when U.S. Treasury yields increase and the U.S. dollar appreciates.

The PBoC, China’s central bank, and Chinese citizens have been big buyers of gold. The buying points to a possible devaluation of the Chinese yuan and also highlights the PBoC’s aversion to increasing its holdings of U.S. Treasury securities.

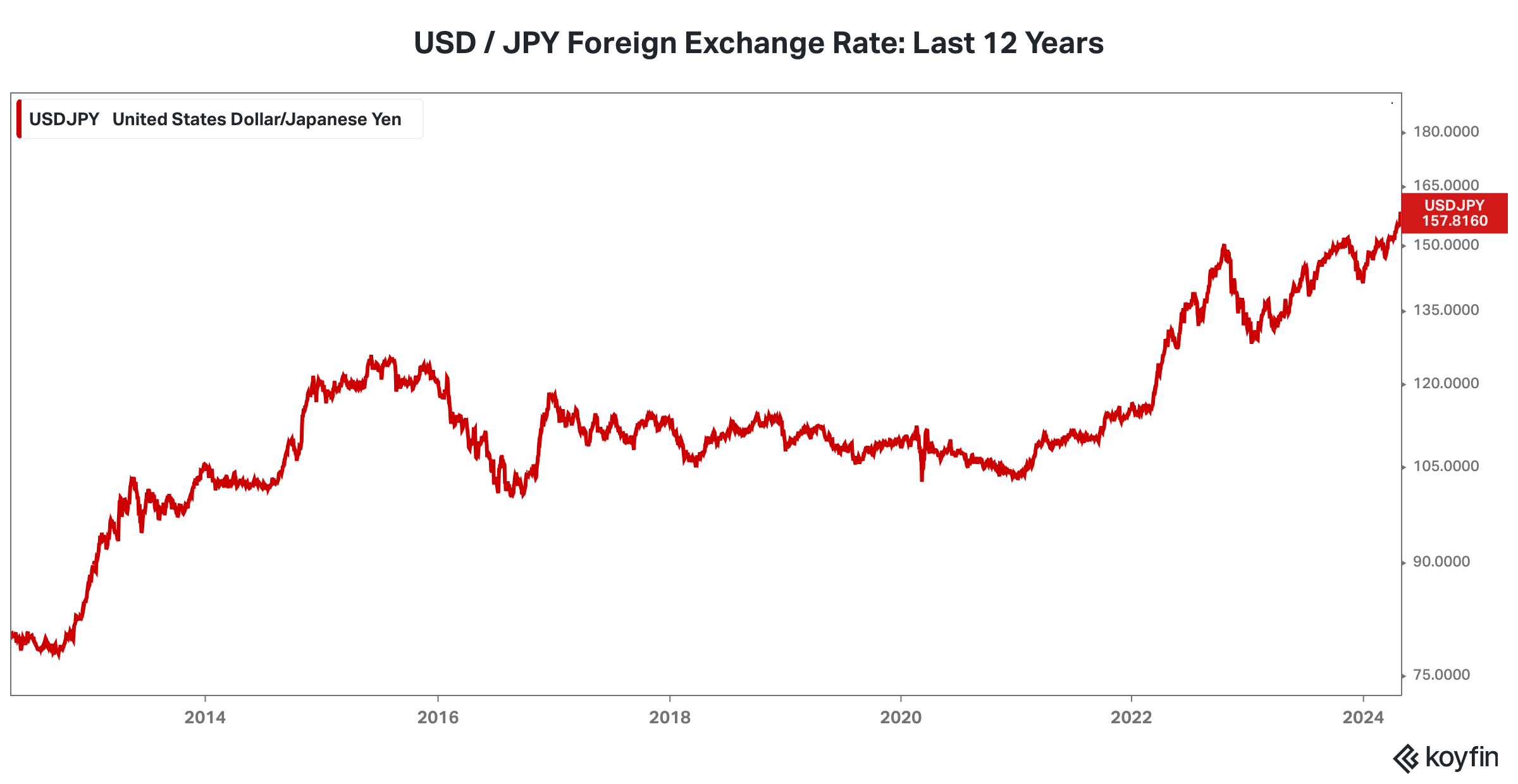

3. The Japanese Yen has certainly lost it lustre and its decline versus the U.S. Dollar has recently accelerated.

The acceleration in yen weakness poses a dilemma for the Japanese government.

Inflation, while low compares to other developed market countries, remains high by Japanese standards. Currency weakness reinforces domestic inflationary pressures.

On the other hand, raising interest rates to combat currency weakness means a higher interest expense for government debt. Among developed market countries, Japan already has the highest public debt as a percentage of GDP. In addition, the BOJ, Japan’s central bank, owns more than 40% of the debt. Finally, asset markets have used the low interest rates in Japan as a cheap funding source for carry trades. Any rapid rise in short term interest rates could reverberate across global asset markets.

A potential short term solution, namely the BOJ selling central bank reserves of U.S. Treasury securities to support the yen, would like force the U.S. Federal Reserve to adjust it quantitative tightening strategy.

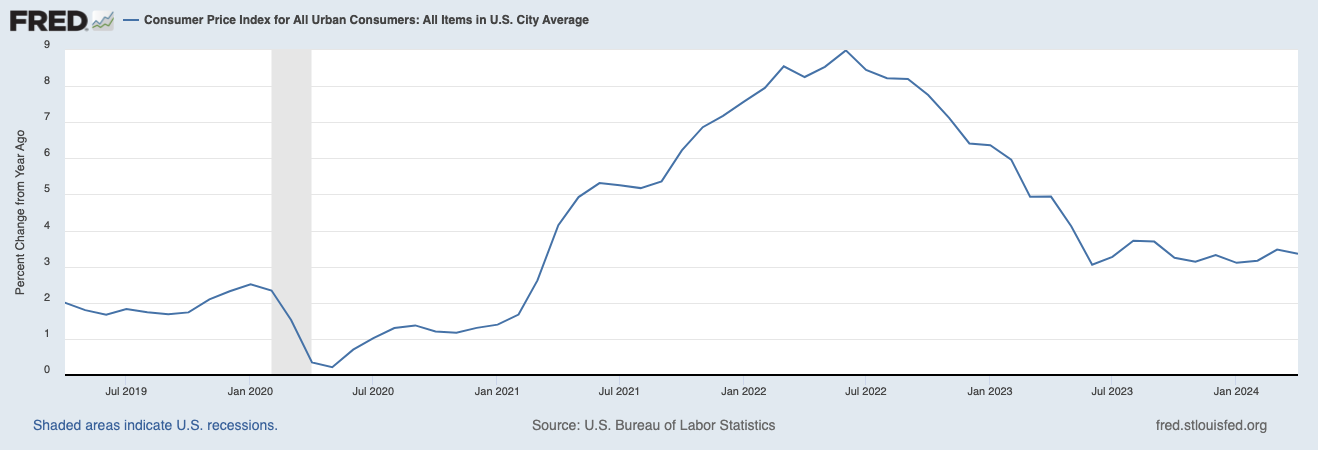

4. Sticky inflation, in the face of high public debt and high fiscal deficits in the developed world, remains a big headwind for investors seeking high real returns (real return = nominal return - rate of inflation).

In the U.S., the headline inflation rate has plateaued over 1% above pre-pandemic levels.

The “core” inflation rate (excludes food and energy) remains 2% above pre-pandemic levels.

The improvement (downtrend) in the rate of inflation has stalled over the last several months. As a result, the FOMC has sat on the sidelines and the effective federal funds rate has sat at 5.33% for the past year.

We discussed the inflation challenge in more detail in last month’s update

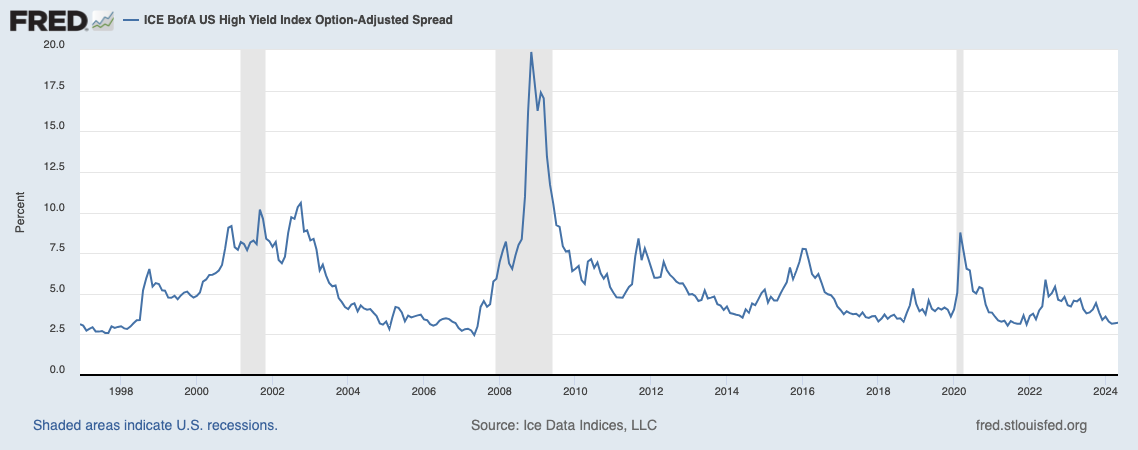

5. Despite sticky inflation, currency market turmoil, and a gold market warning sign, U.S. financial conditions remain loose and U.S. credit markets remain sanguine.

Over the last few months, the Chicago Fed’s National Financial Conditions Index has been signaling looser financial conditions, suggesting monetary policy is not restrictive despite 525 basis points of federal funds rate increases over the last two years.

At month end April 2024. high yield bond spreads remained subdued and had settled over 1.5% below long-term averages and well below recent peaks.

6. Overall, second quarter corporate earnings reports have been solid, albeit not signaling future earnings growth consistent with the elevated valuations for U.S. equities.

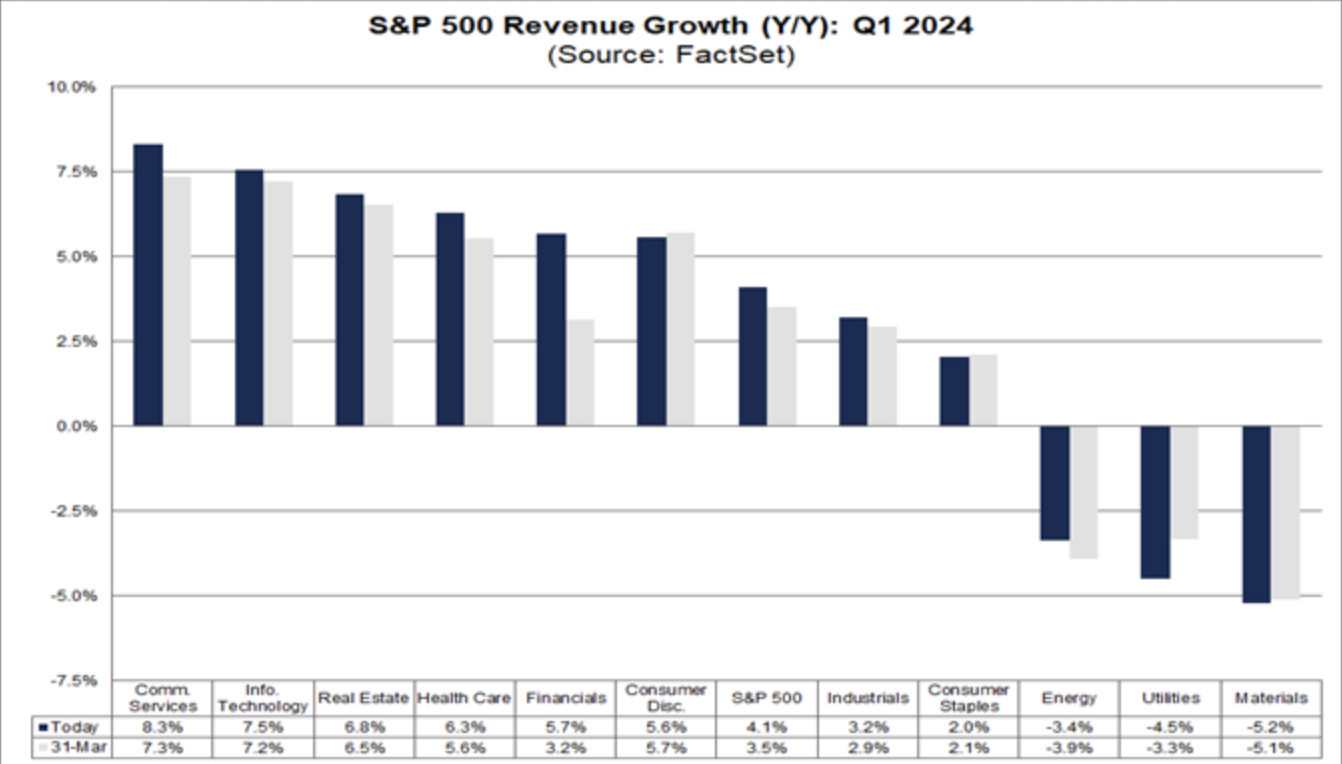

With 80% of S&P 500 companies having reported earnings, year-over-year revenue growth has averaged 4.1% and earnings growth has averaged 5.0%.