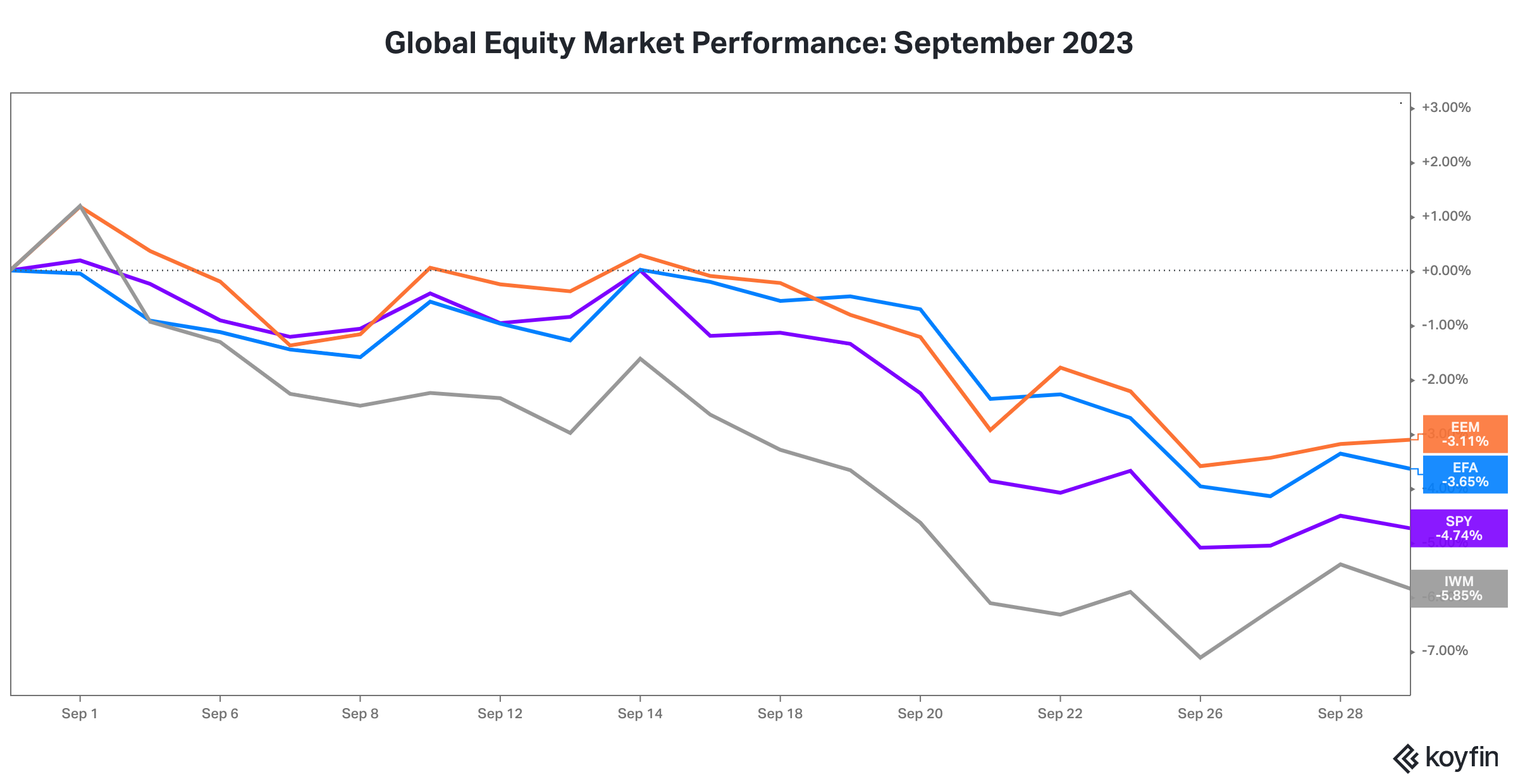

1. The global equity market weakness continued in September.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange) and IWM (iShares Russell 2000 ETF in grey).

2. The unholy trinity of rising oil prices, increasing U.S. interest rates, and a strengthening U.S. dollar is pressuring asset prices.

Since July 13, crude oil prices have risen approximately $12 per barrel (14% price increase), the U.S. dollar has risen approximately 7%, and the ten-year U.S. Treasury note yield has risen 83 basis points. In a world accustomed to low-cost energy, dependent on a cheap reserve currency for facilitating global trade, and addicted to low interest rates for financing, simultaneous increases in the levels of these three financial variables is a threat to global economic activity and asset prices. Stocks, bonds, and gold have responded negatively to the rise of the unholy trinity.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange), WM (iShares Russell 2000 ETF in grey), GLD (SPDR Gold Trust in yellow), TLT (iShares 20 Plus Year Treasury Bond ETF in red), CO1 (Brent crude oil futures contract in black), TBX (ProShares Short 7-10 Year Treasury ETF in light blue), and DXY (U.S. Dollar Index in green).

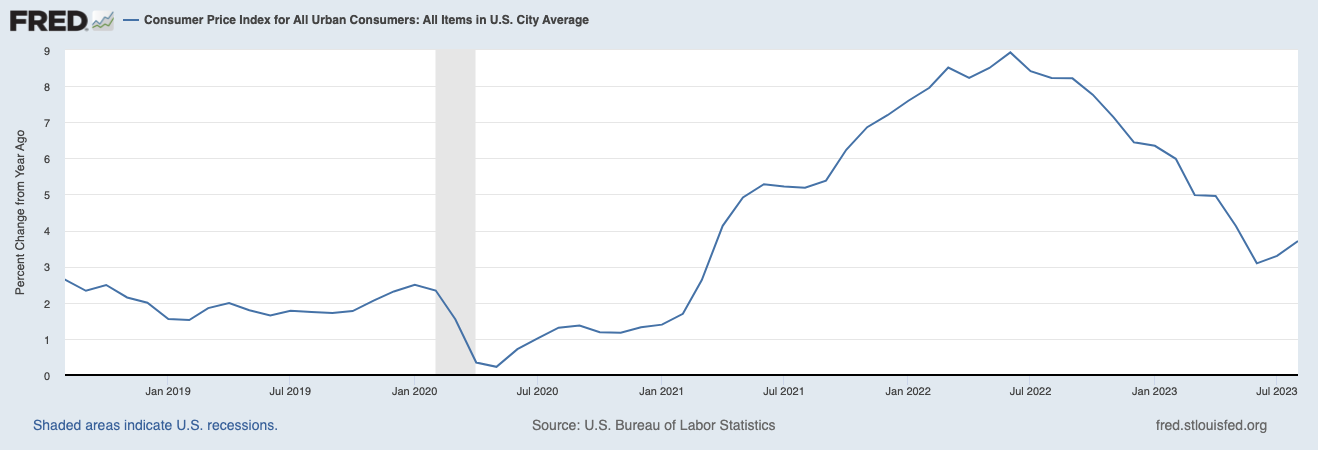

3. What lies ahead for financial markets will likely be driven by the path and composition of inflation.

The level of inflation has historically impacted equity valuation multiples. High inflation has led to lower multiples and thus lower investment returns. The composition of inflation will also impact earnings. The last few decades have been a period of low growth in labor costs and low energy costs, both major drivers of rising corporate profit margins.

The headline inflation rate has dropped to about 1% above pre-pandemic levels but has risen the last two months.

The concern is the “core” inflation rate (excludes food and energy) has proven stickier and remains 2.5% above pre-pandemic levels. A sticky core inflation rate might compel the Federal Reserve to keep raising short term interest rates in an attempt to dampen economic demand and push inflation back towards its 2% target. More tightening of monetary policy risks a severe economic downturn.

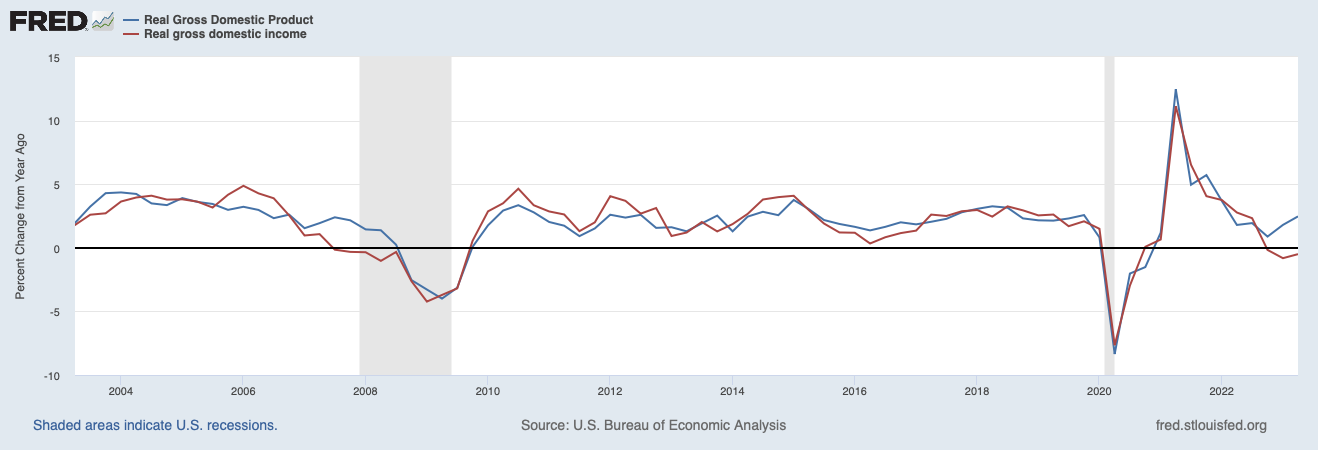

4. Despite the Federal Reserve raising the federal funds rate by 5% over the last eighteen months, real economic growth has not collapsed, though it remains muted.

Real gross domestic product (GDP) and real gross domestic income (GDI) have diverged over the last few quarters. GDP data shows the economy humming along, while GDI data points to an economic slowdown.

The Atlanta Federal Reserve Bank’s GDP Now estimate of 4.9% real economic growth for the third quarter 2023 lends credence to the view that GDI will rise to close the gap to GDP.

5. The challenge the Federal Reserve faces is how to balance its dual mandate of maximum employment and stable (2% target) inflation.

In the current economic environment. the Federal Reserve cannot achieve its inflation target without risking a significant rise in unemployment and a recession. Because of structural supply shortages, most notably in the labor market, tighter monetary policy is less effective in reducing inflationary pressures. Tighter monetary policy operates by increasing the cost of debt capital and thus, with a lag, puts downward pressure on the demand for goods and services. The dilemma is the Federal Reserve may have to risk crushing real GDP growth (the volume of goods and services being transacted) in order to crush inflationary pressures (price of goods and services being transacted).

While the Federal Reserve Bank of Atlanta data shows wage growth across all industries continues to slow, there are many industries facing supply shortages. Recently, United Airlines and American Airlines pilots were able to negotiate 40% wage increases over the next four years. UPS union employees negotiated wage increases near 20% over five years. Currently, the UAW (United Auto Workers) is demanding a 46% pay deal and FedEx pilots are demanding a 30% pay rise.

The unemployment rate remains nears its lows over the last four decades.

6. Credit markets remain sanguine despite the Federal Reserve’s actions to tighten monetary policy.

High yield bond spreads remain near long-term averages, and 2% below the most recent peak of 6% in July 2022.