5. Many companies with seemingly robust business models have performed poorly this year. Below, I briefly discuss the issues facing META, a company which scores highly in the “brand” category of our Focused Quality equity model. I use a discounted cash flow model framework.

META, which owns Facebook, Instagram, and WhatsApp, reported earnings on October 26 after the stock market close. On October 27, META's stock price declined 24%. Year-to-date through the end of October, the stock price had declined 72%. What happened to META, a company which is one the big three, along with GOOGL and AMZN, in the growing and oligopolistic digital advertising industry?

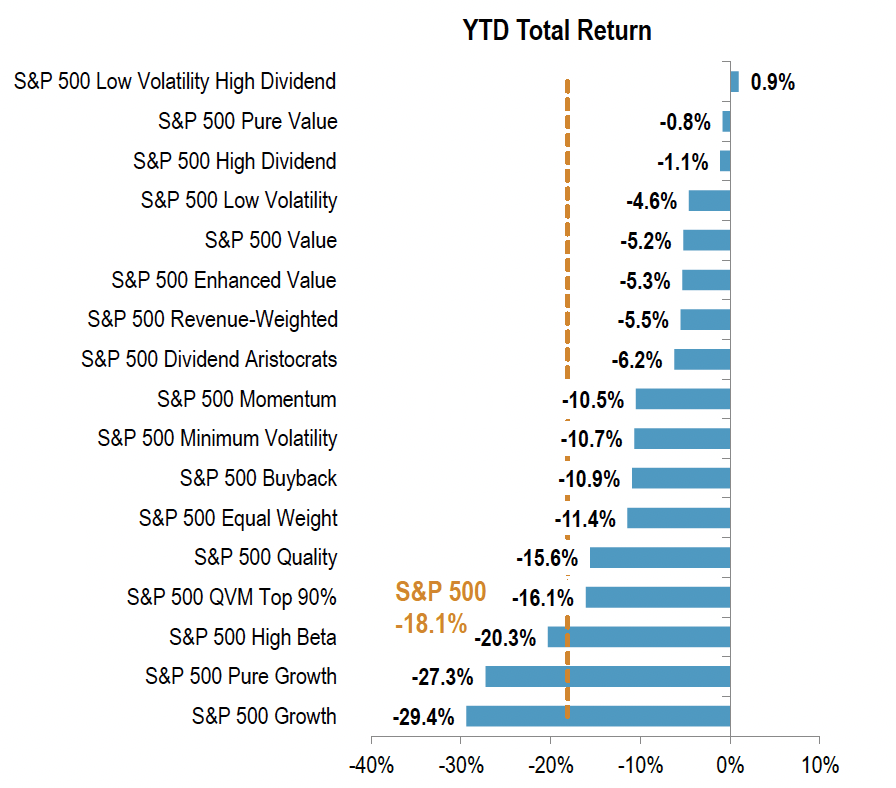

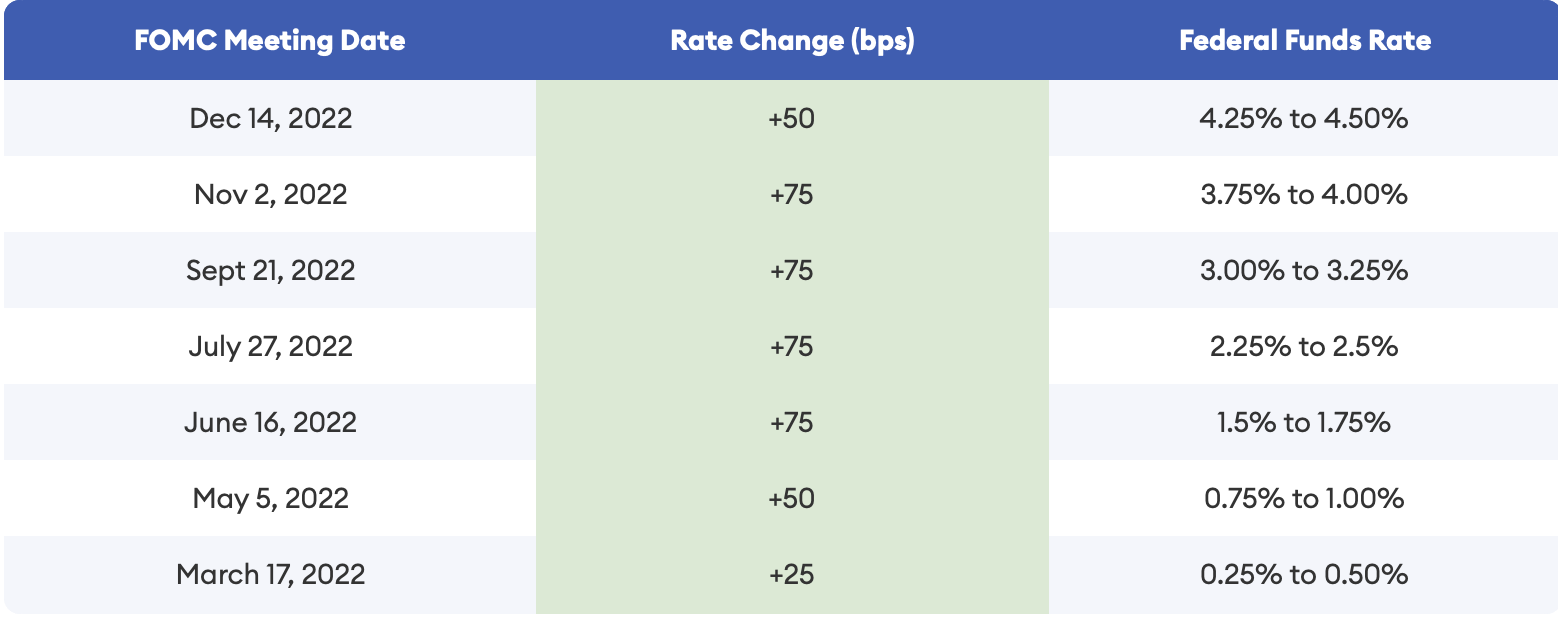

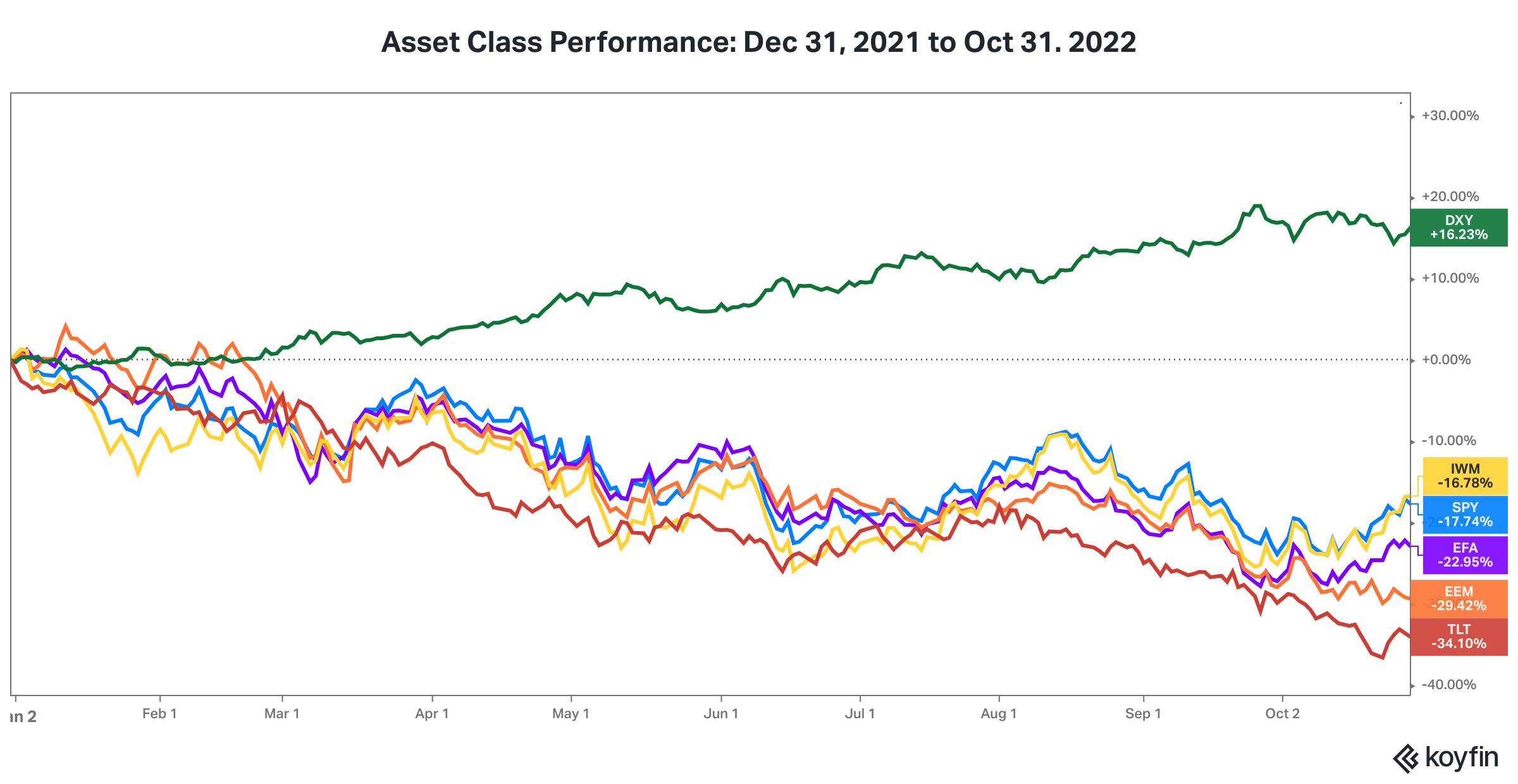

Certainly, higher interest rates have contributed to a higher equity discount rate (all else equal, namely the equity risk premium). This factor has impacted higher growth stocks, which have longer "durations", as more of the cash flows to equity shareholders are further out in the future. GOOGL was impacted similarly. Think of it as a contributor to valuation multiple compression.

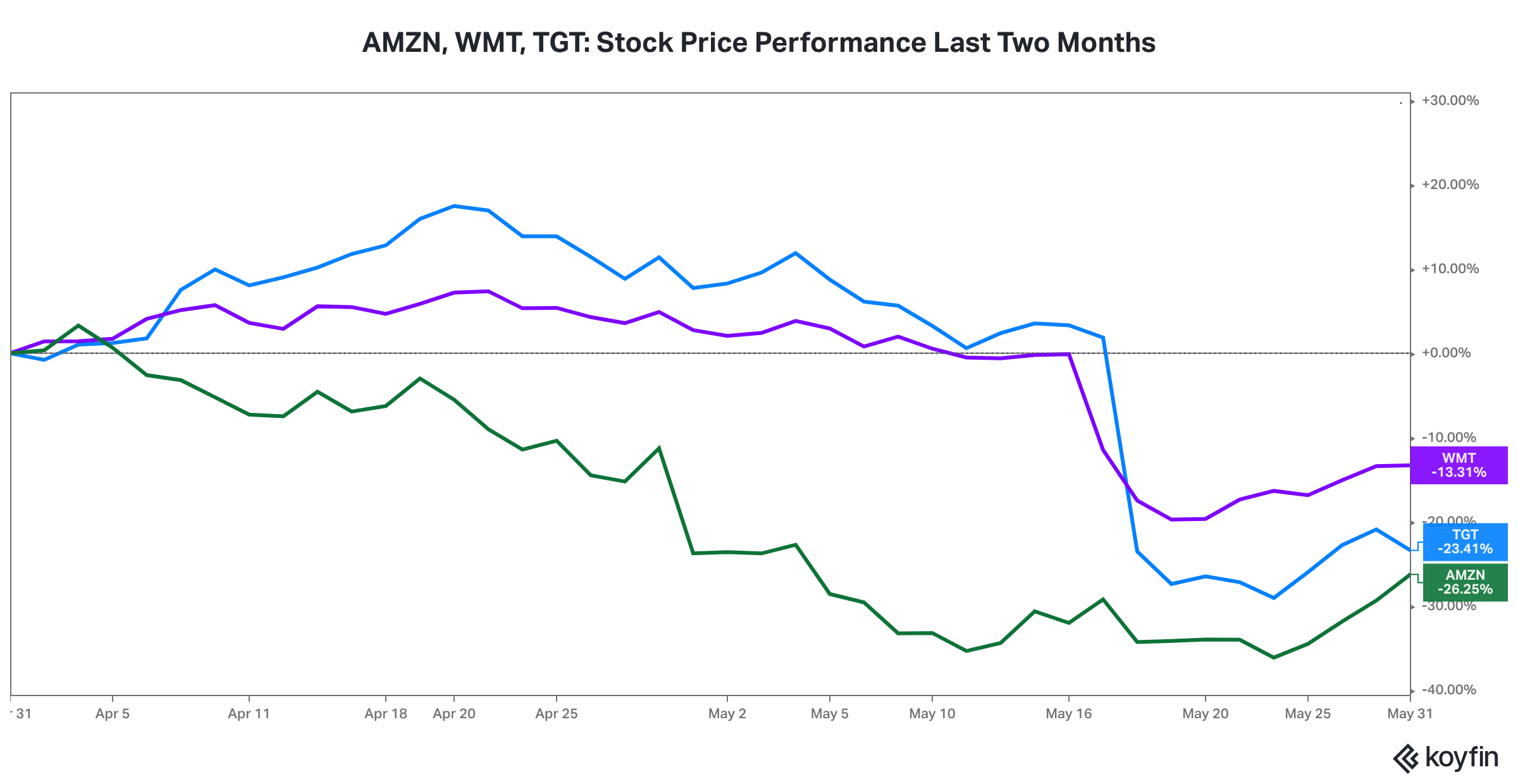

The boost in digital advertising during the pandemic has ended. The economy is also slowing and advertisers are reducing all forms of spending. META faced the additional headwind of AAPL allowing iPhone owners to change their privacy settings to limit tracking by advertisers. In other words, revenue growth has slowed.

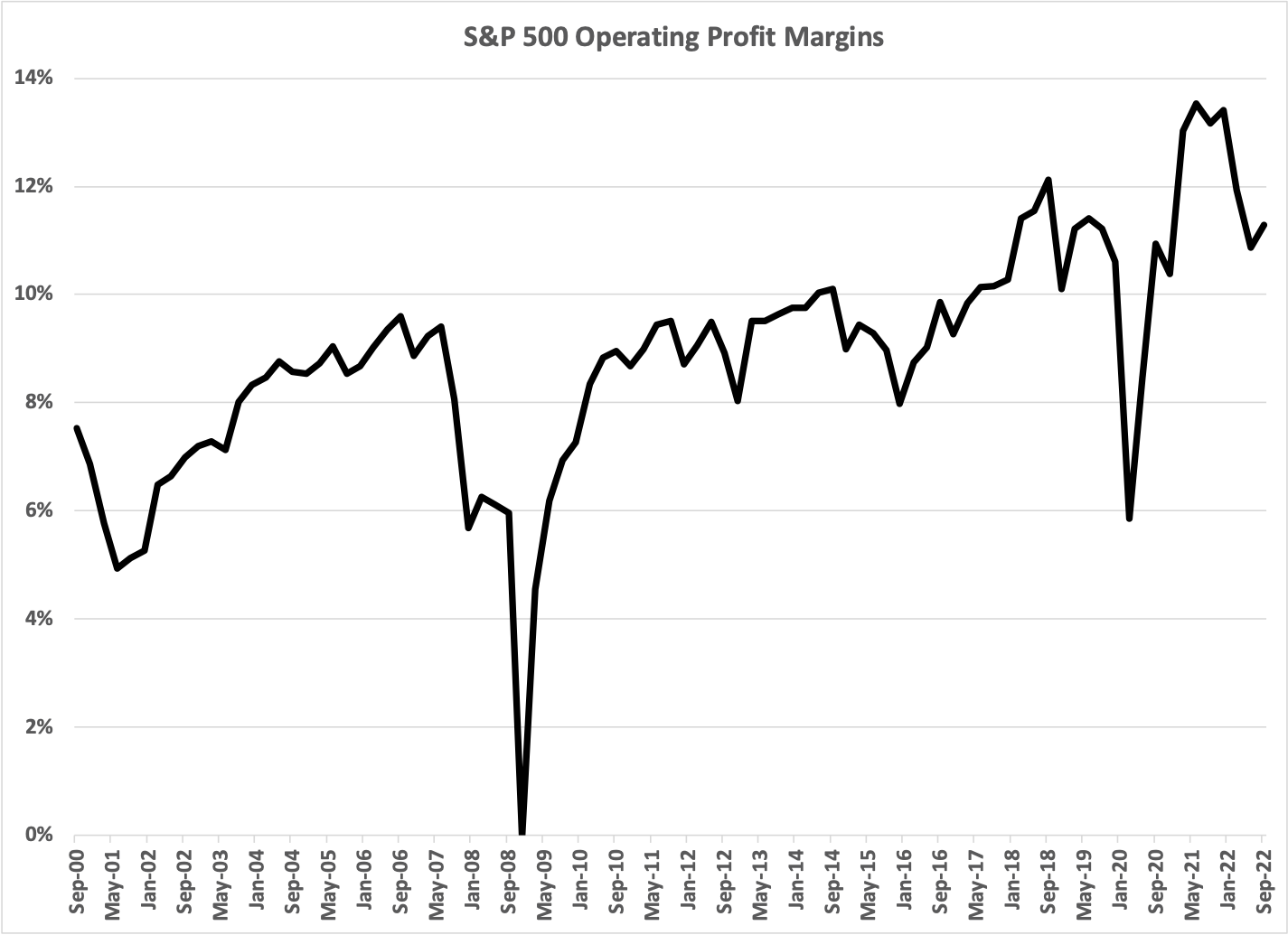

Higher operating expenses, including higher labor costs, reduced profitability as profit margins declined. Lastly, META committed to maintaining much higher capital expenditures (over $32 billion in 2022) to develop the "metaverse" and expand their artificial intelligence capabilities. There is no guarantee these expenditures will produce anywhere near the high Return on Invested Capital (ROIC) produced by META’s core advertising business.

Comparing 3q2022 to 3q2021...

Revenues declined from $29.0 billion to $27.7 billion.

Net Income declined from $9.2 billion to $4.4 billion.

Cash Flow from Operations declined from $14.1 billion to $9.7 billion.

Capital Expenditures increased from $4.3 billion to $9.4 billion.

“Free Cash Flow” declined from $9.8 billion to $0.3 billion.

In summary, lower revenues, higher operating expenses, and valuation multiple compression hit the stock, like they have hit other growth stocks this year. But two other META specific issues have led to additional underperformance, namely AAPL’s business decision and META’s decision to spend aggressively to build a new business at as time when most companies are spending cautiously due to emerging economic growth headwinds.

6. As I was writing this monthly update, news broke about the failure of FTX, one of the largest cryptocurrency exchanges. While we await more details, I will highlight a few principles, likely applicable to the FTX situation and which we articulate to our clients who are considering investing in crypto.