Here are the top market developments on our radar.

1. Equity volatility is rising. Gradual is good. Spikes are bad.

Equity volatility is rising.

Valuation multiples are high (see our full post it here)

Sources: Global Financial Data (GFD); Professor Shiller, IFC at Yale (Cowles), Two Centuries Investments

Sales growth is decelerating.

Source: S&P Global (Howard Silverblatt), Two Centuries Investments

Operating Profit Margins have likely peaked at all time highs.

Source: S&P Global (Howard Silverblatt), Two Centuries Investments

Margin Debt has grown rapidly.

Source: FINRA, Two Centuries Investments

Source: FINRA, Two Centuries Investments. This chart shows debit balances on a logarithmic scale (base 10).

From a fundamental perspective, valuation multiples, revenue growth, and operating margins are at peak levels. From a liquidity perspective, margin debt, i.e., debit balances in customers’ securities margin accounts, is likely tapped out as a source of equity buying power after its rapid rise over the last 18 months. The Federal Reserve has hinted it will tighten monetary policy, thus reducing liquidity, in an attempt to contain inflation.

A reversal of the favorable fundamental and liquidity trends does not imply a precipitous equity market decline. A lengthy period of modest market returns where earnings growth exceeds returns can facilitate a gradual deflation of market valuation multiples to more reasonable levels. GRADUAL IS GOOD.

Our concern is a long period of stability often breeds instability. In investment terms, if volatility spikes as opposed to rising gradually, an air pocket below could be exposed. SPIKES ARE BAD (not just with virus proteins). Extrapolate to the entire market what happened to DOCU, which declined over 40% on December 3, 2021, after management provided disappointing, but not bad, sales guidance. DOCU has massively outperformed the market over the last 3 years, but instead of gradually given back some outperformance over time, it gave it back in one day.

Since risk is elevated, we are monitoring several items.

2. High yield credit spreads remain low, a good sign.

Volatility has not yet infiltrated the high yield market, where credit spreads remain below 4%. In our experience, the high yield market is often the proverbial canary in the coal mine.

3. Price pressures may not be transitory, a bad sign.

The Consumer Price Index (CPI) is at its highest level since November 1990. Enough said.

4. Shipping congestion has not eased, a bad sign.

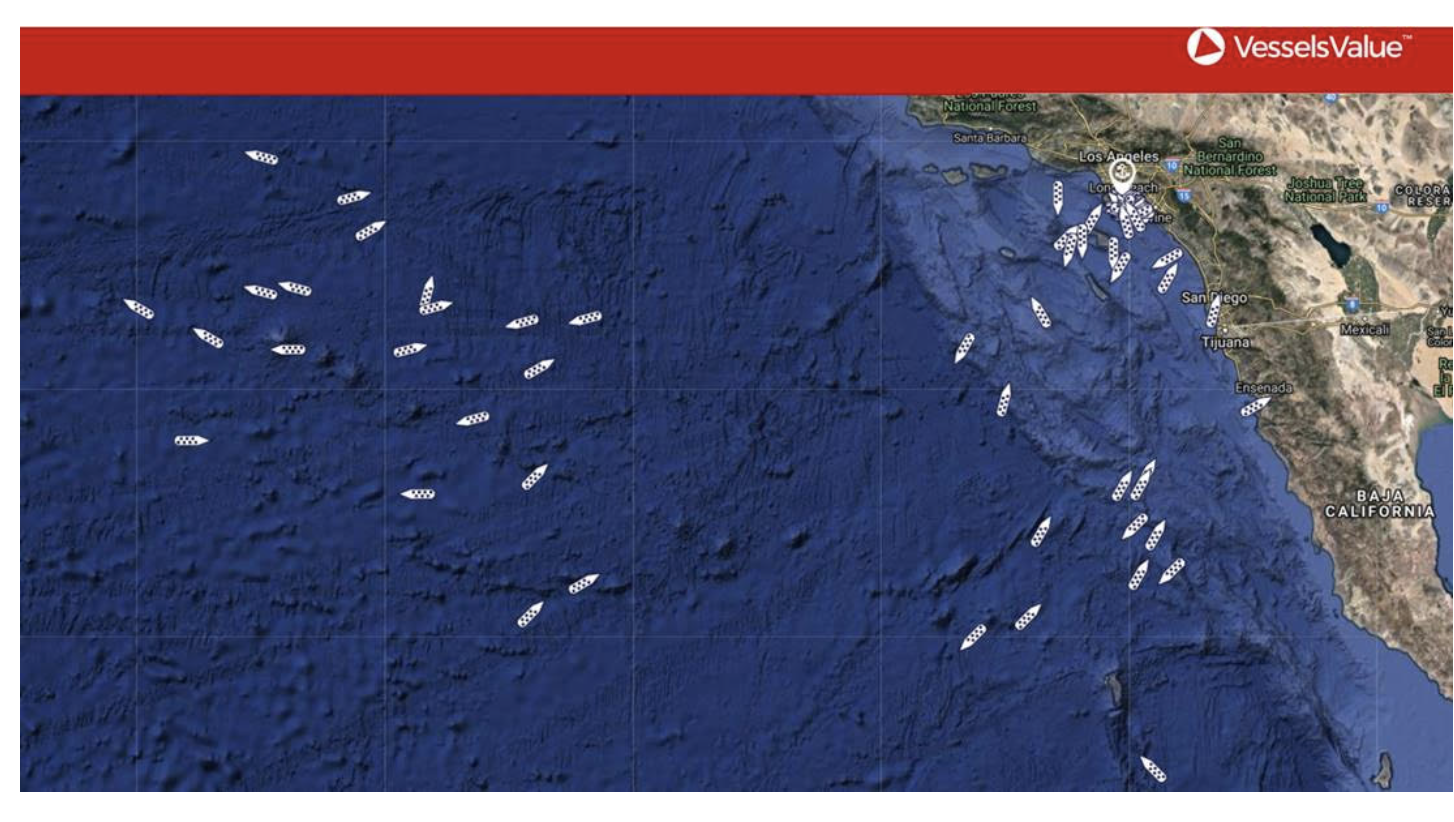

At first glance, the number of container ships in the San Pedro Bay waiting to dock at the Ports of Los Angeles and Long Beach has declined.

Source: VesselsValue, Freightwaves. The photo shows the location of container ships waiting to dock in the Ports of Los Angeles and Long Beach.

The decline is a mirage, a result of the new queuing system, whereby some vessels wait much further away from the coastline. As a result, they are no longer counted in official congestion statistics. The reality is 96 container ships are waiting to dock, an all time record, not just the 40 ships close to shore.

Source: Freightwaves.

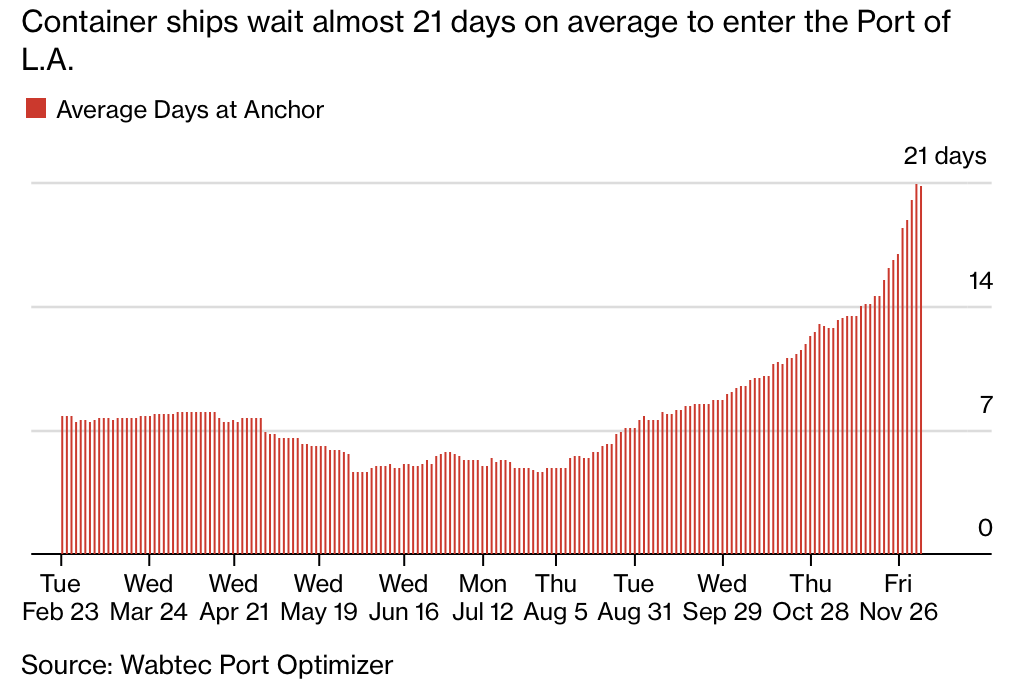

The average wait is at an all-time record too.

Source: Wabtec Port Optimizer, Bloomberg

The reality is the average days at anchor continues to rise. Until these supply chain issues are solved, inflation will persist, as we discussed in last month’s update (here).

5. China’s real estate crisis has worsened, meaning overseas economic growth will likely be another headwind.

The recent price action of US dollar debt obligations of Evergrande, China’s largest property developer and Asia’s largest junk bond issuer, is signaling a debt restructuring is imminent.

The China property market, and associated infrastructure investment, remain under pressure due to a debt crisis hitting several of China’s largest property developers, particularly Evergrande. The real estate industry and industrial sector contribute around 50% of China GDP, according to some estimates.

Evergrande has more than $300 billion in liabilities. In a last ditch effort to maintain payments on domestic debt obligations, Evergrande will restructure its offshore public bonds and private debt obligations.

The Evergrande situation has sparked a contagion. November saw a flurry of defaults and downgrades in the property industry, with yields on junk dollar bonds from Chinese issuers approaching 25%. Credit spreads for many investment grade companies also rose as the contagion spread.