1. Inflation risk and interest rate risk drove financial market performance in 2022, not just for bonds, but also for stocks.

In its November 3, 2021 statement, the FOMC asserted “…Inflation is elevated, largely reflecting factors that are expected to be transitory.” Inflation, as measured by CPI-U, proved less transitory than the Fed thought, rising an additional 3.6% from 5.4% to a peak of 9% in June 2022.

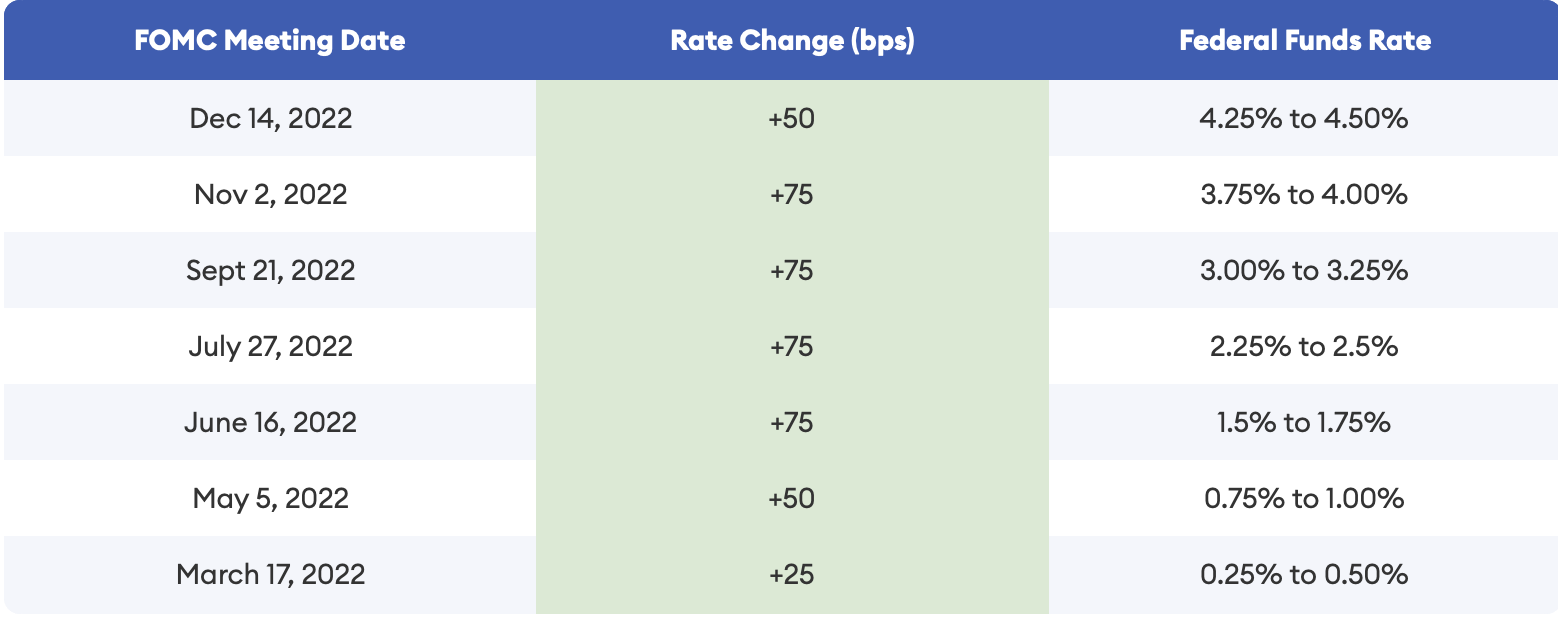

In 2022, the FOMC raised the target range for the Federal Funds Rate by 425 basis points to 4.25% - 4.50% in an attempt to dampen inflation.

Source: Forbes Advisor

For the first four months of the year, the Treasury yield curve steepened, signaling continued Fed rate increases, higher inflation, and a shift in demand for Treasuries relative to the supply of Treasuries. In the back half of the year, the yield curve flattened and finished the year slightly inverted, signaling slower economic growth on the horizon.

Source: treasury.gov, Two Centuries Investments

Because of their higher interest rate sensitivity (higher duration), long maturity Treasury portfolios experienced large declines, in the neighborhood of 30% drawdowns.

This chart shows the price performance of IEF (iShares 7-10 Year Treasury Bond ETF in purple) and TLT (iShares 20+ Year Treasury Bond ETF in blue).

The long duration equivalent in the equity market, namely growth stocks, declined by a similar percentage, also near 30%, as measured by the performance of the Russell 1000 Growth Index. The growth stock headwind dragged down the performance of the U.S. equity market, with the S&P 500 Index barely avoiding a 20% drawdown for the year.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in purple), and IWG (iShares Russell 1000 Growth Index ETF in blue).

2. As we enter 2023, inflationary pressures are moderating. Interest rates for longer maturity Treasuries are likely approaching a peak.

Global supply chain issues have lessened, especially in the global shipping network. The prices of many goods are falling as the pandemic induced demand bounce has ended. Shipping container rates have plummeted towards pre-pandemic levels.

Source: Flexport

Prices have fallen rapidly for used passenger vehicles and computer hardware as previously spiking during the pandemic. Housing rents are rolling over, though the impact has yet to appear in the shelter cost component of CPI-U. The housing market faces the headwind of higher mortgage loan interest rates. Food price increases have likely peaked and energy prices have fallen, though we would caution against expecting further energy price declines.

With inflation moderating and no large tailwind for real economic growth, we suspect interest rates are approaching a peak.

3. Service sector inflation and wage pressures, along with de-globalization trends, will likely put a higher floor under inflation in the near term.

The labor market remain tight, largely due to the supply side. In particular, many older workers left the labor force during the pandemic and are not expected to return. The number of unemployed persons per job opening is at a low level relative to both recent history and the entire post World War II period.

Geopolitical tensions, especially with China, mean supply chains will be adjusted, resulting in higher costs. In addition, the massive influx of low cost Chinese labor into the global economy is over. China’s population has likely peaked. Wages in China have risen significantly over the last decade.

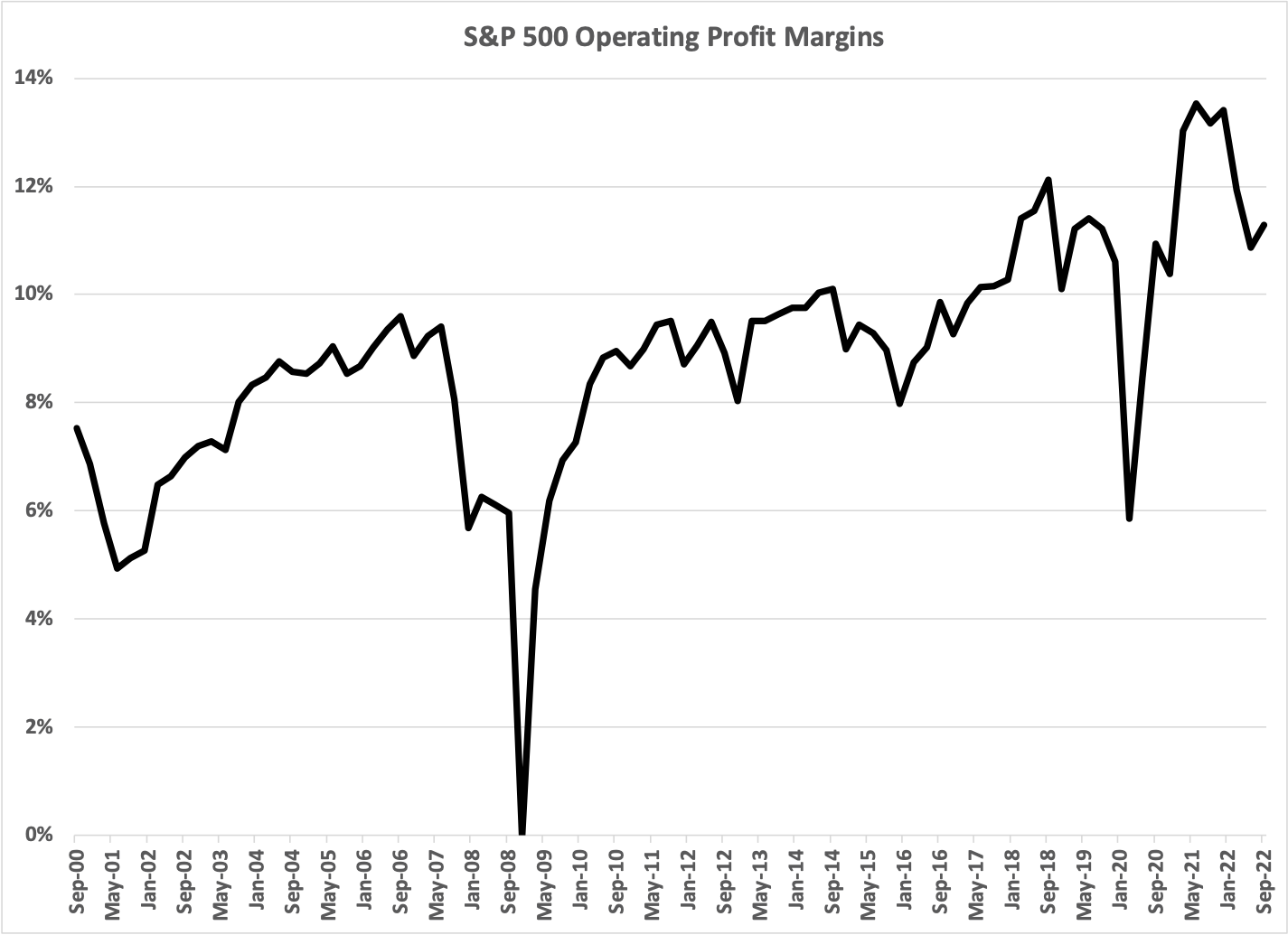

4. While U.S. equity market valuation multiples have contracted, the market is facing profitability headwinds due to higher expenses.

Much higher labor, materials, and equipment costs have reversed the trend of increasing operating profit margins. Higher interest expense and higher taxes will be additional headwinds to net income margins and earnings per share growth.

Source: spglobal.com, Two Centuries Investments

Non-US developed markets equities and emerging markets equities appear more attractive. Europe is facing energy related cost pressure due to the Russia-Ukraine conflict and China is facing a real estate crisis as it emerges from its zero-Covid economic activity restrictions, but valuation multiples outside the U.S. embed a lot of bad news already.

Source: Yardeni Research

5. The path forward for the U.S. equity market is encased in heavy fog. We suspect the path will be inseparable from the path of credit risk.

The heavy fog is due to several factors.

The new floor for inflation is impossible to predict.

The lagged effect of a sizable and rapid tightening of monetary policy on economic activity is difficult to predict.

The Fed’s reaction function is difficult to predict as the Fed balances inflation risk vs. recession risk.

China’s new trend line of economic growth is difficult to predict.

The damage done to the European economy from the Russia-Ukraine conflict and the accompanying energy crisis is difficult to predict.

If the Fed leans too hard in the direction of crushing inflation, an economic downturn is a near certainty and will manifest itself in rapidly rising credit risk.

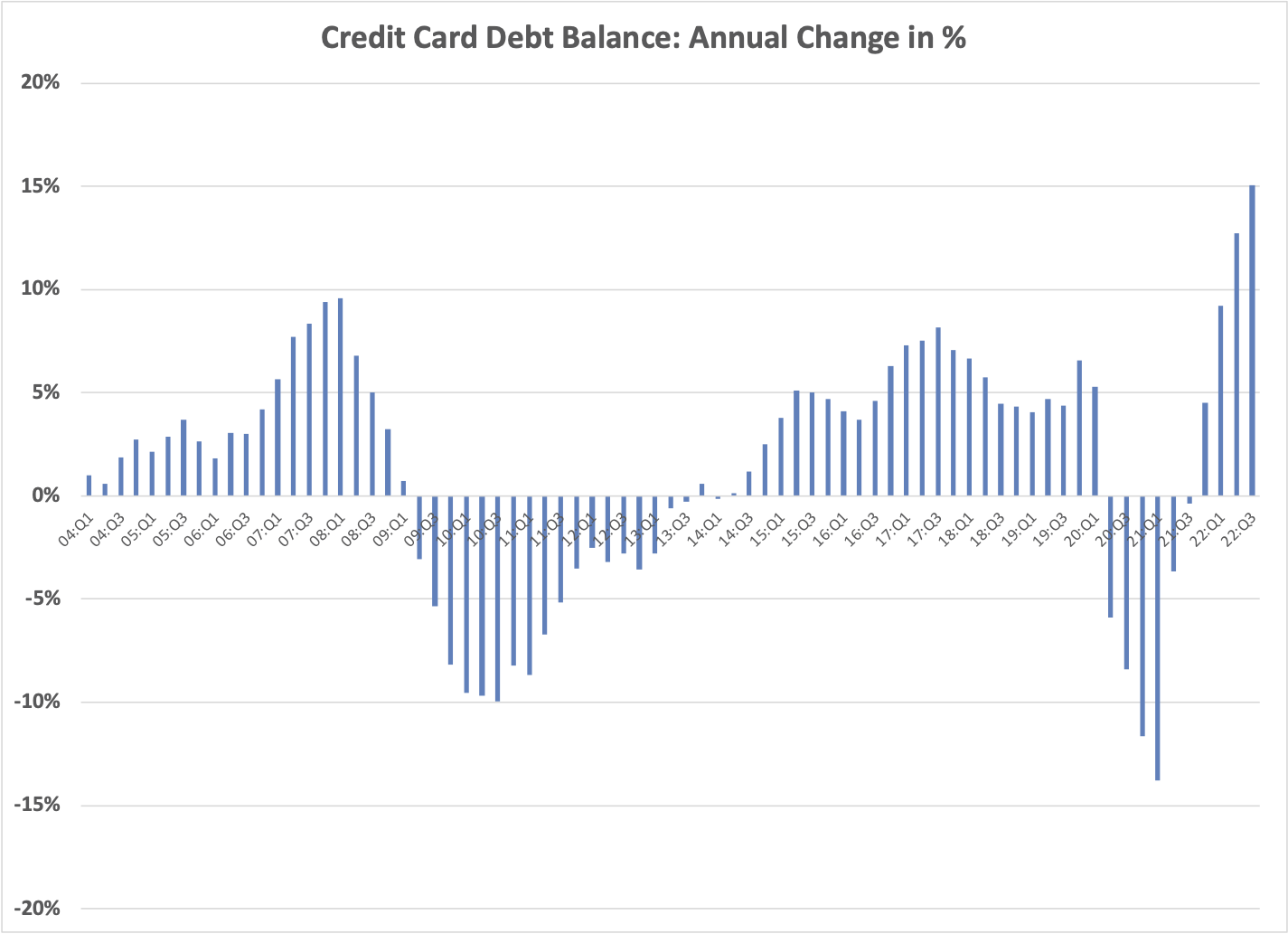

On the consumer front, we are monitoring credit card delinquencies. We do know consumers are running down the savings they built up during the pandemic.

Note: Data from July 1, 2012 to July 1, 2022

Credit card balances increased by over 10% annualized in the second and third quarters of 2022.

Source: New York Fed Consumer Credit Panel/Equifax

On the business front, we are monitoring corporate credit spreads, especially for below investment grade debt.

Leveraged loans (floating rate loans for lower quality issuers) experienced over 300 basis points in rate increases (higher interest expense) in 2022.

Source: Eaton Vance, data through September 30, 2022

Higher operating expenses and interest expense are starting to take a toll on some companies as the percentage of distressed loans has increased. However, the percentage is well below crisis levels.

Source: Eaton Vance, data through September 30, 2022

High yield debt spreads have risen 175 basis points from post pandemic lows, but still remain well below crisis levels.