1. Despite the failure of two large U.S. banks, the equity market rose in March.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in blue), KBE (SPDR S&P Bank ETF in purple), and KRE (SPDR S&P Regional Banking ETF) in orange.

In March, bank stocks experienced sharp declines as three well known banks failed, namely Silicon Valley Bank, Signature Bank, and Silvergate Bank. Silicon Valley Bank had over $200 billion in assets and Signature Bank had over $100 billion in assets as of December 31, 2022.

Over a two-year period ending in early 2022, many banks experienced rapid balance sheet growth and increased interest rate risk to earn a higher return. The spike in interest rates in 2022 led to unrealized losses on securities and loans and damaged the solvency of most banks.

That said, Silicon Valley Bank was an outlier and will serve as a case study on how not to do interest rate risk management.

To the extent the banks do not experience a rapid rise in credit losses, akin to what happened during the Global Financial Crisis of 2008, a banking crisis is highly unlikely. Most banks can access financing from the combination of the capital markets and the Federal Reserve as they deal with the unwind of rapid deposit growth.

Source: Bloomberg

The current decline in bank deposits and corresponding rise in money market fund assets looks like a replay of the late 1970s / early 1980s.

Source: @MaxfieldOnBanks, The San Francisco Examiner - December 27, 1981

2. Certainly, the events of March will lead to higher financing costs for banks. Combined with rising credit provisions, banks will continue to tighten lending standards, creating a headwind for economic growth.

Source: federalreserve.gov

According to the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices, banks have been tightening lending standards on Commerical & Industrial loans since July 2022. Even more severe has been the tightening the Commercial Real Estate loans.

Source: federalreserve.gov

After a period of decline from the pandemic peak, commercial mortgage loan delinquency rates have started to creep up. The special servicing rate (loans that have been modified due to default) has been rising since mid 2022.

This chart shows delinquency. special servicing, and grace rates for CMBS (commercial mortgage-backed securities).

The delinquent loan rate has started to rise before the outstanding balance of delinquent loans returned to pre-pandemic loans.

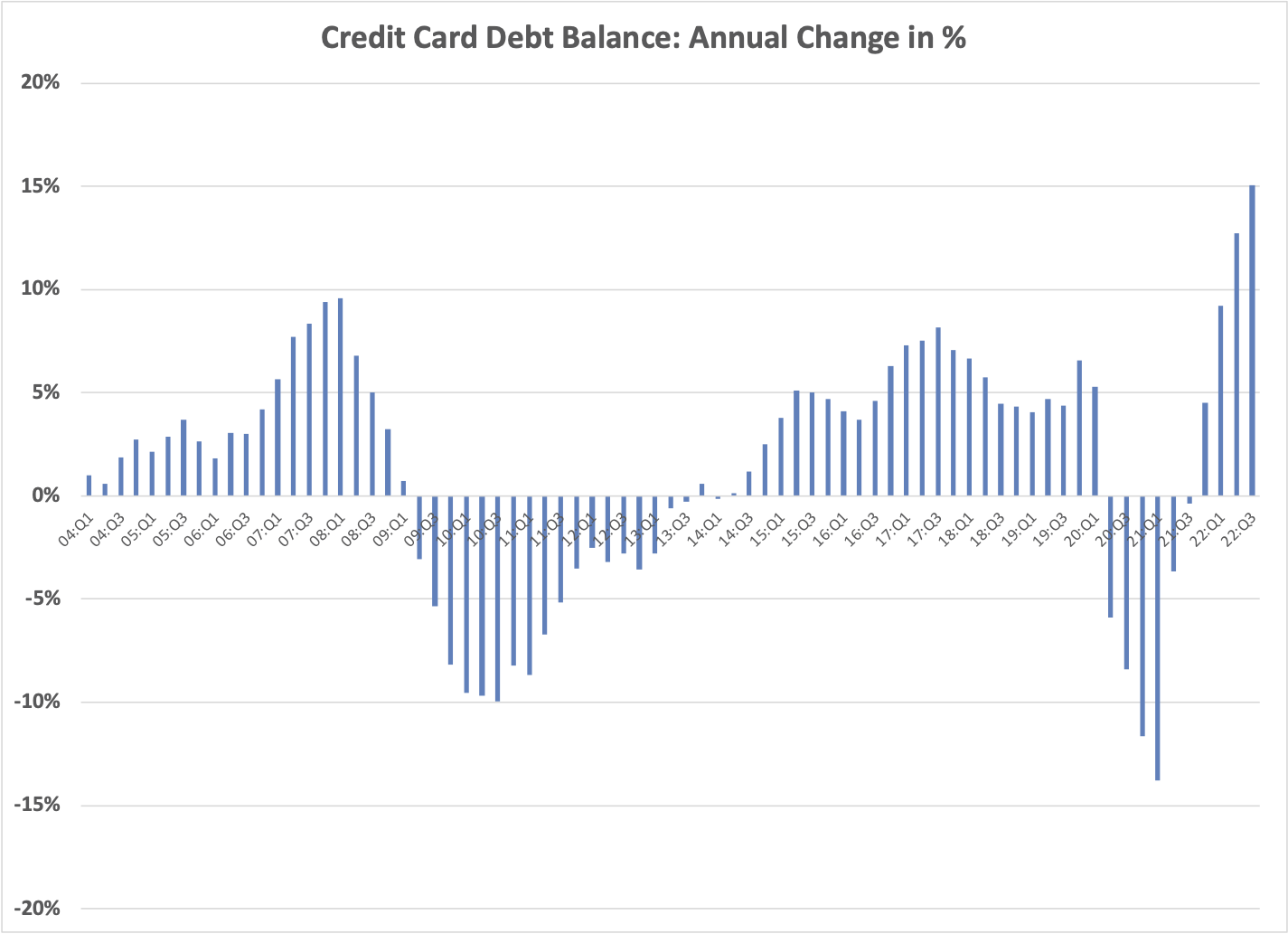

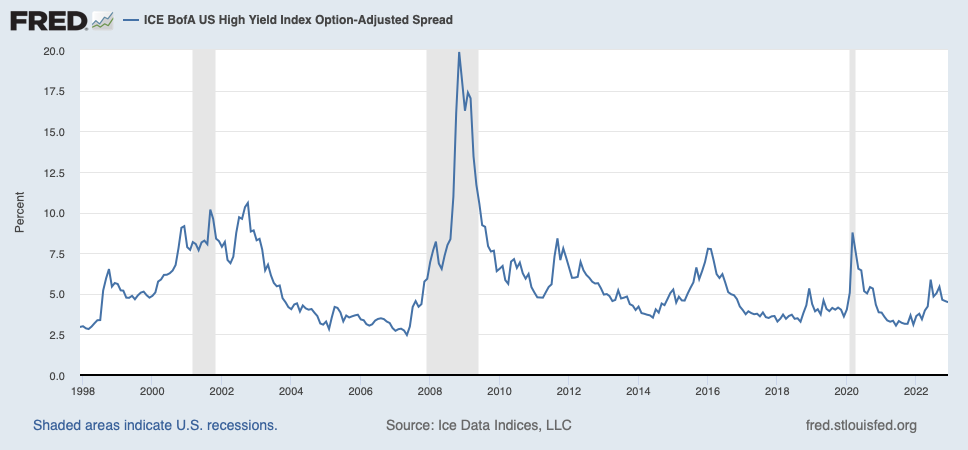

3. Despite some signs of stress in the loan market, the high yield debt market remains sanguine. Credit spreads remain below the the highs of 2022, and well below crisis peaks.

4. The yield curve has become more inverted since the beginning of the year, signaling increasing concerns about future economic growth.

Source: treasury.gov, Two Centuries Investments

5. U.S. manufacturing activity is already contracting. Manufacturing output is more volatile than service sector output and typically leads the services sector.

ISM Manufacturing PMI (Purchasing Manager Index)

Source: March 2023 Manufacturing ISM® Report On Business®

New orders remain weak.

ISM Manufacturing PMI: New Orders component

Source: March 2023 Manufacturing ISM® Report On Business®

6. China’s manufacturing activity is rolling over, a surprising outcome given China only fully reopened its economy late last year.

The weakness in both US and China manufacturing activity is concerning.

7. Inflation continues to decline and is currently running at a 6% annual rate after peaking at 9% in mid 2022.

The big unknown is whether the decline in the inflation rate will continue to be symmetric to its rise. We suspect it will be over the next few months, but are concerned the rate will plateau near 4%.