1. June was a strong month for the U.S. equity market.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange) and IWM (iShares Russell 2000 ETF in green).

In June, U.S. equity markets outperformed non-US equity markets. U.S. small cap stocks outperformed U.S. large cap stocks after lagging their larger cap peers since the regional bank crisis in March.

2. Year-to-date trends remain intact, with large cap U.S. equities leading the way and emerging market equities as the laggard, dragged down by China.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), EFA (iShares MSCI EAFE ETF in blue), EEM (iShares MSCI Emerging Markets ETF in orange) and IWM (iShares Russell 2000 ETF in green).

3. The powerful rally in U.S. growth stocks has propelled the U.S. equity market.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), IWF (iShares Russell 1000 Growth ETF in blue), IWD (iShares Russell 1000 Value ETF in orange).

Year-to-date, U.S. large cap growth stock universe has generated a 30% return.

4. Year-to-date, other asset classes have provided modest returns.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), IWM (iShares Russell 2000 ETF in green), HYG (iShares iBoxx USD High Yield Corporate Bond ETF in blue), GLD (SPDR Gold Trust ETF in yellow), and TLT (iShares 20+ Year Treasury Bond ETF in orange).

5. An examination of performance over the last 18 months is a sober reminder financial markets have not fully recovered from the carnage of the first nine months of 2022.

This chart shows the performance of SPY (SPDR S&P 500 Index ETF in purple), IWM (iShares Russell 2000 ETF in green), HYG (iShares iBoxx USD High Yield Corporate Bond ETF in blue), GLD (SPDR Gold Trust ETF in yellow), aTLT (iShares 20+ Year Treasury Bond ETF in orange), IWF (iShares Russell 1000 Growth ETF in red), IWD (iShares Russell 1000 Value ETF in gray).

6. What lies ahead for financial markets will be likely be driven by the path and composition of inflation.

The level of inflation has historically impacted equity valuation multiples. High inflation (and deflation) has led to lower multiples and thus lower investment returns. The composition of inflation will also impact earnings. The last few decades have been a period of low growth in labor costs, thus boosting corporate profit margins.

Producer prices have already declined back to pre-pandemic levels.

Consumer prices have continued to decline but remain around 2% above pre-pandemic levels.

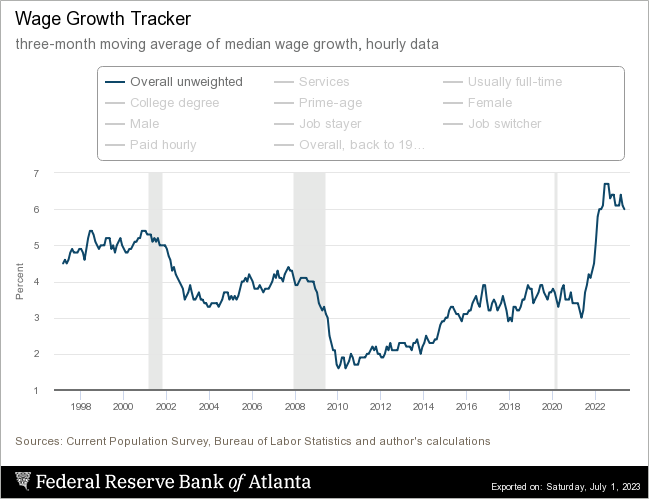

Wage growth remains strong in many segments of the labor market. The stickiness of higher wage growth remains a headwind to profit margins.

7. Global trade volumes are declining and manufacturing surveys point ot continued weakness.

Source: John Kemp (Reuters)

8. Corporate earnings reports for the second quarter are just around the corner. The results and management commentary will provide some clarity on the economic outlook, now that the pandemic related distortion of economic collapse / economic surge / economic normalization is entering the rear view mirror.

The results from early reporter FedEx Corp. (ticker: FDX) were not reassuring. All three FedEx segments (Express, Ground, Freight) experienced volume declines and management is forecasting “flat to low-single-digit-percent revenue growth year over year” for fiscal year 2024.

9. While manufacturing and global trade exhibit sustained weakness, consumer spending on services and most of the service sector have chugged along.

What could disrupt this consumer momentum, outside of the obvious job losses, which is a lagging indicator?

(1) Refinancing risk for loans, especially mortgages, either in the form of higher interest rates (compared to 2021) and tighter bank lending standards, likely driven by the aftershocks of the March 2023 regional bank crisis.

Source: treasury.gov, Two Centuries Investments

(2) Higher energy prices, namely higher crude oil prices.

Source: John Kemp (Reuters)

Crude oil prices remain well below the recent 2022 peak.