1. On the surface, May was a quiet month for U.S. financial markets.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in purple), TLT (iShares 20 Plus Year Treasury Bond ETF in green), LQD (iShares iBoxx $ Investment Grade Corporate Bond ETF in red), HYG (iShares iBoxx $ High Yield Corporate Bond ETF in orange), IWM (iShares Russell 2000 Index in blue), and GLD (SPDR Gold Trust in yellow).

U.S. large cap equities, US small cap equities, U.S. high yield debt, U.S. investment grade debt, long maturity U.S. Treasury bonds, and gold all generated returns in a narrow band between +1% and -1% in the month of May.

2. However there was considerable dispersion within the U.S. equity markets.

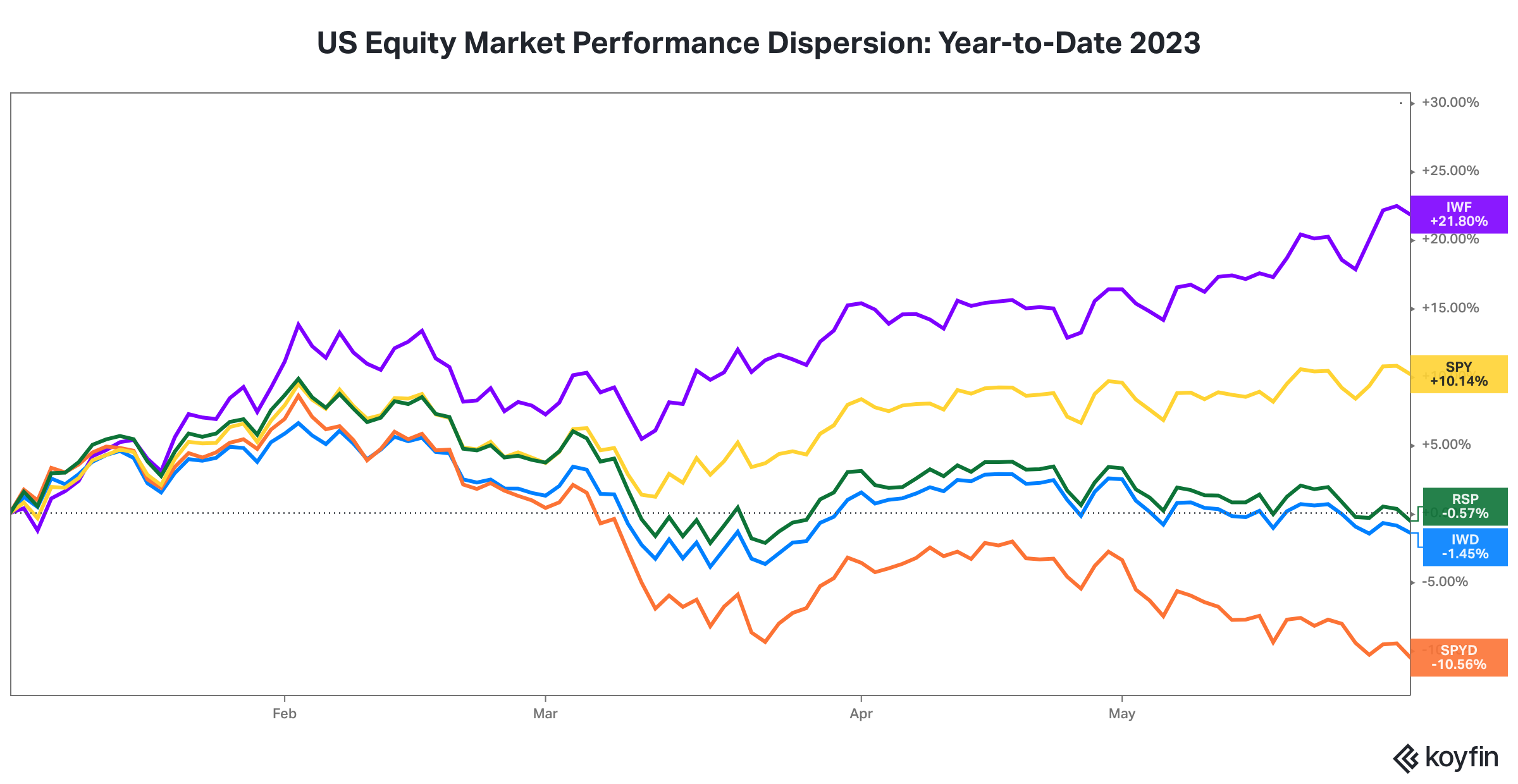

This chart shows the price performance of IWF (iShares Russell 1000 Growth ETF in purple), SPY (SPDR S&P 500 Index ETF in yellow), RSP (Invesco S&P 500 Equal Weight ETF in green), IWD (iShares Russell 1000 Value ETF in blue), and SPYD (SPDR Portfolio S&P 500 High Dividend ETF in orange).

Growth stocks outperformed value stocks by more than 8%. The market cap weighted S&P 500 Index outperformed an equally weighted index of S&P 500 constituents by more than 4%. High dividend stocks were the worst performing style (factor), underperforming the S&P 500 by over 8% and underperforming growth stocks by over 12%.

This chart shows the price performance of IWF (iShares Russell 1000 Growth ETF in purple), SPY (SPDR S&P 500 Index ETF in yellow), RSP (Invesco S&P 500 Equal Weight ETF in green), IWD (iShares Russell 1000 Value ETF in blue), and SPYD (SPDR Portfolio S&P 500 High Dividend ETF in orange).

The year-to-date performance dispersion is even more stark. Growth stocks have outperformed high dividend stocks by an astounding 32%.

3. Large liquid mega cap stocks remain the standout performers.

This chart shows the returns for the following stocks. NVDA = NVIDIA Corporation; META = Meta Platforms, Inc.; TSLA = Tesla Inc.; AAPL = Apple Inc.; AMZN = Amazon.com, Inc.; GOOGL = Alphabet Inc.; MSFT = Microsoft Corp.

These seven mega cap stocks were under performers for most of 2022. All are also considered beneficiaries of trend towards Artificial Intelligence, the most well known applications being autonomous driving systems and ChatGPT with its large language model.

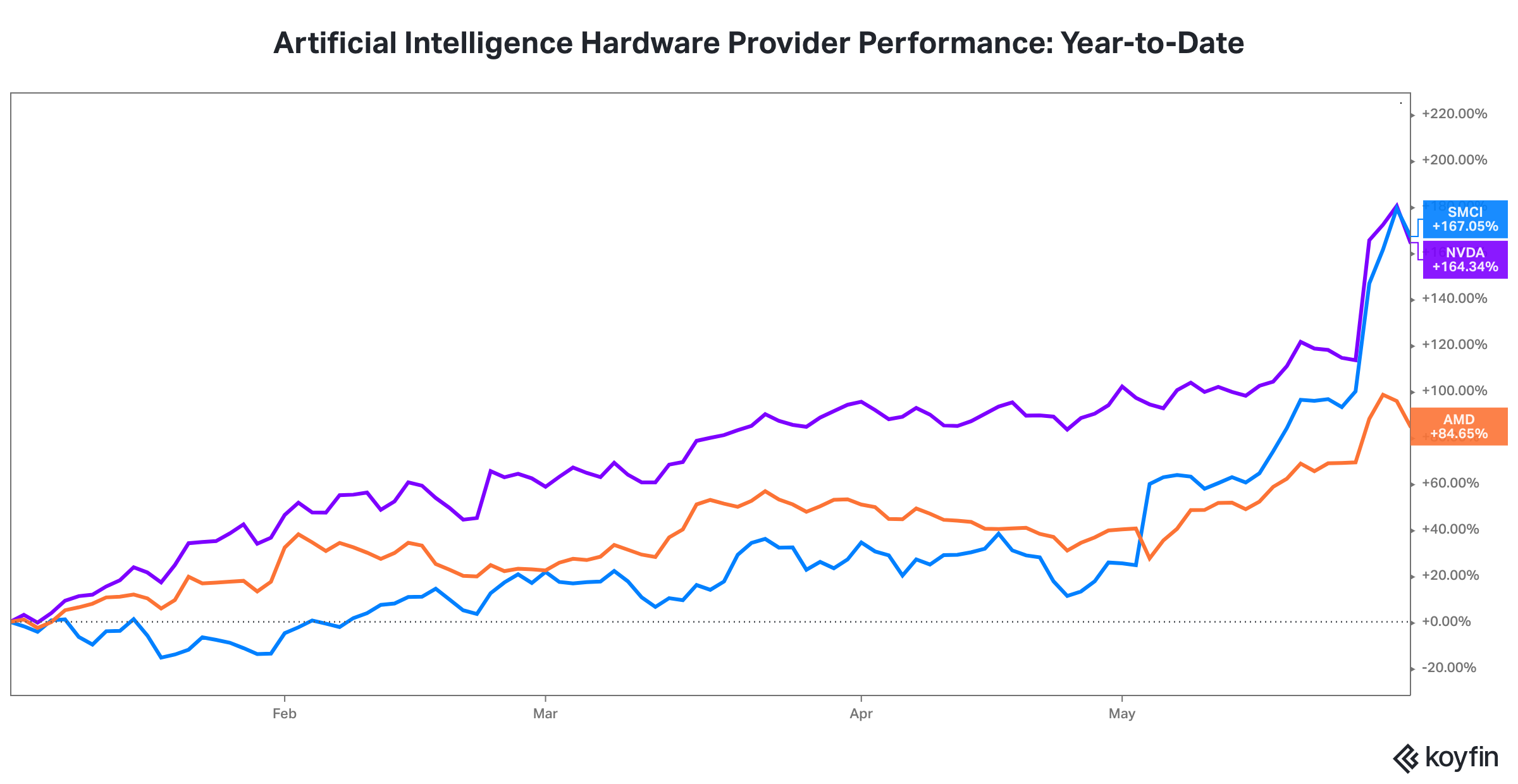

4. The Artificial Intelligence business opportunity has also been a tailwind for certain computer hardwire providers, including some semiconductor stocks.

This chart shows the returns for the following stocks. NVDA = NVIDIA Corporation; AMD = Advanced Micro Devices, Inc.; SMCI = Super Micro Computer Inc.

5. U.S. equity market valuations look expensive at current levels of economic growth and inflation.

Source: Yardeni Research

6. Real economic activity has remained muted over the last four quarters.

This chart shows the year over year change in real gross domestic product.

The good news is the much ballyhooed recession has not materialized. The concern is real economic activity below a 2% growth rate will not translate to the strong corporate revenue growth needed to offset profit margin pressure, especially with no economic growth tailwinds from China and Europe.

7. Producer prices have already declined back to pre-pandemic levels. Consumer prices have remained stickier and well above pre-pandemic levels. Wage growth remains strong in many segments of the labor market.

A continued decline in inflation will ease the pressure on corporate profit margins. However, lower wages represent a trade-off, namely lower consumer spending but lower costs for companies.

8. The boom in federal government spending is behind us.

The pandemic related federal government spending boom supported corporate profit margins and likely delayed the full impact of monetary policy tightening on the economy.

9. Commercial banks are tightening credit standard for loans. The tightening started before the bank crisis in March and has picked up steam since then.

Tightening credit standards for loans is a lagged impact of tighter monetary policy. It will be a headwind for economic growth.