“Water, water, every where,

And all the boards did shrink;

Water, water, every where,

Nor any drop to drink.”

- from Samuel Taylor Coleridge’s famous poem,

The Rime of the Ancient Mariner, first published in 1798

Dollars, Dollars, Everywhere: As the Fed Prints Money

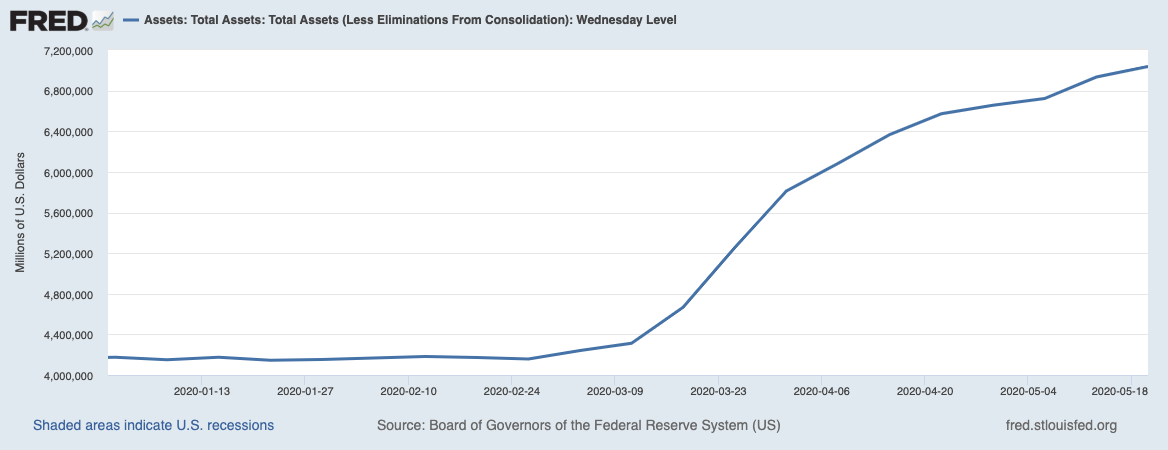

With the Federal Reserve’s printing press whirling to the tune of almost $3 trillion in just three months, one would think US dollars are everywhere. The Fed’s balance sheet has increased massively.

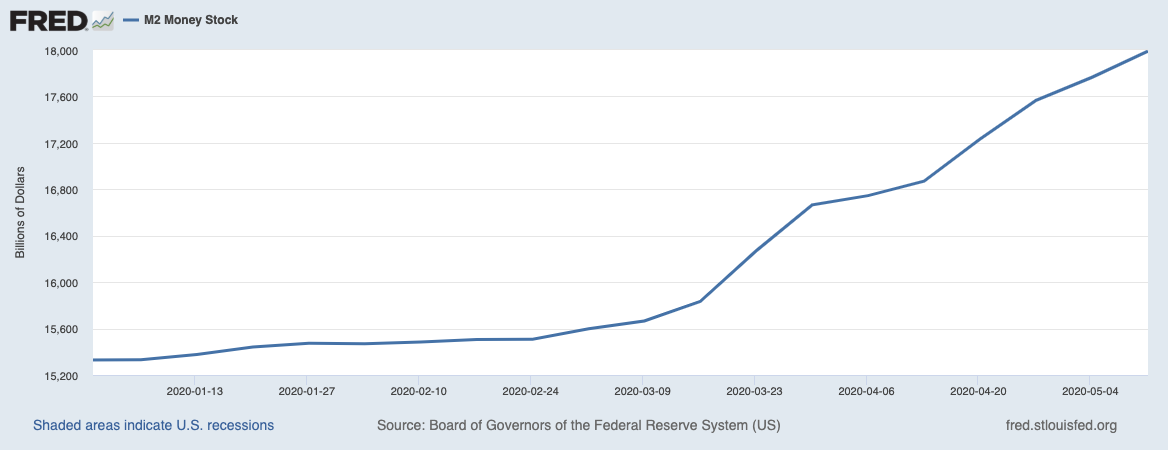

Money supply as measured by M2 has exploded.

Why Did the Value of the USD Not Shrink? - Flight to Quality Trade

With this increase in supply of US dollars, mostly via banking reserves to date, and an increase of another few trillion anticipated, one would expect the value of the US dollar to shrink. Instead, it increased slightly.

The argument most commonly proffered for the increase in the value of the US dollar is the flight to quality trade which surfaces during an economic, financial and political crises. Increased demand for the US dollars offsets the increased supply of US dollars.

Nor a Drop to Drink Overseas: Non-US Investors are Thirsty for the USD

But what underlies the flight to quality trade? One reason is a shortage of US dollars overseas. I was surprised to discover this issue had not been resolved after the 2008 financial crisis. For all the talk of the global economy moving away from the US dollar as the sole reserve currency, the global economy appears to be even more tied to the US dollar today than in 2008.

The USD was involved in almost 90% of all foreign exchange trades in 2019, according to the Bank of International Settlements (BIS). In addition, a May 2019 BIS paper authored by Egemen Eren and Semyon Malamud shows the amount of non-bank debt denominated in USD rose from $6 billion in September 2008 to over $11 billion one decade later. The share of USD debt rose almost 20 percentage points over the decade to almost 70% of all foreign currency non-bank debt. (USD is the solid blue line, EUR is the dashed red line).

Due to the combination of an ongoing reliance on the USD and the recent global economic downturn, many countries face one or more USD related challenges, including

Decline in local currency revenues related to assets that were financed with USD debt, a classic asset-liability mismatch (e.g., Turkey, South Africa),

Decline in USD revenues as exports to the US declined (e.g., China),

Decline in USD revenues as commodity prices (and volumes) declined, since most energy and industrial metals are priced in USD (e.g., Saudi Arabia),

Need to access to USD to pay down loans related to financing global trade, which suddenly and rapidly declined (more than 50% of goods imported into the EU were invoiced in USD in 2018, according to Eurostat), and

Decline in foreign currency reserves while simultaneously increasing their monetary supply at a faster pace than the Federal Reserve.

These forces place downward pressure on currencies, to the benefit of the USD. To help alleviate the current US dollar shortage and quench the thirst of foreign institutions for USD, the Federal Reserve has expanded its existing currency swap lines with foreign central banks.

The Albatross: An Unbalanced Global Economy Too Dependent on the USD

In “The Rime of the Ancient Mariner”, a sailor brings down a curse upon himself and his fellow shipmates by wantonly killing an albatross. The albatross haunting the world post Covid-19 is an unbalanced and fragile global economy, lacking strong productivity growth, with too few engines of economic growth, and ever dependent on cheap access to US dollars. As I noted in prior note (link), without a major restructuring the endgame will be rising inflation, potentially even in the US.

Investment Implication: The Albatross Will Haunt Emerging Markets

While emerging market equities are optically cheap vs. US equities, a continued shortage of US dollars overseas is an albatross for emerging markets - to EM’s economic growth, earnings, and investor sentiment. An easing of the funding pressures is a likely catalyst needed to reverse the years of EM’s equity under-performance.

“Dollars, dollars, every where,

And its value does not shrink;

Dollars, dollars, every where,

EM begging for some to drink.”