Have the stock and bond markets finally bottomed? Where is the inflation rate ultimately headed? Is the US entering a recession or is it just experiencing a dip in activity post the massive fiscal stimulus unleashed during the pandemic?

1. Risk assets sold off sharply in June. The US equity market, as proxied by the SPY ETF (S&P 500) declined 8.25% in June and has declined 20% year-to-date. The 23.5% US equity market drawdown from early January to mid June was one of the 10 largest in the last 60 years.

This chart shows the price performance of SPY (the SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in orange), EEM (iShares MSCI Emerging Markets ETF in purple), and JNK (SPDR Bloomberg High Yield Bond ETF in yellow).

This chart shows the price performance of SPY (the SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in orange), EEM (iShares MSCI Emerging Markets ETF in purple), and JNK (SPDR Bloomberg High Yield Bond ETF in yellow).

US equities and US high yield debt suffered large declines, primarily due to the impact of monetary tightening on valuations.

2. Year-to-date, long maturity US Treasuries have also sold off sharply, declining almost 22%, more than the equity market. Given Treasuries have long acted as the flight to quality asset, their sell-off during the equity market drawdown is a rare occurrence. Gold performed much better than Treasuries, only declining 1.5%.

This chart shows the price performance of SPY (the SPDR S&P 500 Index ETF in blue), TLT (iShares 20+ Year Treasury Bond ETF in purple), and GLD (SPDR® Gold Shares ETF in orange).

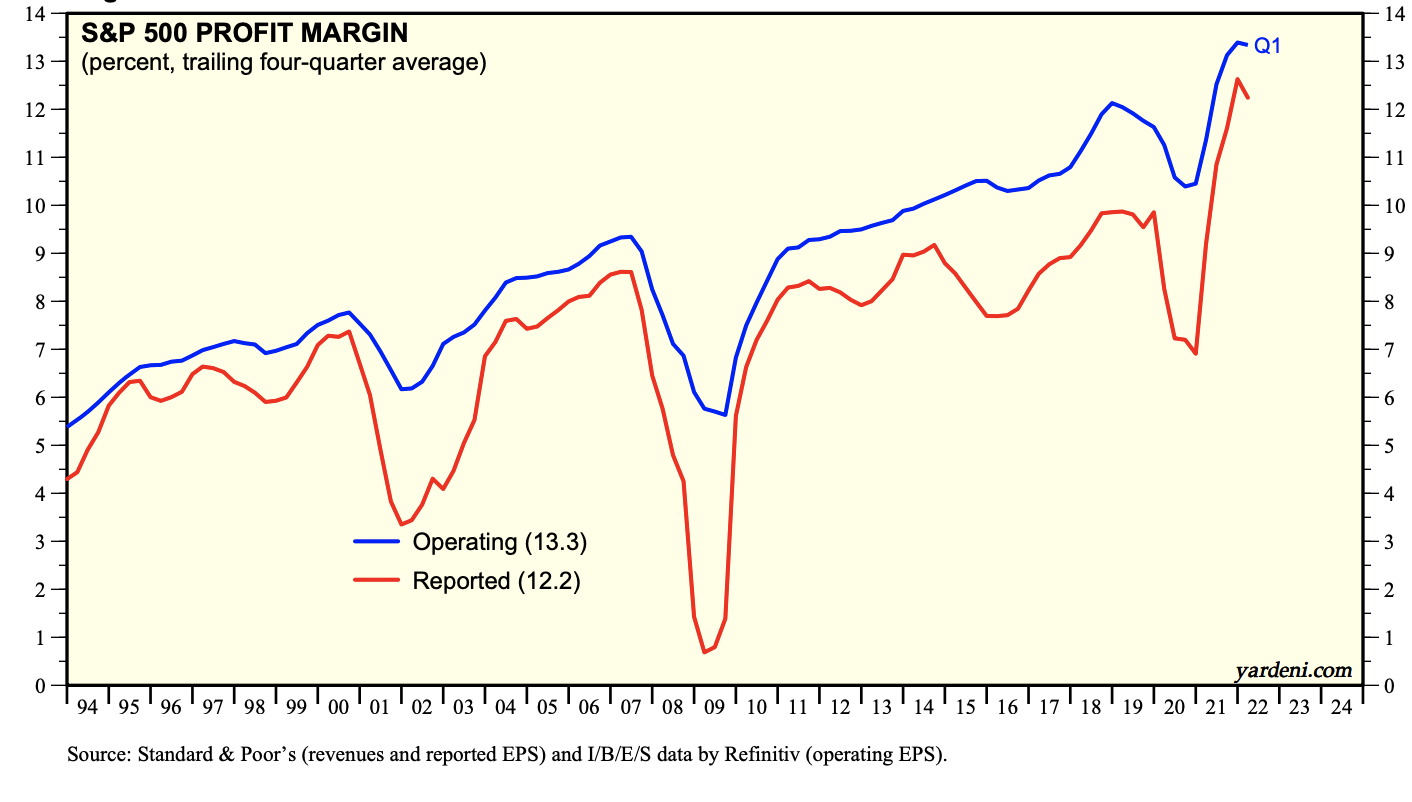

3. The decline in equity prices, while painful for investors, has resulted in more reasonable equity market valuations. The unanswered question is how the equity market will react to declining profit margins due to higher costs, especially labor, transportation, and energy costs.

Source: Yardeni Research, Inc.

The current forward Price / Earnings ratio of approximately 16 is near the long term average. However, analysts are forecasting a strong earnings rebound following the anticipated 4% earnings growth this quarter (2nd quarter). Given the headwinds, a strong rebound is unlikely to materialize.

Source: Yardeni Research, Inc.

Profit margins has been on an upward trend for the last few decades. The three dips occurred during economic growth shocks driven by the bursting of the Dot-Com Bubble (2000-2002), the Global Financial Crisis (2008-2009) and the COVID-19 Pandemic (2000). Whether another growth shock is on the horizon is up for debate. However, profit margins about about to decline. The question is by how much and for how long.

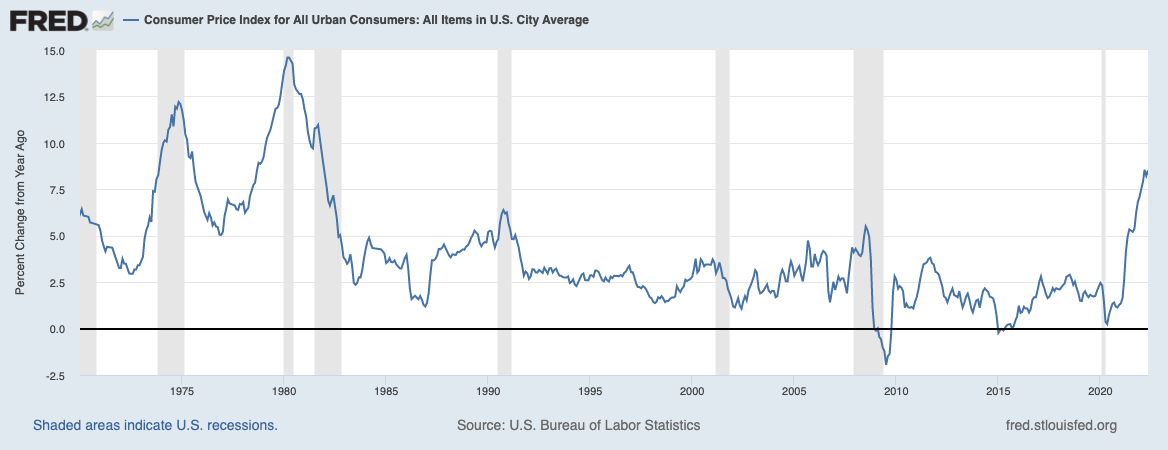

4. Inflation (as measured by CPI) has risen to its highest rate since the 1970s. In an attempt to suppress inflation, the Federal Reserve has tightened monetary policy, raising the Fed Funds Rate by 150 basis points thus far in 2022. We suspect inflation will moderate, but remain well above pre-pandemic levels until energy supply and global transportation system issues are resolved.

Initially the rise in inflation was driven by the goods sector, as exemplified by the rapid rise in used car prices. The demand for most goods has normalized post the pandemic boom while supply chain issues that hindered the production and delivery of many goods have begun to moderate. The housing market has begun to cool as mortgage rates have risen well over 200 basis points.

On the other hand, inflationary pressures have seeped into the service sector and the labor market remains tight. We are most concerned with the high prices of crude oil and natural gas. These fossil fuels touch almost every aspect of economic activity, as they impact transportation costs, fertilizers for food, manufacturing, mining, chemicals, packaging, and so on.

5. Recession fears rose in June as it became more apparent real economic activity has slowed. We anticipated some slowing as the impact of the massive fiscal stimulus wore off. Whether a sustained economic downturn is brewing is uncertain. The economic data is harder to interpret than usual because of the pandemic related distortions.

US government expenditures rose at a relatively steady pace until the pandemic hit and then spiked. The normalization of expenditures will be a near term headwind to economic growth and corporate earnings.

Source: treasury.gov, Two Centuries Investments

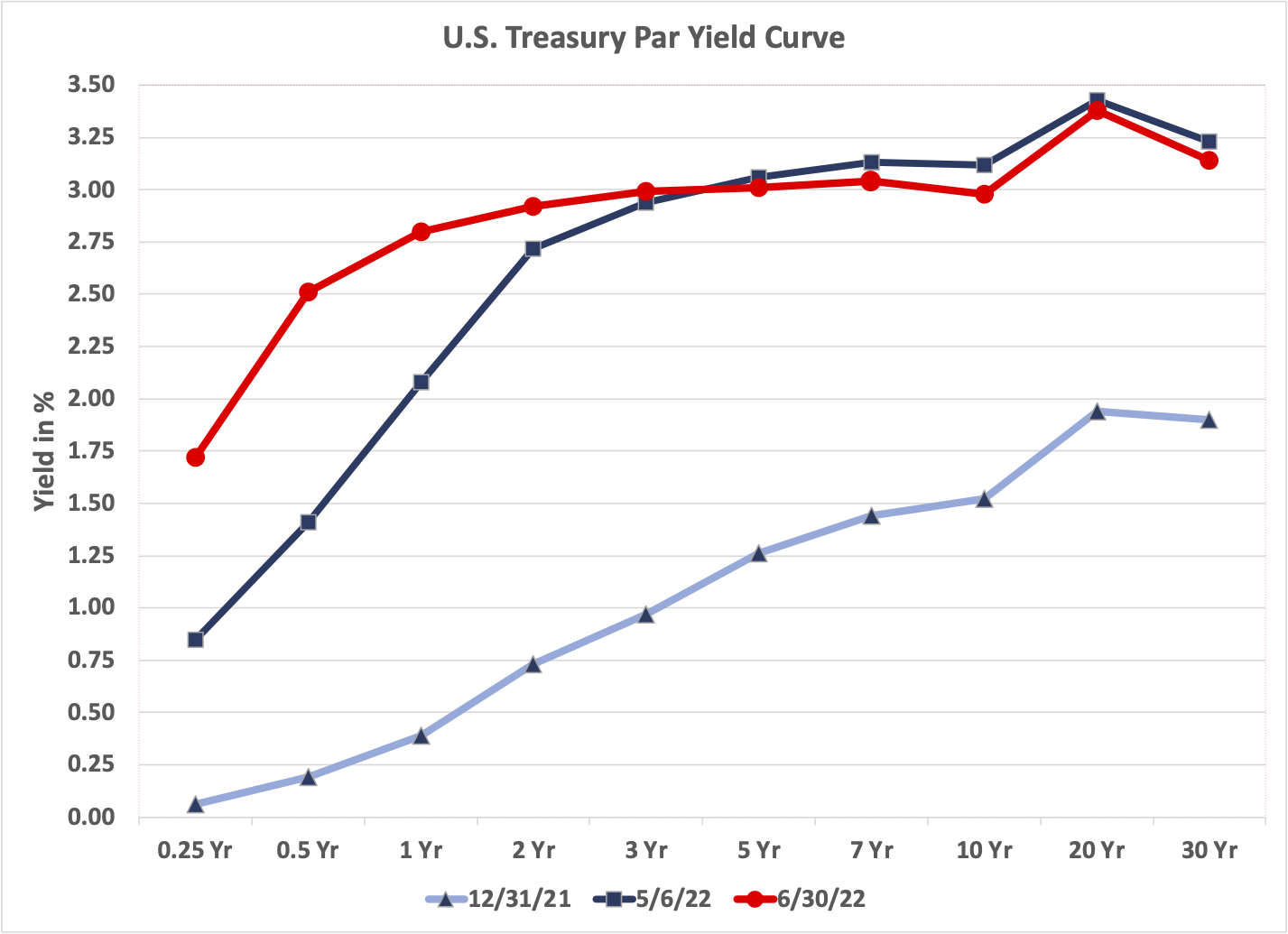

The Treasury yield curve has started to reflect concerns about the sustainability of real economic growth. Since early May, the yield curve has noticeably flattened.

Source: Alhambra Investments

The Eurodollar futures curve is inverted, and has been for quite awhile, implying the market is expecting the Fed to have to cut the Fed Funds Rate (yes, cut rates) in early 2023 because of a growth slowdown.

On the other hand, the labor market appears strong on many metrics, including the widely referenced unemployment rate. If the labor market remains tight, the economy may be able to bridge the near term slowdown from the normalization of fiscal spending. Admittedly, the labor market is a lagging indicator. Also some labor metrics, such as the number of workers holding multiple jobs, don’t paint as favorable a picture as the unemployment rate.