1. Financial market performance in July was in sharp contrast to investor experience in the first six months of the year. Risky assets in the U.S. staged a big rally.

This chart shows the price performance of QQQ (Invesco QQQ ETF, which tracks the Nasdaq-100 Index, in purple), RTY (iShares Russell 2000 ETF in orange), SPY (SPDR S&P 500 Index ETF in blue), and JNK (SPDR Bloomberg High Yield Bond ETF in green).

2. Does July mark a change in trend, i.e., a market bottom for risky assets? If the Fed continues to tighten monetary policy, the answer will depend on corporate earnings growth. Thus far, earnings reports have provided a mixed message.

By the end of July, 56% of the companies in the S&P 500 had reported quarterly earnings results for the second quarter of 2022. No surprise, the energy sector has been the star performer. The financial, consumer discretionary, and communication services sectors have experienced double digit earnings declines, year over year.

The good news is the S&P 500’s expected earnings growth has risen from 4% to 6% and revenue growth from 10.1% to 12.3%, based on analyst consensus.

The bad news is the boost in earnings and revenue expectations was not broad based and was driven entirely by the energy sector. In addition, earnings growth is about 400 basis points below revenue growth, meaning profit margins are contracting.

A good example is Verizon (ticker: VZ). Verizon’s Consumer Wireless Segment, which generated 85% of the overall company’s EBITDA (earnings before interest, taxes, depreciation, and amortization) in 2021, experienced 9.1% revenue growth but no EBITDA growth year-over-year. Profit margins declined almost 400 basis points.

Verizon management is now forecasting a modest slowdown in revenue growth going forward. The CEO stated “The inflationary environment is clearly impacting consumer behavior. And we also saw intensified competition for consumer attention. The result was a significant impact on our gross adds.” In summary, Verizon is being squeezed by higher expenses as revenue growth begins to decelerate.

More competition and a modest pickup in inflation is not surprising late in an economic cycle. What is different this cycle is much higher inflation has occurred, and, even more concerning, the high inflation has persisted.

3. The yield curve continues to flash a warning about economic growth.

Source: treasury.gov, Two Centuries Investments

The U.S. Treasury yield curve has flattened markedly since early May. At the end of July, the yield curve was inverted, as measured by the two year yield of 2.89% exceeding the ten year yield of 2.67%. An inverted yield curve usually signals a recession is brewing.

Source: CME, Two Centuries Investments. This chart shows the Eurodollar Futures rates, calculated as 100 minus the settlement price, for various maturities.

The Eurodollar futures curve is sending an even stronger signal, indicating the Federal Reserve is risking a policy error with its planned tightening of monetary policy.

Remember, much of the economic impact of tighter monetary policy occurs with a lag.

4. The credit markets are exhibiting a more sanguine attitude about economic growth than the interest rate markets.

High yield spreads declined by over 100 basis points in July to below 500 basis points. If credit spreads revert back to a rising trend, we will become concerned credit markets are confirming the signal from interest rate markets.

5. The strength of the US dollar, high prices of energy and food, and the troubles in China’s real estate market are weighing on many emerging markets countries.

The US dollar is approaching its highest level in twenty years after a dramatic spike over the last year.

Emerging markets equities did not rebound in July like US equities.

6. Technically, we are already in a recession, with two consecutive quarters of negative real economic growth. However, it feels more like stagflation since the the duration and depth of the downturn in real economic activity has been mild to date.

Crude oil supply constraints and the trend of deglobalization will keep inflation above levels to which we have become accustomed.

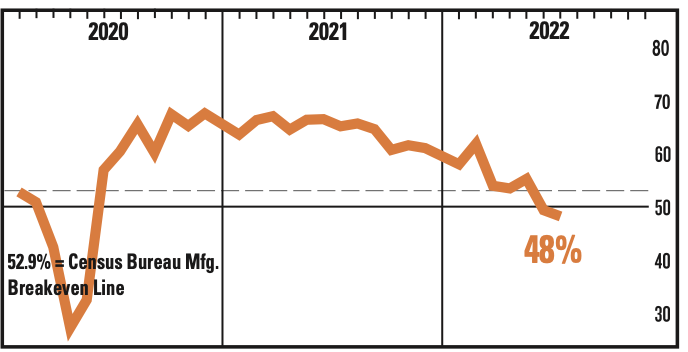

Of immediate concern is the trend of real economic growth. One item we are monitoring closely is trend of new orders relative to the trend in inventories, especially for manufacturers. Institute of Supply Management Report on Business in July raised an alarm as new orders continued to decline while inventories continued to raise.

Walmart and Target have recently highlighted inventory management issues in discretionary items, like apparel and home furnishing. These issues are a result of lower consumer disposable income, due to high energy and food prices, and changing consumer preferences post pandemic. Presumably these inventory issues will be resolved within the next two quarters. More concerning would be the spread of inventory management issues to industries like semiconductors.

manufacturing ISM - New ORDER Index: July 2022

Source: Institute for Supply Management Report on Business. This chart shows shows the Manufacturing ISM New Order Index.

manufacturing ISM - inventories Index: July 2022

Source: Institute for Supply Management Report on Business. This chart shows shows the Manufacturing ISM New Order Index.