Orange Is the New Black was an Emmy award winning television series based on Piper Kerman's memoir Orange Is the New Black: My Year in a Women's Prison. The series ran from 2013 – 2019 on Netflix.

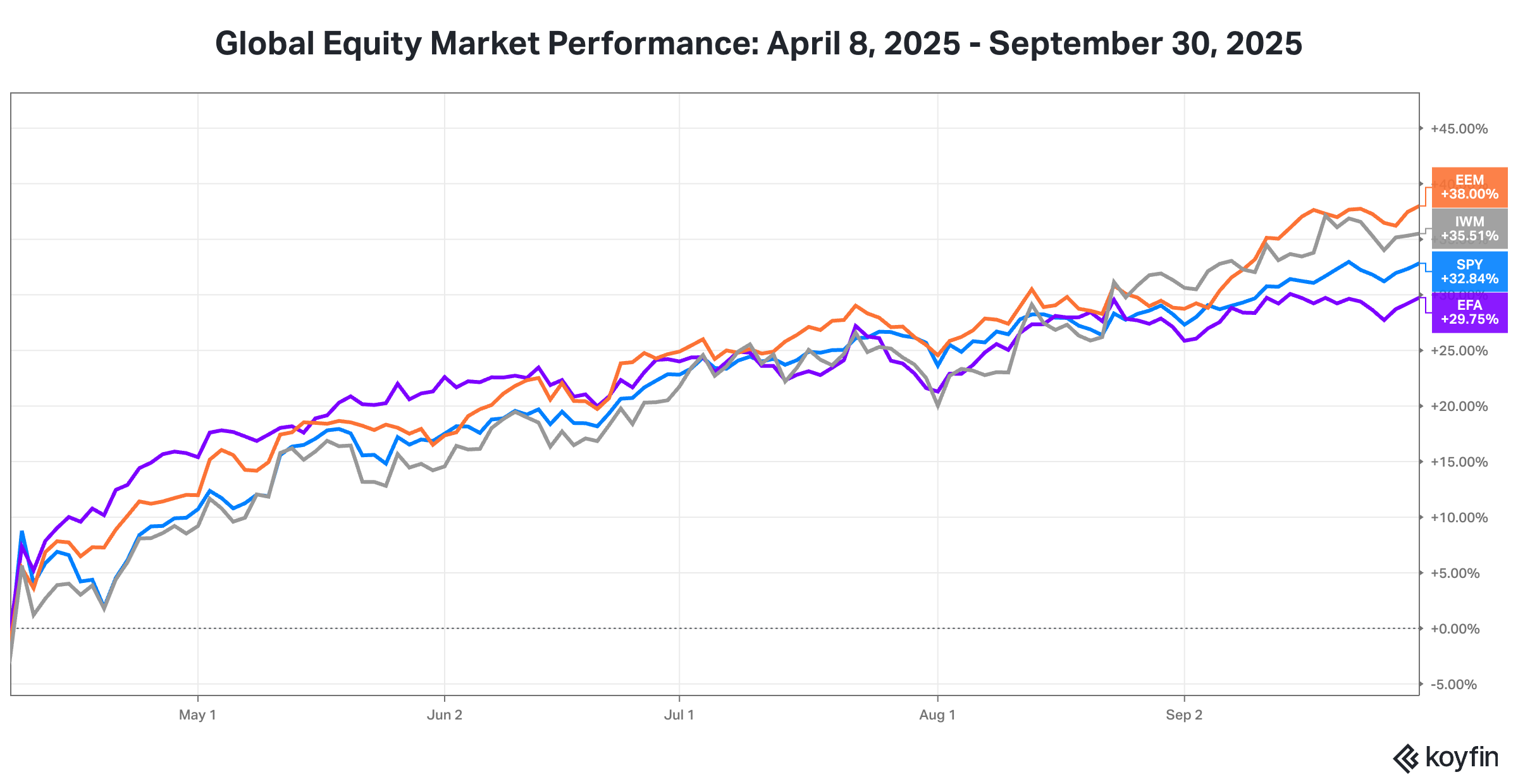

Since the April 1 “Liberation Day” tariffs were announced by the Trump Administration, investors seem to have decided “High Beta is the New Alpha”. The 100 stocks in the S&P 500® Index exhibiting the highest sensitivity to market movements, or “beta”, have outperformed the index, i.e., generated “alpha”, for seven straight months and by a cumulative 23%. High beta stocks have even edged the so-called Magnificent 7 mega-cap stocks over those seven months.

OK. OK. Most of the excess return generated by high beta stocks isn’t alpha. The excess return is just stocks with higher measured sensitivity (beta) to the market’s movements exhibiting that price sensitivity when the stock market surges upward as it has done for seven months.

Our point is equity investors have adopted a more speculative positive, as evidenced by the combination of

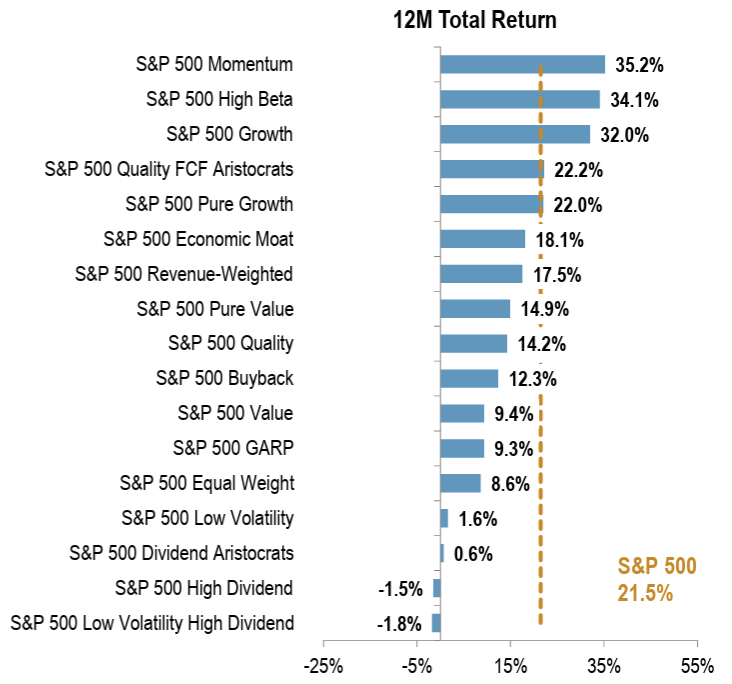

large outperformance of high beta stocks over last twelve months, especially the last seven months,

large underperformance of low volatility stocks, high dividend stocks and dividend aristocrat stocks (consistent dividend payers) over the last twelve months, and

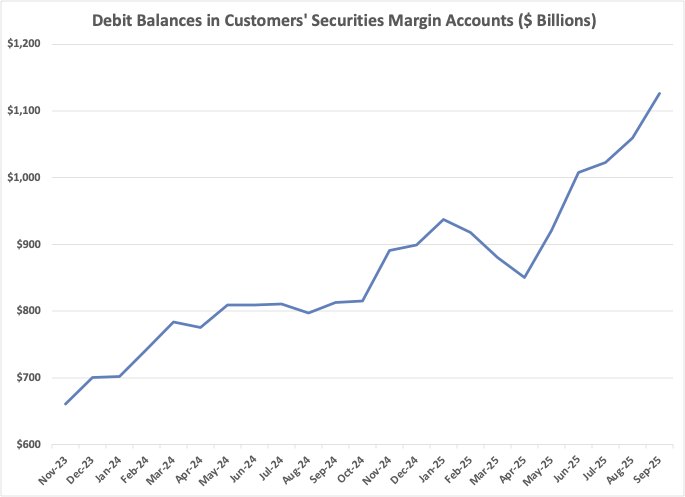

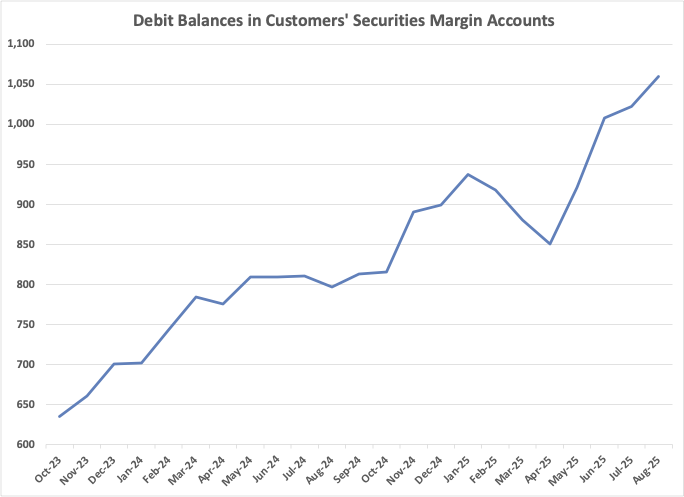

rise in financial leverage, i.e., buying stocks on margin, discussed in our Oct 2005 Market Update, Knockin’ on Leverage’s Door,

1. High beta stocks have been the equity market leaders over the last seven months.

2. The stocks driving the outperformance of the high beta factor within the S&P 500 Index do not fall within the mega-cap stock universe.

Source: S&P Dow Jones Indices

3. The performance divergence among factors has been quite stark over the last twelve months.

High beta, momentum, and growth have been the best performing factors over the last twelve months.

Low volatility, high dividends, and dividend aristocrats have been the worst performing factors.

Source: S&P Dow Jones Indices

4. The continued rise in margin loans has boosted the U.S. stock market.

Source FINRA

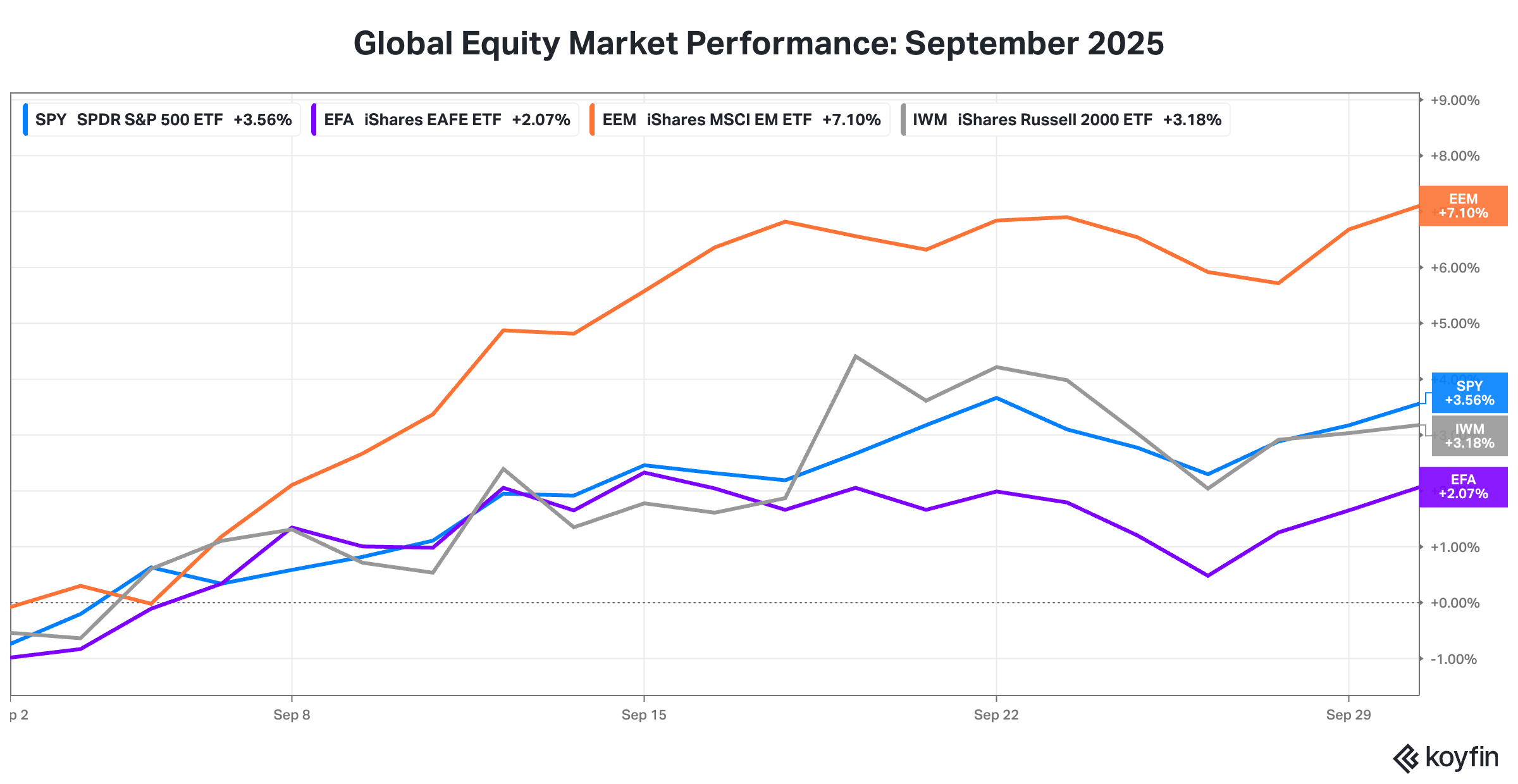

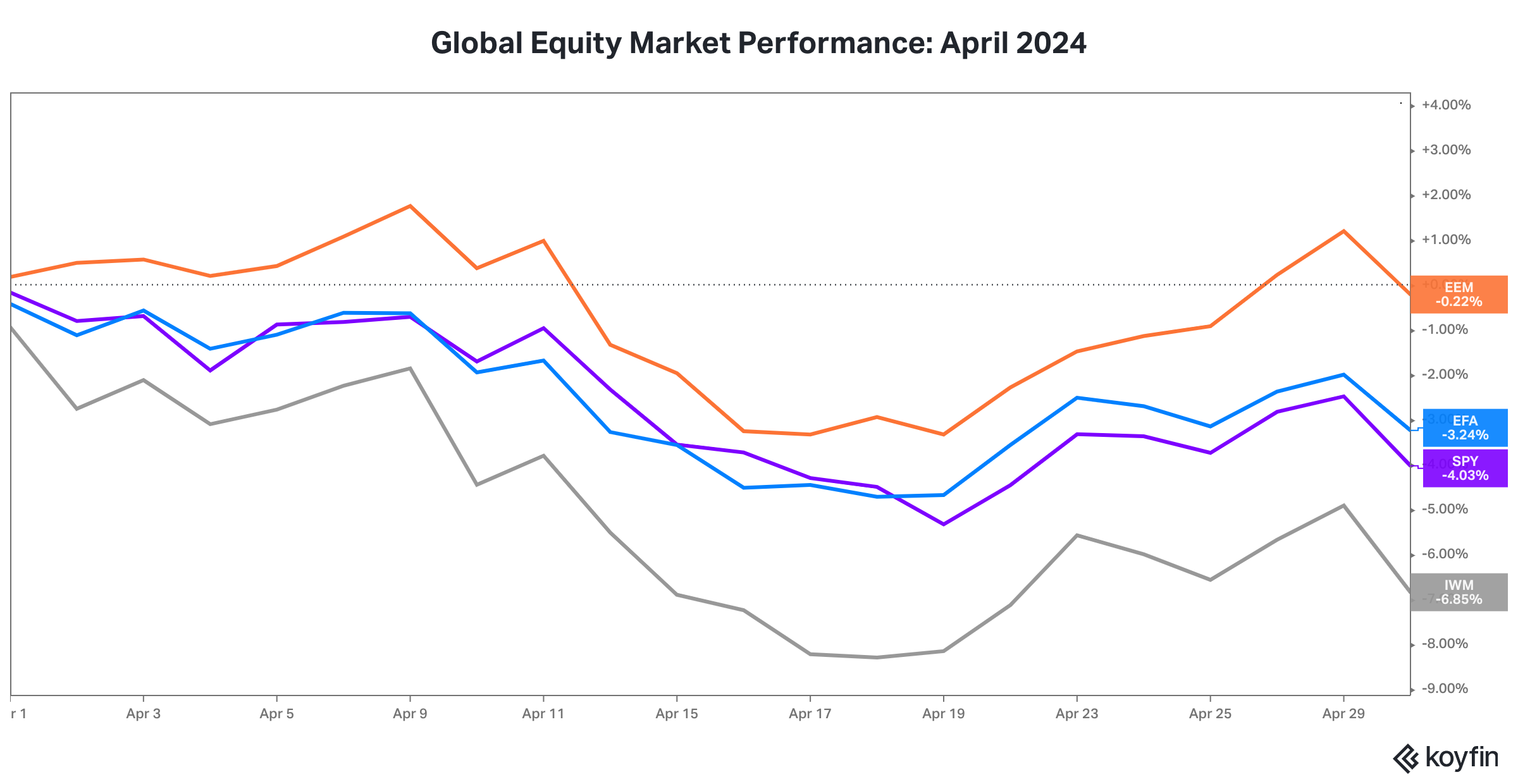

5. Emerging markets equities outperformed developed markets equities in October, extending their year-to-date outperformance.

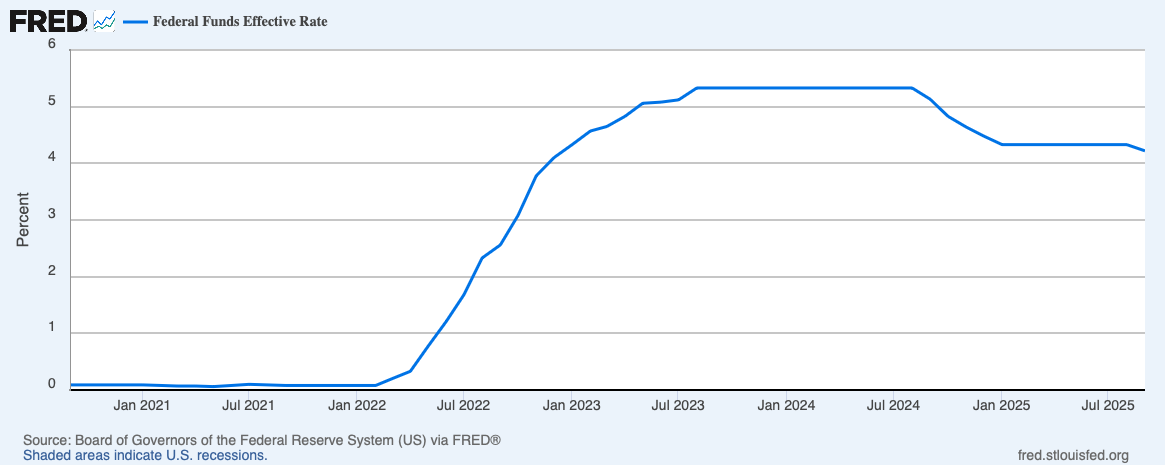

6. On October 29, the Federal Reserve cut its target for the Federal Funds Rate by 25 basis points, the second reduction to its policy rate since the end of April.

Fascinatingly, despite two policy rate cuts, the Treasury yield curve, from the two year maturity to the thirty year maturity, was unchanged from April 30 to October 30.

Source: https://www.ustreasuryyieldcurve.com

Disclosure: Two Centuries Investments is a registered investment advisor. That material is for general information and reference purposes only and does not constitute tax, legal, or investment advice and is not intended as an offer to sell, or a solicitation to buy securities, services or investment products. All information has been obtained from sources believed to be reliable, but accuracy is not guaranteed, and reliance should not be placed on the information presented. This material may not be reproduced, copied, or transmitted, or any of the content disclosed to third parties, without the permission of Two Centuries Investments. Past performance is not a guarantee of future results.