1. Despite the failure of a third large U.S. bank, the U.S. equity market rose in April.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in purple), and EEM (iShares MSCI Emerging Markets ETF in orange).

2. April continued the year-to-date trend of non-US developed market equities leading the way higher, while emerging market equities continue to lag.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in purple), and EEM (iShares MSCI Emerging Markets ETF in orange).

3. While the US equity market has risen almost 10% year-to-date though the end of April, there has been massive performance dispersion within the market.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in blue), XLK (Technology Select Sector SPDR ETF in green), and KRE (SPDR S&P Regional Banking ETF in red).

Technology stock prices have bounced higher, with the sector generating a year-to-date return in excess of 20%. On the other hand, the bank crisis has crushed regional bank stocks, which have crashed by more than 25% year-to-date through the end of April.

4. The regional bank crisis has yet to be resolved, highlighted by the failure of First Republic Bank and its sale at a discounted valuation to JP Morgan Chase & Company.

First Republic Bank was a large regional bank, with $165 billion in deposits as of December 31, 2022.

As we noted in last month’s update, over a two-year period ending in early 2022, many banks experienced rapid balance sheet growth due to an influx of deposits. The banks invested the deposits to earn higher interest income, but took significant interest rate risk in the process. In 2022, the spike in interest rates across the yield curve led to unrealized losses on securities and loans and reduced the capital (solvency) of most banks.

Adding to the solvency concerns for regional banks is rising delinquencies for commercial real estate loans, especially office and retail loans.

On the other side of the balance sheet, the spike in short term interest rates exposes the banks to disintermediation (deposits being withdrawn and moved to money market funds) and to higher funding costs to replace lost deposits. Together, these factors reduce the future net interest income (earnings) needed to replenish the capital.

Worst of all is uninsured depositors who travel in the same personal and professional circles. Silicon Valley Bank (SVB) and First Republic Bank (FRB) had well above average exposure to these “hot money” depositors.

Not only aren’t they “sticky” depositors, they don’t act independently and their behavior is highly correlated. Their risk profile is reminiscent of the subprime borrowers of the 2008 Global Financial Crisis, a group whose default behavior was highly correlated once stress hit the financial system.

Once these depositors initiated large and rapid deposits withdrawals, the fates of SVB and FRB were sealed. Selling a large percentage of assets with unrealized losses crystallizes insolvency. Replacing a large percentage of existing deposit funding, even with Federal Home Loan Bank (FHLB) secured borrowing available, is near impossible and will result in negative earnings for the near term as funding costs will exceed interest on assets.

The chart below, from Moody’s Analytics, shows the banking system funding stress has reached 2008 Global Financial Crisis levels.

The chart below shows the build up of deposits in smaller banks during the pandemic, driven by the massive government stimulus programs, and the recent accelerated decline.

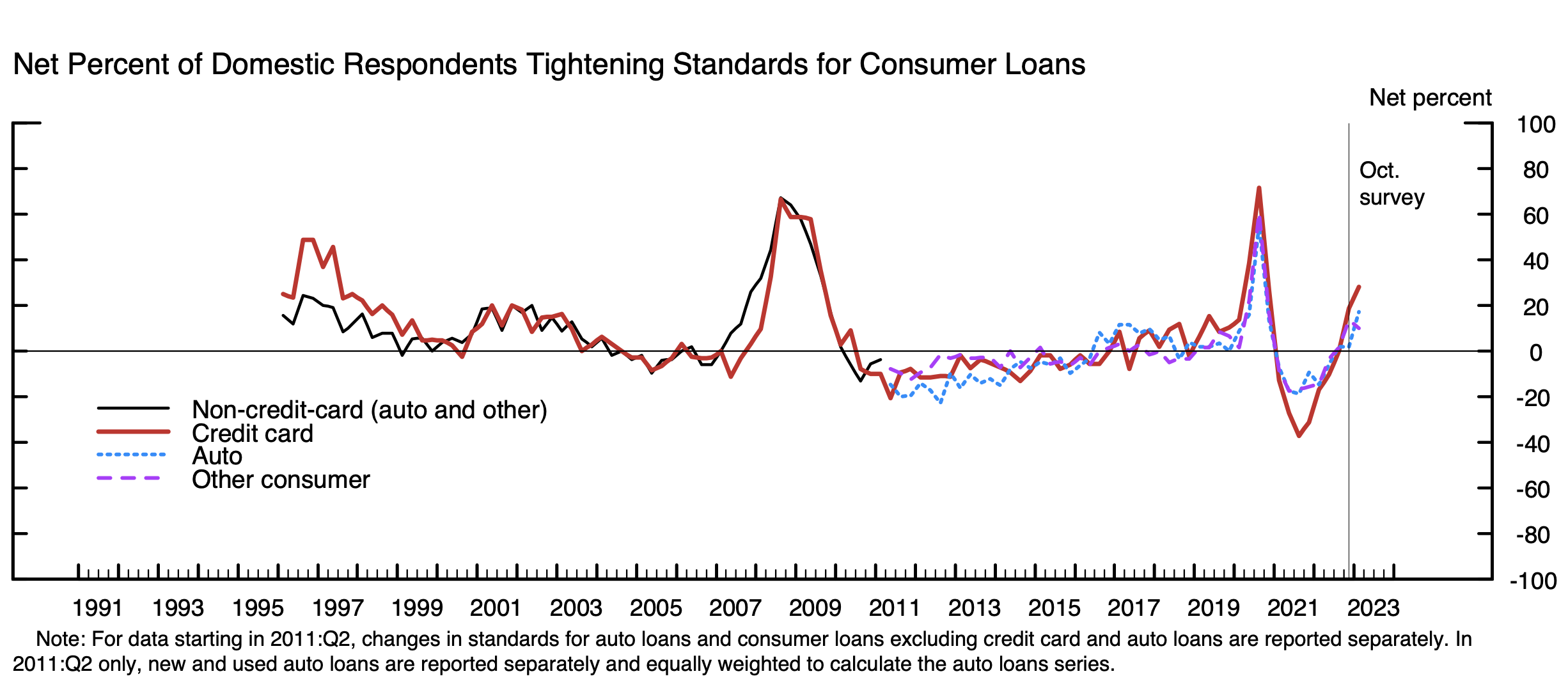

5. Even if the bank crisis gets resolved in the near term, the events of March and April will lead to risk aversion by many banks. Combined with rising credit provisions, banks will continue to tighten lending standards, creating a headwind for economic growth.

Source: federalreserve.gov

Source: federalreserve.gov

According to the Federal Reserve’s Senior Loan Officer Opinion Survey on Bank Lending Practices, banks have been tightening lending standards on loans since July 2022.

The tightening of credit standards is running into increased demand for loans from U.S. consumers.

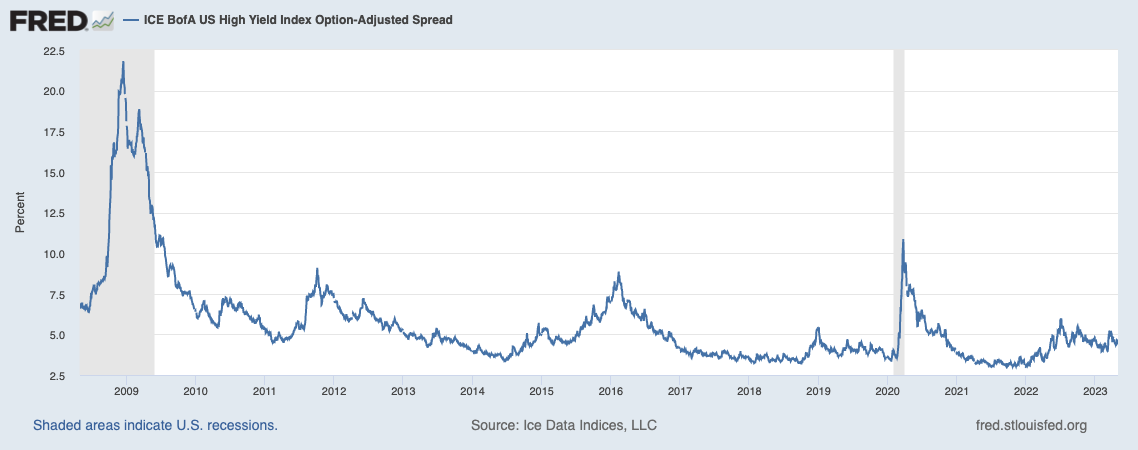

6. The bank funding stress has yet to show up in the high yield debt market as credit spreads remain quite muted relative to prior recessions and crises.

7. Corporate earnings season confirmed businesses are still dealing with cost pressures, though the pressure is moderating.

With 85% of S&P 500 companies having reported earnings, year over year revenue growth was a modest 3.9%. However, earnings declined 2.2%, though less than the 4.6% decline in the prior quarter. Operating profit margins are below their recent peak, and have stopped their rapid decline. With companies facing moderating top line growth and a higher cost of capital, the path of profit margins will assume increased importance.