1. In November, almost every class exhibited a reversal of trend. Global equities rallied, led by non-US equity markets. Long maturity U.S. Treasuries rose in price and the U.S. dollar declined modestly.

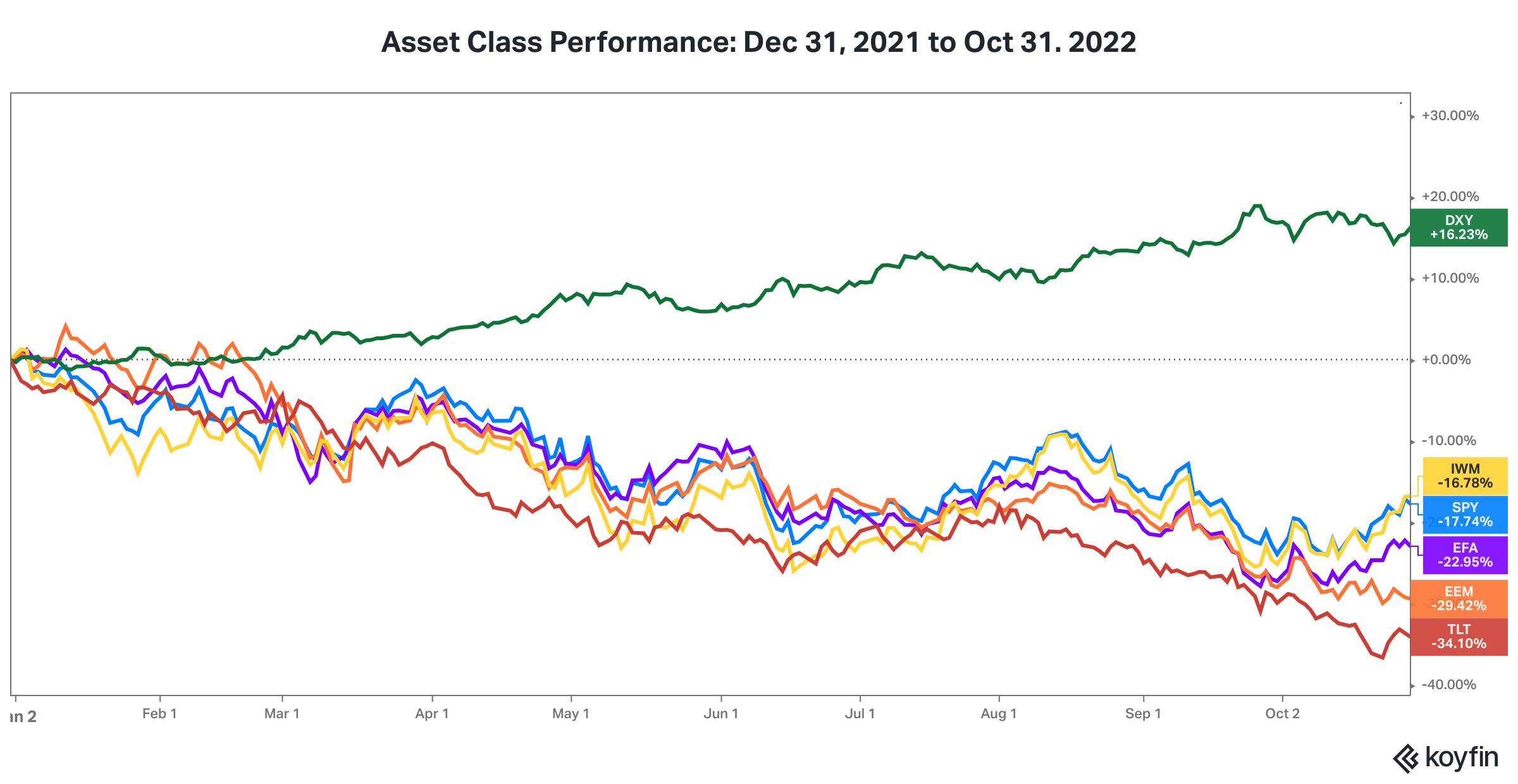

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in purple), EEM (iShares MSCI Emerging Markets ETF in orange), and IWM (iShares Russell 2000 Index ETF in yellow), TLT (iShares 20+ Year Treasury Bond ETF in red) and DXY (U.S. Dollar Index in green) .

Year-to-date, equities and long maturity Treasury portfolios remain significantly underwater.

This chart shows the price performance of SPY (SPDR S&P 500 Index ETF in blue), EFA (iShares MSCI EAFE ETF in purple), EEM (iShares MSCI Emerging Markets ETF in orange), and IWM (iShares Russell 2000 Index ETF in yellow), TLT (iShares 20+ Year Treasury Bond ETF in red) and DXY (U.S. Dollar Index in green) .

2. In October, U.S. inflation rate (as measured by CPI-U) fell to 7.7% from September 8.2% and June’s 9.0% rate, which was the highest annual rate since the 1970s.

The moderation in inflation was likely a contributor to the reversal of the trend of asset class performance. If inflation continues to moderate at the pace experienced in October, it will facilitate an earlier end to the tightening of monetary policy.

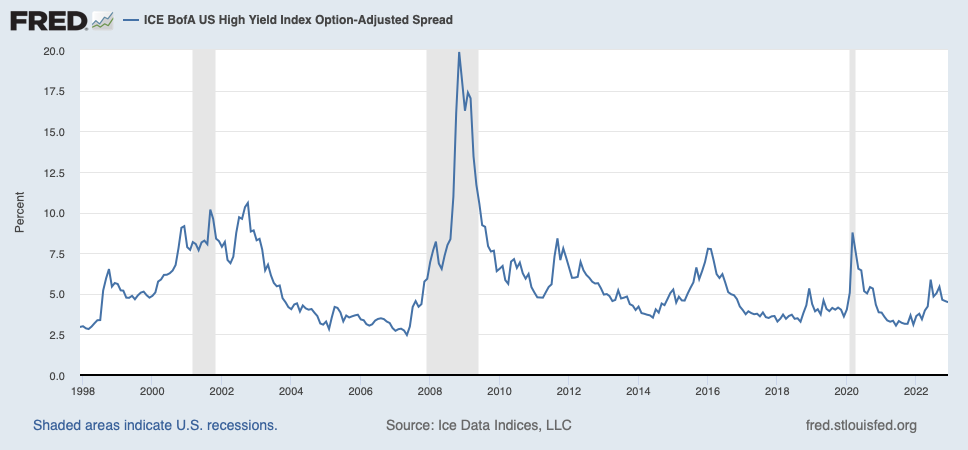

3. While equity risk, interest rate risk, and inflation risk have hammered asset class performance this year, credit risk remains muted. We anticipate the trend in credit risk will drive financial market performance over the course of the next year.

While high yield credit spreads have risen almost 150 basis points year-to-date as of November 30, the level of credit spreads remains quite low compared to the last 25 years. From our perspective, the big question going forward is whether the combination of inflationary pressures, tighter monetary policy, and economic imbalances precipitate a credit crisis.

4. Is the lack of container ship backlog at the Ports of Los Angeles and Long Beach the proverbial canary in the coal mine?

Source: Freightwaves.com

As we noted late last year and earlier this year, strong demand for goods, supply chain issues, and global shipping network challenges led to an unprecedented container ship backlog at the Ports of Los Angeles and Long Beach. The backlog has evaporated. On November 22 and 23, there were no container ships waiting offshore at the ports.

Certainly, the global supply chain has adjusted as pandemic related economic restrictions have been removed. Certainly, there was a pull forward in demand for goods, so there will be a period of below trend demand. However, the labor, equipment, and warehouse issues at the ports have not been resolved. Thus, our concern is the lack of a backlog may be signaling economic weakness.

5. Credit risk has emerged in a few pockets of the economy. most notably in the cryptocurrency industry. The FTX bankruptcy filing was the latest and biggest outbreak of credit risk in the industry. As with almost every credit crisis these days, the cryptonite was financial engineering.

In last month’s monthly update, I noted “Understand cryptocurrencies are illiquid, intangible assets which do not generate cash flows, at least not organically. As a result, they do not represent quality collateral for lending.”

Part of the financial engineering revolved around the concept of yield farming, whereby cryptocurrency owners could lend their cryptocurrency and receive a high interest rate, much higher than rate in a commercial bank savings account or the yield on a money market fund.

This concept befuddled me, as cryptocurrencies do not generate cash flows, so it seemed much riskier than traditional securities lending (applied to stocks and bonds).

Many cryptocurrency companies engaged in yield farming also held low amounts of equity capital, i.e., they were highly levered. Commercial banks are required to hold higher equity capital and the banks even have the benefit of access to the Federal Reserve’s discount window.

In addition, the so-called cryptocurrency exchanges did not operate like traditional stock, commodity, and derivative exchanges, by managing counter-party (credit) risk tightly via daily, and often high, margin requirements.

Lastly, there seems to have been an incestuous relationship between several cryptocurrencies and cryptocurrency companies, meaning the cryptocurrencies and businesses were highly correlated.

Note 1: I am ignoring the allegations of fraud and focusing only on the structural problem of financial engineering, since it relates to my concern about credit risk lurking below the surface of the economy. While frauds can be large, they will be contained. Credit risk in systematic form is the big danger; it is hard to contain.

Note 2: Not all cryptocurrency industry players engaged in financial engineering, as some act as true custodians of customer assets, supported by compliance, risk management, and audit systems.