Here are the top market developments we have been watching in May.

1. Inflation: Are we at the cusp of a paradigm shift?

This chart illustrates the 12 month change in CPI-U index over the last 12 years ending April 30, 2021. The chart also shows the “Core” CPI-U index, which excludes food and energy.

Inflation, as measured by the Consumer Price Index for All Urban Consumers (CPI-U), increased 4.2 percent before seasonal adjustment over the 12 months ending April 30. According to the U.S. Bureau of Labor Statistics data, it represented the largest 12-month CPI increase since September 2008.

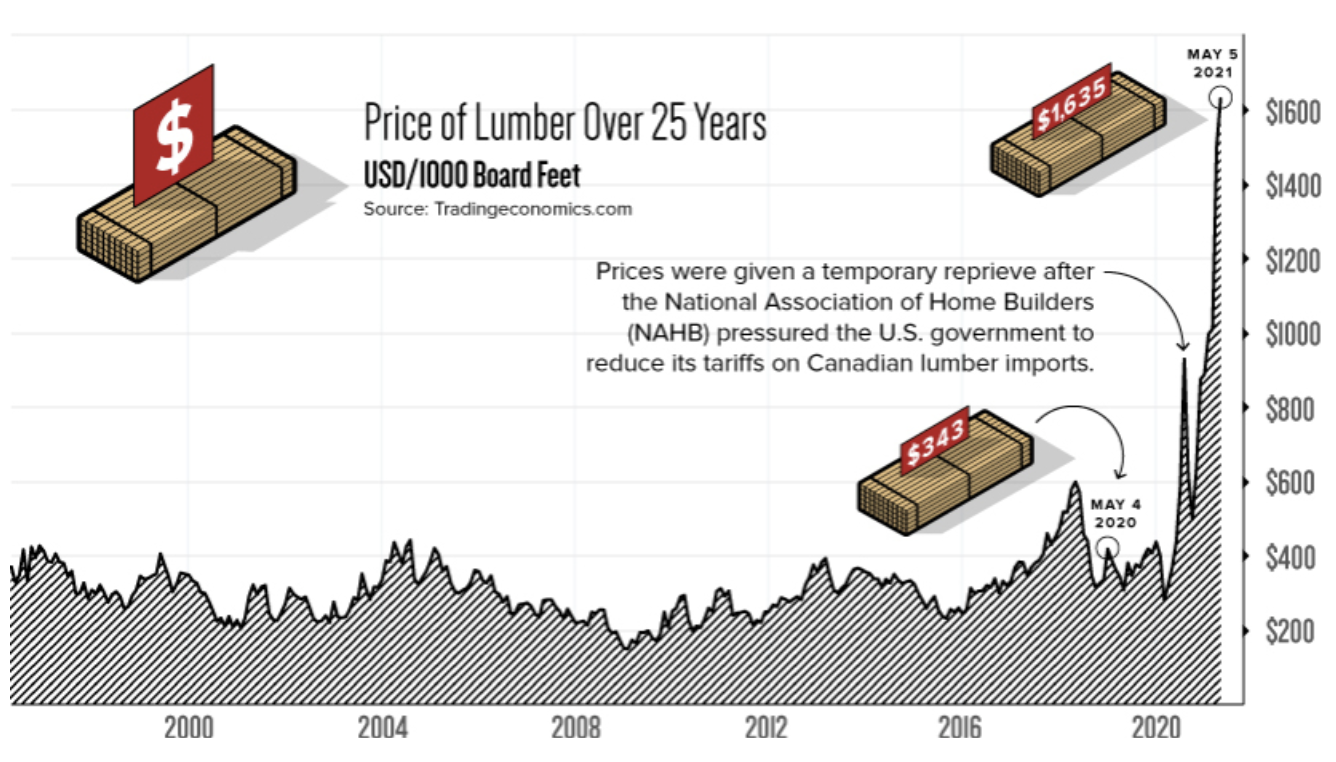

Source: Visual Capitalist. This chart illustrates the price of lumber, in units of 1000 board feet over the last 25 years. The price at the close of the month, May 28, 2021, was $1323.

Alarmingly, the “core” CPI index rose 0.9 percent on a seasonally adjusted basis in April, its largest monthly increase since April 1982. All major components, except medical care services, increased in April. The core index rose 3.0 percent before seasonal adjustment over the last 12 months. Households have experienced a 21% increase in used vehicle prices and an astounding 350% increase in lumber prices (see chart above) over the last 12 months. The core index excludes the more volatile categories of food and energy, and is considered a better indicator of the sustainability of any inflation trend.

This chart illustrates the 12 month change in CPI-U index since 1960. The chart also shows the “Core” CPI-U index, which excludes food and energy.

Is the U.S. entering an inflationary environment the likes of which we have not experienced since the 1970s? “This is the million dollar question right now” in the words of one of our clients. We agree with her thought process. There are major implication for asset allocation and security selection if inflation is upon us.

This chart shows the growth in the money supply, as measured by the M2 money stock over the last 12 years ending April 30, 2021.

The U.S. Federal Reserve’s expansionary monetary policy over the last twelve years has massively boosted the money supply and boosted asset prices, but has neither catalyzed strong economic growth nor unleashed inflation. Any sustained increase in inflation will require an ongoing expansion in demand and a contraction in supply. An ongoing expansion in demand is unlikely, with high levels of debt in the household and corporate sectors, a divided government in Washington, D.C., and a current deflationary impulse from China.

Source: American Enterprise Institute

An ongoing contraction in supply is a more plausible rationale for inflation. A reversal of globalization is possible, as trade tensions have been increasing, the global labor force expansion driven by China is waning, transportation costs are rising, and national security concerns about supply chains are a hot topic. In addition, domestic regulations continue to increase, the U.S. labor force expansion from increasing female participation has waned, and percentage of industries with oligopolist structures or restricted competition has risen. The COVID-19 pandemic has exacerbated supply chain issues. As the chart above illustrates, the goods and services most exposed to globalization and competition have experienced price declines over the last two decades while those more insulated from globalization and competition have experienced price increases. We remain vigilant regarding the supply chain.

High inflation is a menace for investors. There are few assets like Treasury Inflation Protected Securities (TIPS) with a contractual link to inflation. Equities and high yield bonds tend to perform well in the initial stages of inflation as economic activity increases and companies can pass through price increases to customers. However, sustained high inflation makes business planning more difficult and reduces risk appetite. In addition, companies with high debt levels eventually face higher borrowing costs. Most importantly, the ability to push through price increases diminishes so corporate profit margins contract. Real assets like real estate and certain commodities are often viewed as a panacea. However, they come with storage / carrying costs and increased liquidity risk, and are not guaranteed to match or exceed inflation. In summary, inflation is the antithesis of productivity, which benefits the economy and by extension the stock market.

2. Cryptocurrencies took a beating in May. Are they an inflation hedge?

The price of Bitcoin (BTC-USD) declined 38.2% in May. Ethereum (ETH-USD) performed better as its price declined 13.8% over the course of the month. However, the price of Ethereum declined almost 43% from its May 11 peak to month end.

Cryptocurrencies (the non-gimmick ones) may turn out to be viable currency substitutes, but will need to satisfy the store of value, medium of exchange and unit of account requirements. For now, we like to think of them as akin to digital gold, with the added features of being programmable and storable in a wallet. However, there is no reason to believe they are an inflation hedge as their price movements in the month of May demonstrated.

We remain intrigued by cryptocurrencies due to their potential to facilitate decentralized finance. We are believers in the benefits of innovation and its cousin productivity. Decentralization facilitates creativity and innovation. We also believe centralized financial systems are more fragile. Such systems experience large crashes that lead to destructive, emotionally driven investment decisions by many investors. Decentralization offers opportunity to spread risk across a wider set of parties and reduce the negative impact of contagion.

3. Corporate Earnings Season Did Not Disappoint

Last month, we started our monthly market update with the header “Whoa! Earnings feel good. So good. So good.” At that juncture, 60% of S&P 500 companies had reported earnings, with earnings up 45% and revenues up 9% year over year. The earnings results improved slightly in May. With 95% of companies having reported, earnings are calculated to be up 51.9% and revenues up 10.7% year over year, according to FactSet. The main takeaway is S&P 500 companies with higher internationally sourced revenues performed the best, driven by the Asia-Pacific region.

Source: FactSet

This chart shows earnings growth for S&P 500 companies that have reported earnings results by May 21. For the 5% of companies yet to report earnings, the sell-side consensus for earnings and revenue growth was used.

Going forward, we will be closely monitoring corporate earnings and the big three drivers of equity returns (yes, we are ignoring dividends, the fourth driver).

Revenue Growth: The rebound off the pandemic bottom is likely to be sustained in the near term by the massive fiscal stimulus. In the intermediate term, will the rebound be sustained by a transition to private sector driven economic growth?

Profitability: Corporate profit margins are near record highs. Can they be sustained in the face of supply chain pressures and rising labor costs?

Valuations: Depending on the metric being considered, valuations are at or near all time highs. Forecasting future valuation levels is near impossible, but we expect the outcome on the inflationary front to be the primary determinant of valuations in the intermediate term.