Here are the top market developments we have been watching in April.

1. Whoa! Earnings feel good. So good. So good.

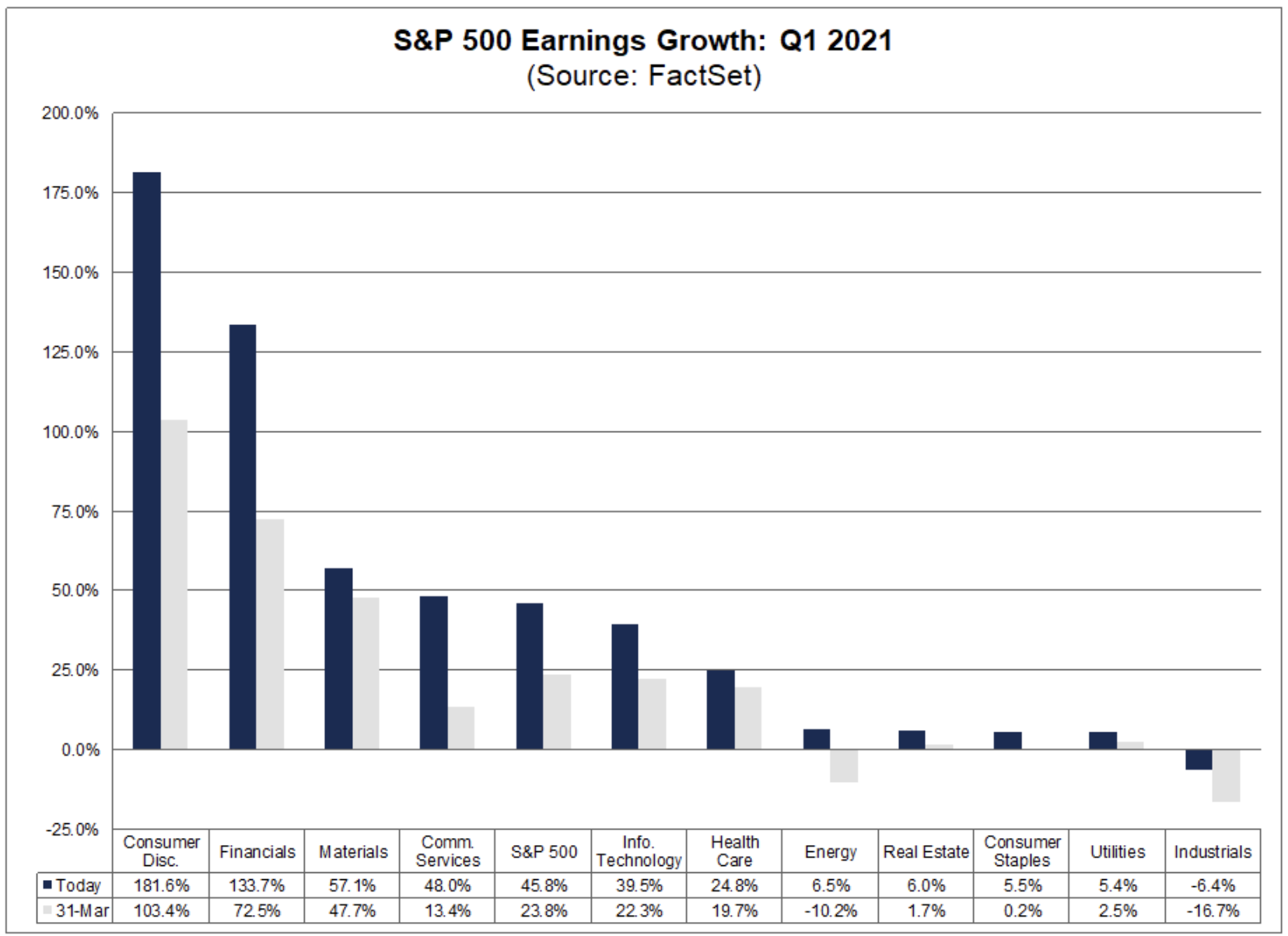

Earnings are up a whopping 45% year over year with 60% of the companies in the S&P 500 have reported Q1 2021 results. Revenues have increased 9%. It feels so good compared to a year ago when earnings declined 14.6% in Q1 2020, per FactSet.

The consumer discretionary, financials, and materials sectors have benefited the most from the rebound in economic activity, showing strong revenue growth and powerful operating leverage.

Source: FactSet

This chart shows earnings growth for S&P 500 companies that have reported earnings results by April 30.

A slowdown in earnings growth is inevitable and well understood by investors since comparisons will get tougher once we annualize the pandemic driven economic trough of 2020. We are monitoring several other variables as they will likely be the primary determinants of equity market performance over the next year or two.

2. The enacted fiscal stimulus is massive and will boost revenue growth over the next few quarters.

Fiscal spending from the American Rescue Plan of 2021 has already started to flow into the U.S. economy. The $1.9 trillion in spending represents 9% of U.S. GDP. Since the outbreak of the pandemic in the U.S., the total approved fiscal spending has approached 25% of GDP, almost five times the amount spent to boost the economy during the 2008 Financial Crisis.

While the tailwind to company revenues will be large, if the stimulus does not ignite a sustainable boost to economic activity in the private sector, the stock market won’t feel so good when the benefit of the stimulus wanes in 2022.

3. To keep the good times rolling, the Biden Administration has proposed spending trillions more. The Taxman Cometh.

Only one thing seems certain. Higher taxes will be included in any spending bill. The tax pain will arrive much sooner than the spending boost. In other words, equity markets will face a potential earnings and cash flow air pocket. At a minimum, after tax profit margins will decline. Top line revenue might take a hit too.

4. The massive fiscal stimulus is exacerbating supply chain issues resulting from the economic lockdowns and the recent rapid activity rebound. Inflation Cometh, at least temporarily, and will likely pressure profit margins.

In last month’s update (here), we discussed the ongoing semiconductor shortage. On April 28, auto maker Ford warned it may have to cut production of vehicles by as much as 50% due to the shortage.

This chart illustrates the increasing capacity utilization for semiconductor fabrication facilities, an indication of the shortage of available supply to meet demand.

Supply chain issues, along with increased demand, have also led to breathtaking price increases for many commodities. For example, lumber prices have quadrupled over the last year.

Source: Bloomberg, CME

While some industries and companies will be beneficiaries of higher prices, the net effect on the equity market earnings will be negative. However, with most commodities, the cure for low prices is low prices. For high inflation to persist, structural changes or secular changes are necessary, given the current excess supply of labor and capital globally. We would be more concerned about inflation if the world experienced a sustained global supply shock such as a large expansion of trade restrictions.

5. Many U.S. businesses are reporting a labor shortage. There is political pressure for higher minimum wages.

Higher labor costs are a headwind to profit margins. The labor shortage appears to be due to a combination of attractive unemployment benefits, COVID-19 health fears, and lack of affordable child care. These factors will wane as the time passes, all schools reopen for in-person education, and the pandemic wanes. At April month end, non-farm payrolls are approximately 7 million jobs short of the prior peak in February 2020.

Source: Argent Financial

To the extent the economy is undergoing a secular transition, accelerated by the pandemic, and some of labor shortage is due to a skills mismatch, some wage pressures will remain.

6. Interest rates don’t seem to be signaling sustained inflationary pressures.

Source: treasury.gov

Long-term interest rates spiked in the first quarter of 2021 as economic activity rebounded and deflationary pressures eased. The rate rise hammered the prices of long-maturity high-quality bonds. However, the rate rise stalled in April.

6. Our immediate concerns about credit risk have eased. However, credit risk and financial leverage remain one of our biggest concerns.

The rebound in economic activity has alleviated the financial stress on many businesses. High yield bonds spreads have compressed from over 1000 basis points at the peak of the pandemic fears in 2020 and are approaching a measly 300 basis points.

Source. St. Louis Federal Reserve Bank

From a near term equity market perspective, the concern is the recent spike in margin debt. Any event that precipitates a large margin call could create a short term air pocket.

Source: Yardeni Research

Of greater concern is the rise in U.S. corporate bonds outstanding to $10.5 trillion, representing an annualized increase of 5.77% over the 20 years ending December 31, 2020.

Source: SIFMA

In contrast, US. GDP has only increased by an annualized 3.66% over the same 20 year period ending December 31, 2020. So the corporate debt burden has increased. Admittedly, interest rates, as measured by ten year Treasury yields have declined by around 350 basis points over the last 20 years, so the interest rate burden has not increased.

Therein lies the conundrum. The U.S. economy, and global economy too, have been ever reliant on debt growth, first in the private sector and now in the public sector, to boost economic activity and offset muted labor force growth and productivity. The best solution to drive sustainably higher real economic activity is better incentives. However, the U.S. government’s stated solution now seems to be higher inflation.

Higher inflation, if achieved, will boost nominal economic growth and corporate revenues but will impact many companies via higher costs, lower profit margins and increased interest burden. Credit risk will eventually seize the limelight. It is why we remain focused on companies with valuable intangible assets. Intangibles can help facilitate innovation, generate higher productivity, and navigate bumps in the road and stormy seas. In other words, they can help us feel good and stay invested when volatility returns.