What is the most significant risk in quant (and all active) investing today?

The First Moment (the mean)

The Second Moment (under-estimating tracking error)

The Third Moment (skewness, left tails, crash risk)

Mis-specified risk model (hidden factor biases, factors ‘eating’ alphas)

Sub-optimal portfolio construction methodology (error maximization)

Higher than expected transaction costs

Individual stock risk

Quants typically chose 2, 3, 4, 5 and 6.

In my view, the most important risk in active investing is #1: The First Moment.

This is the no-alpha risk = strategy does not outperform the benchmark = the long-term mean <=0

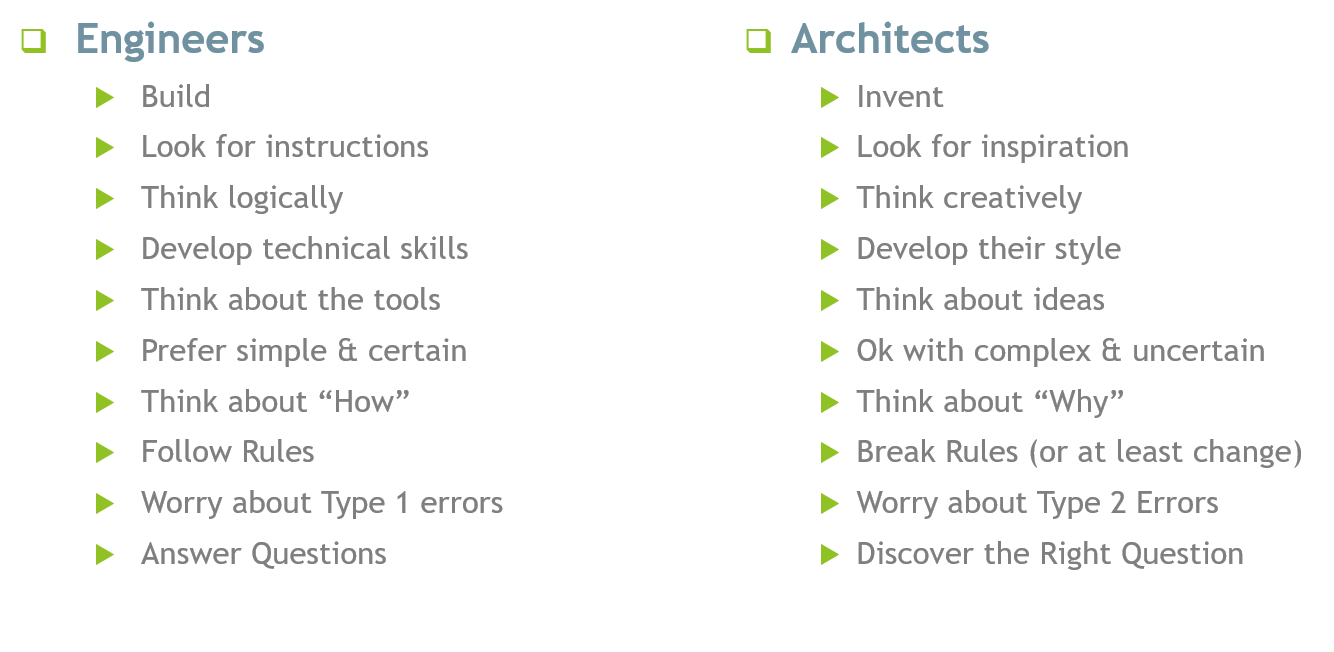

The lack of alpha in the industry is not news, and many are trying their best, but I believe the reason more effort is not producing better results is because we are trying to solve the alpha risk as an engineering problem rather than an architectural one.

Today’s quants are already very well equipped to deal with risks 2 through 7. These risks have engineering-friendly convergent solutions. 50 years ago, some of these other risks might have been at the top of my list, but after decades of advances in these areas, these risks are much less problematic than the First Moment Risk (as a side: in total portfolio mandates from the asset owner’s viewpoint, Crash Risk #3 is still very much alive and real).

If one agrees that alpha is the most important risk and that the other risks have been pretty much tamed, then why are we not spending 95% of our time and resources on radically addressing risk #1?Risk #1 doesn’t come with “an instruction manual” although many prefer to see academic papers as such. For example, trying to call alpha a risk-premium, is an attempt to categorize alpha as an engineering problem. Instead, risk #1 requires architecture-like thinking in order to come up with a solution that hasn’t been written about yet. Engineering is an essential part of making ideas come to life. Yet, the quality of ideas depends on innovation, style, and divergent thinking.

Source: Innovation Workshop by Two Centuries Investments

Jim Simons, the founder of the highly successful Renaissance Technologies hedge fund, summed up his magic formula for divergent thinking in an interview last week:

“Be guided by beauty, Beauty is an aesthetic. There is beauty in things that work really well — the way a company is run, or the way a theorem comes out” - Quant pioneer James Simons on math, money, and philanthropy, MIT Sloan.

As one head quant portfolio manager of a large investment firm recently told to me: “Finding a dream quant is like finding a unicorn”. It’s hard to expect that one person can be great at innovation and execution. This poses an important question: what does a harmonious introduction of creative talent look like?

I would suggest that introducing a more diverse set of thinkers can be of great help: how about English and philosophy majors, designers, architects, journalists, historians, psychologists, advertising creatives, artists and musicians? What kind of fresh questions and new ways of identifying a company’s success would they formulate? These ideas could be screened and translated into metrics. Many average ideas might come out of that, but I would suggest that some great insights would be generated as well. Even if some of these new ideas don’t work out individually, collectively, they will be generate the progress of innovation, decreasing the model’s type 2 errors.

Similar to the traits of great leaders, alpha calls for an increased comfort with chaos. In his famous 2004 article, Harvard management professor Abraham Zaleznik compares leaders and managers in the following way:

“The difference between managers and leaders, he wrote, lies in the conceptions they hold, deep in their psyches, of chaos and order. Managers embrace process, seek stability and control, and instinctively try to resolve problems quickly—sometimes before they fully understand a problem’s significance. Leaders, in contrast, tolerate chaos and lack of structure and are willing to delay closure in order to understand the issues more fully. In this way, Zaleznik argued, business leaders have much more in common with artists, scientists, and other creative thinkers than they do with managers. Organizations need both managers and leaders to succeed, but developing both requires a reduced focus on logic and strategic exercises in favor of an environment where creativity and imagination are permitted to flourish.”

This might appear as a radical shift for traditional investment firms, but for inspiration we can look at successful technology firms that have successfully combined the cultures of architecture and engineering and delivered significant value to the customer. I would suggest that the most significant risk can be reshaped into the most significant opportunity when seen from the eyes of architecture.

PS. Say no to the open office plan if you want to foster creative thinking, see details here.