Here are the top market developments on our radar.

1. Inflation is a concept about which we all know frighteningly little. Its path will have a big influence on financial markets in 2022.

In the highly acclaimed movie Spider-Man: No Way Home, Doctor Strange tell Peter Parker “The multiverse is a concept about which we know frighteningly little”. Sometimes, I feel the same way about inflation.

Source: marvel.com

For over a year, as many consumers and businesses highlighted rising prices, the Federal Reserve downplayed the inflationary pressures as reflecting transitory factors. On December 10, 2021, the Bureau of Labor Statistics announced the Consumer Price Index rose at a 6.8 percent annual rate for the 12 months ending November, the largest 12-month increase since the period ending June 1982.

Five days later, at its December policymaking meeting, the Federal Open Market Committee reversed course. The FOMC written statement was notable for the absence of the phrase “some inflationary largely reflecting factors that are expected to be transitory” which appeared in the statement coincident with previous policymaking meeting on November 3. The Committee also announced tighter monetary policy via a slower pace of purchases of Treasury securities and agency mortgage-backed securities in its Quantitative Easing program.

In sharp contrast, analysts surveyed by FactSet project the inflection point for inflation has already occurred. According to the analyst consensus, a steep decline will ensue beginning around the second quarter 2022.

I am not as sanguine as the FactSet analyst consensus. The good news is the demand for final goods will moderate as the demand for services picks back up, the global transportation network will adapt, and the period of double ordering of materials, particularly semi-conductors, is in the rear view mirror. However, the supply of labor hasn’t rebounded to pre-pandemic levels and oil supply growth is constrained. The global supply chain is also in need of a redesign, especially as tensions continue to rise between the US and China. In summary, the path of inflation remains uncertain. We continue to collect and analyze data.

2. Can the US equity market continue its run of large outperformance? Highly unlikely.

The US stock market outperformed in December.

This chart shows the performance of SPY (SPDR S&P 500 ETF Trust) in blue, EFA (iShares MSCI EAFE ETF) in purple, and EEM (iShares MSCI Emerging Markets ETF) in orange.

The US stock market significantly outperformed in 2021.

This chart shows the performance of SPY (SPDR S&P 500 ETF Trust) in blue, EFA (iShares MSCI EAFE ETF) in purple, and EEM (iShares MSCI Emerging Markets ETF) in orange.

The US stock market massively outperformed over the last ten years.

This chart shows the performance of SPY (SPDR S&P 500 ETF Trust) in blue, EFA (iShares MSCI EAFE ETF) in purple, and EEM (iShares MSCI Emerging Markets ETF) in orange.

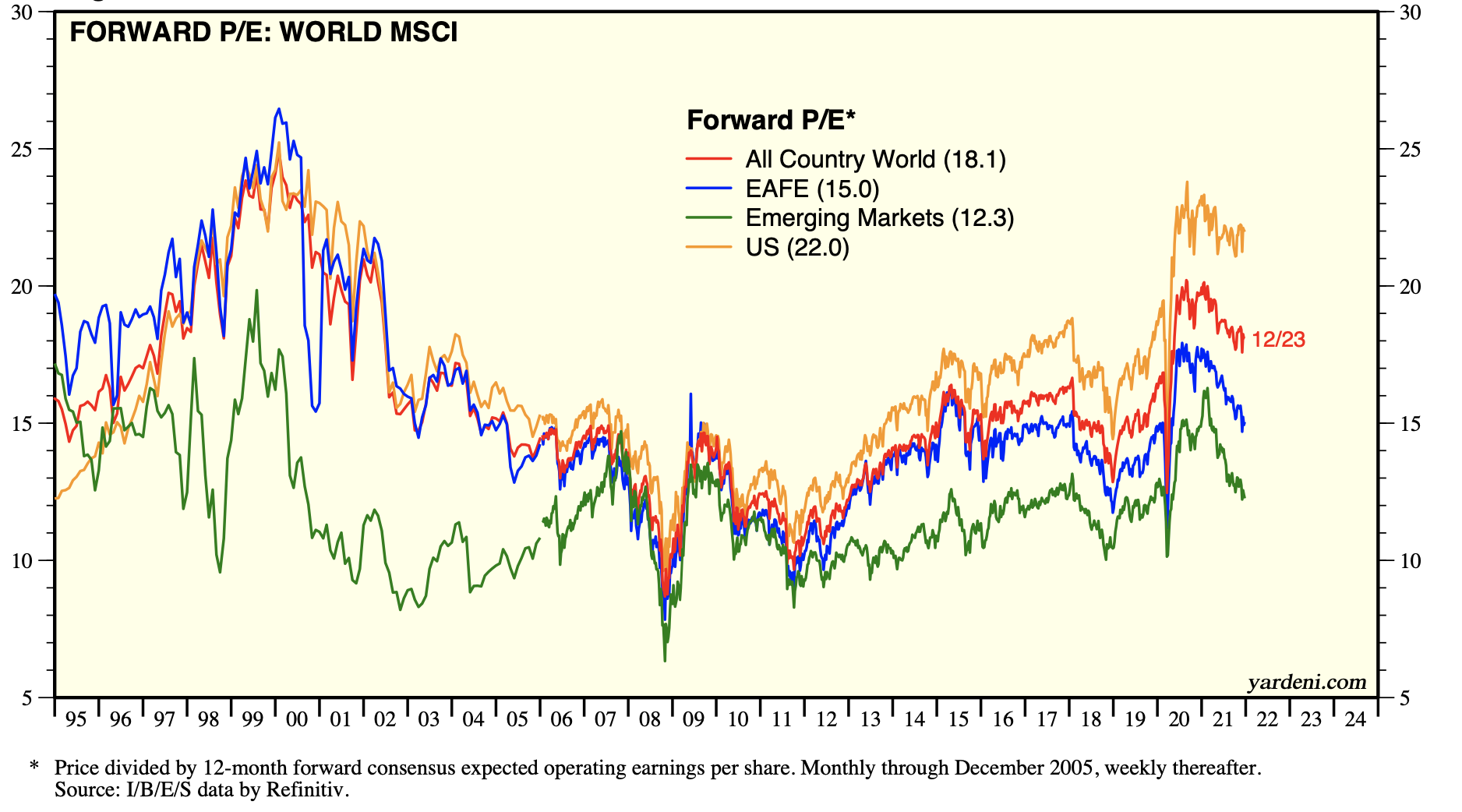

While some of the US equity market outperformance can be explained by superior fundamentals (stronger earnings growth, high free cash flow generation) and the creation of valuable intangible assets by US companies, the valuation gap between the US and rest of the world has become extended.

Source: Yardeni Research

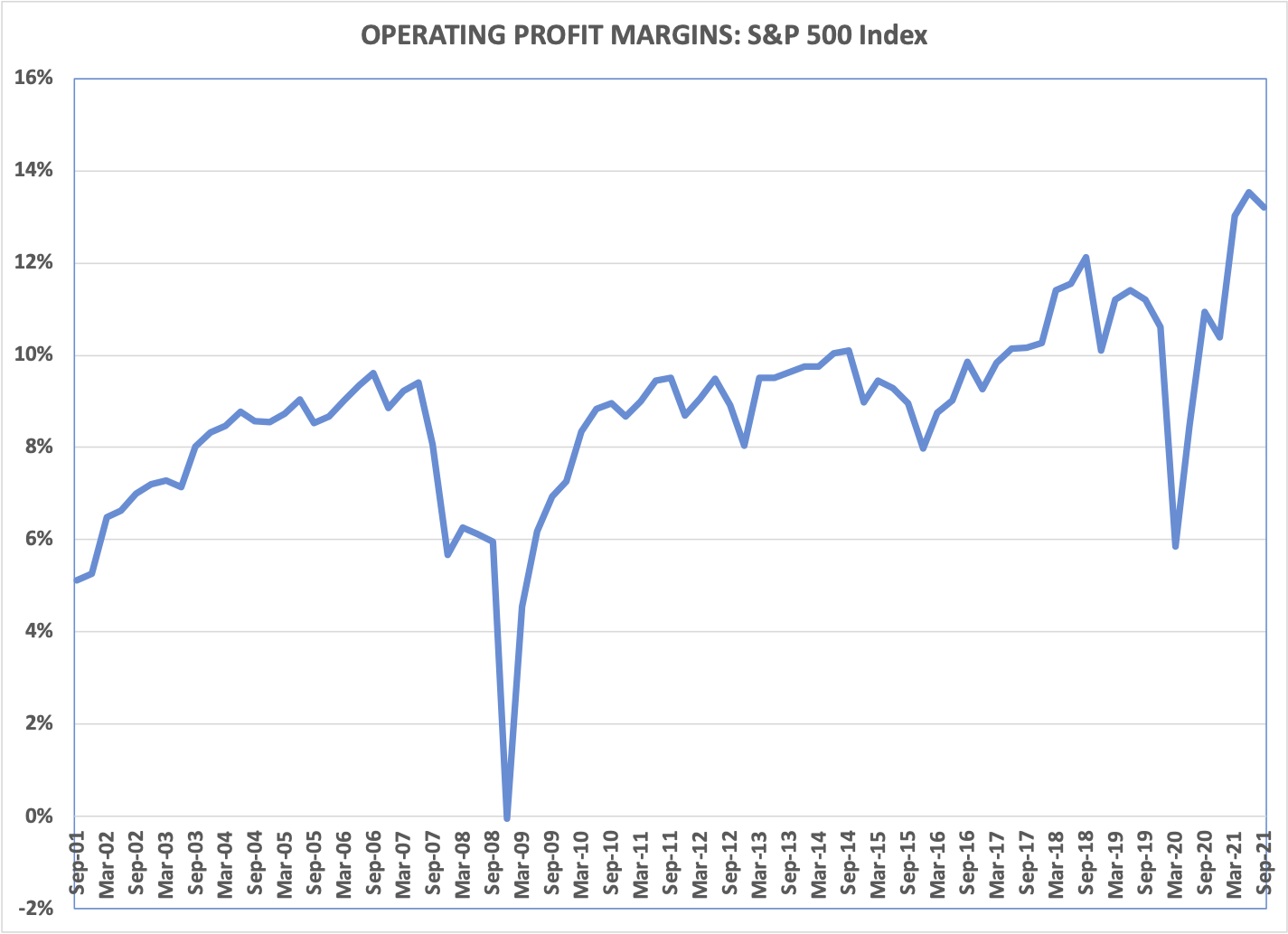

Any revenue and earnings disappointments in the US and / or improvements in business fundamentals in the rest of the world could lead to underperformance by US equities. As we noted in last month’s market update, S&P 500 operating margins and US equity valuation multiples are near all time highs.

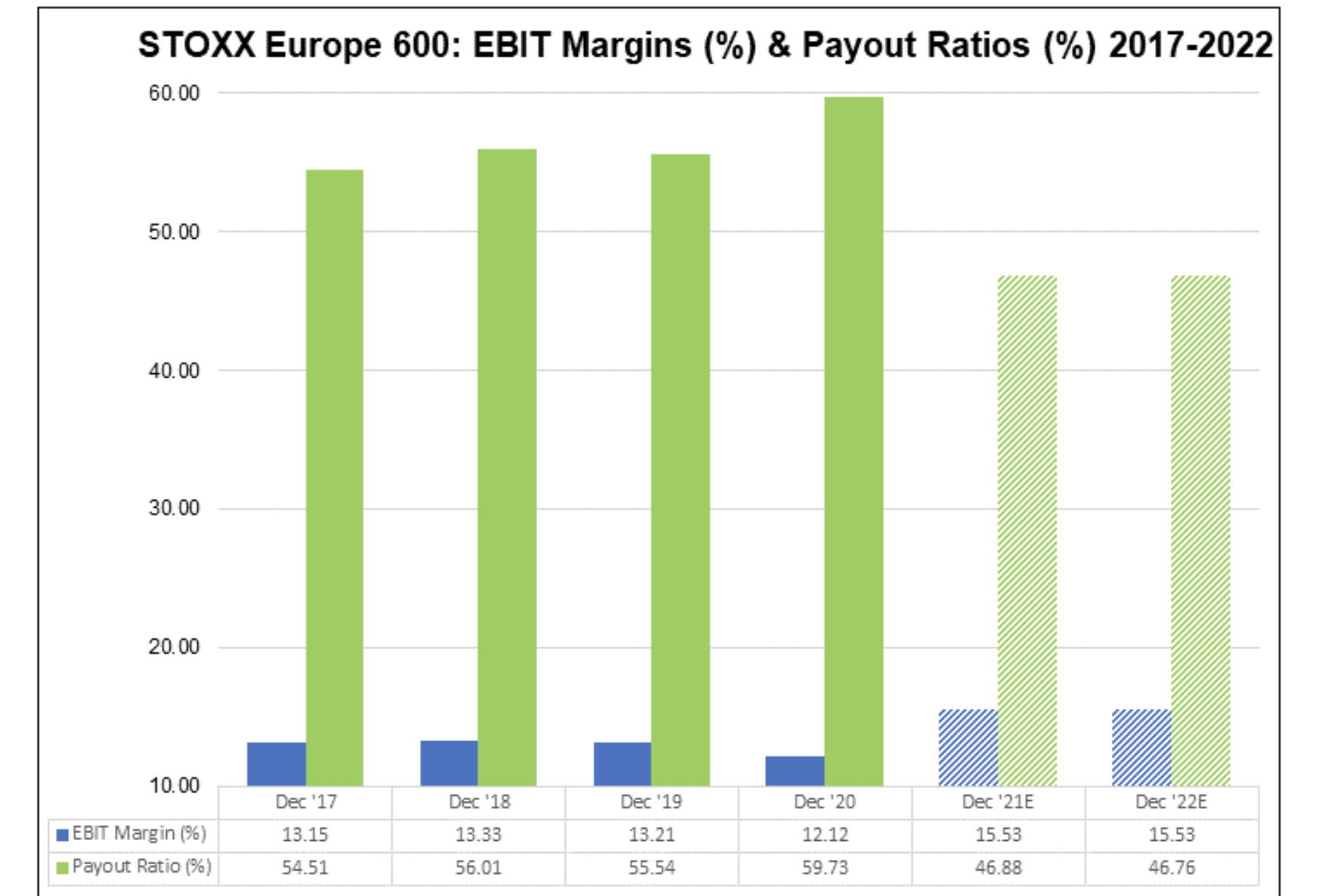

In Europe, analysts are predicting the EBIT margin for the STOXX Europe 600 in 2021 and 2022 will exceed 15%, the highest EBIT margin over the past decade. The focus on improving productivity and maintaining a healthy operating margin will likely support valuation multiples, which are well below peak levels.

Source: FactSet

3. Evidence continues to accumulate that oil supply growth will be constrained.

The rise of renewable energy, criticism from politicians and the ESG investor community, weak earnings growth and lagging stock price performance have made oil companies quite unpopular. These factors have led to a renewed focus by oil companies on Return On Invested Capital (ROIC), an associated reduction in exploration and production spending (lower capital spending), increased dividends, higher share buybacks, debt reduction, and more industry consolidation. The result has been a massive decline in oil discoveries, to the lowest level in 75 years.

Note: 2021 discoveries are as of November 2021

Constrained oil supply growth likely means sustained high oil prices, a headwind for global economic growth. My spidey-sense is tingling, indicating there are some excellent investment opportunities in the oil exploration & production industry.