In the past, I shared thoughts about the need to combine creative and organized thinking in order to generate investment alpha. “A robust investment process” and “a strict disciplined application” are concepts that one often hears in typical quant and fundamental investment teams. These are important but not sufficient to generate out-performance.

In addition, readers know that I believe that quant investing can benefit both from the long-run (here, here, here, here) and the creative (here, here, here, here) angles.

By studying 200 years of creativity in language, this paper does both!

It came out in Nature* earlier this year. Here are some highlights:

We first develop a new linguistic measure to measure historical changes in tightness–looseness.

Analyses show that America grew progressively less tight (i.e., looser) from 1800 to 2000.

We next examine how changes in tightness–looseness relate to …indicators of creative output: registered patents, trademarks, feature films produced, and baby-naming conformity.

These findings imply that the historical loosening of American culture was associated with a trade-off between higher creativity but lower order.

What makes this paper even cooler is that the authors provide both the data and the code.

The paper trains its natural language processing algorithm on 1 trillion words from Google News and applies it to the language used in two centuries of Google Books from 1800 to 2000.

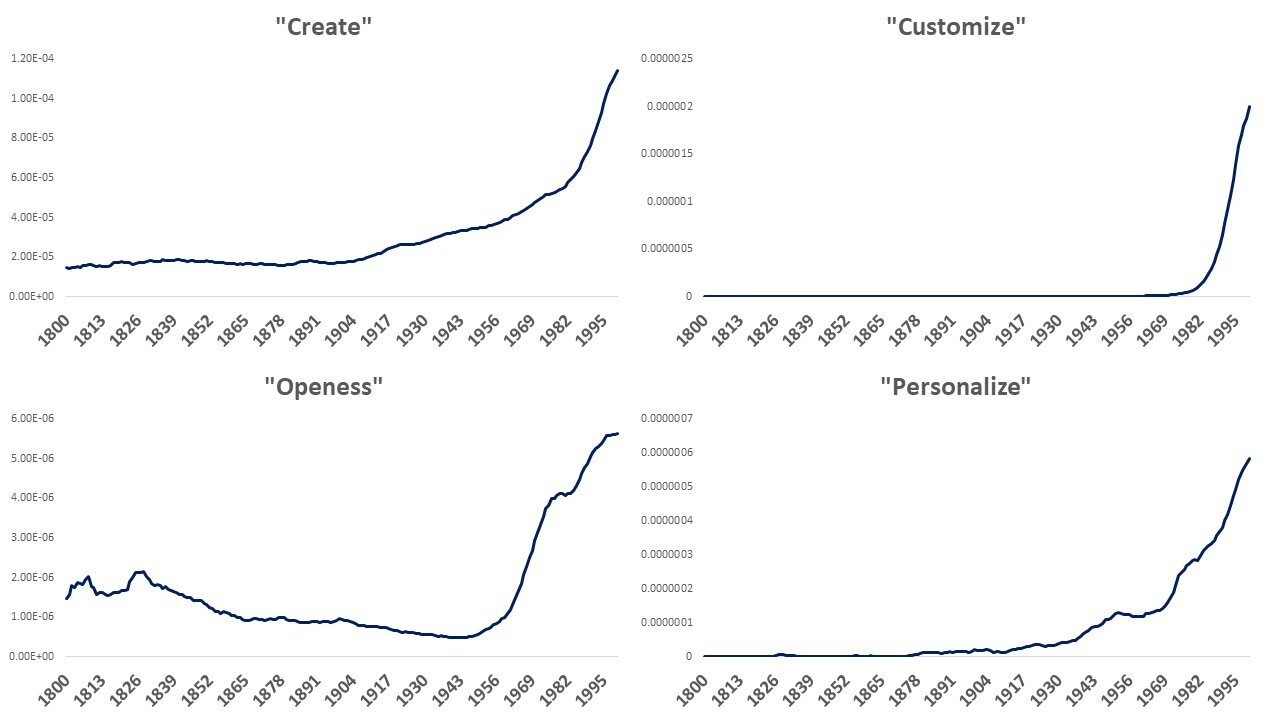

Here are the frequencies of some of the terms that reflect the cultural ‘looseness’ over time:

Now, let’s contrast that with the frequency of terms that measure cultural ‘tightness’:

The paper observes that “changes in cultural tightness appeared to temporally precede changes in three of the four measures: naming conformity, feature film production and trademark applications. Changes in patent applications, however, appeared to occur together with changes in cultural tightness, showing less evidence of temporal precedence”.

The paper concludes that: “cultural tightness decreased from 1800 to 2000 in the United States and that decreases in cultural tightness over this time period correlated with decreases in order but increases in creativity.”

Economic Productivity is the equivalent of Investment Alpha and both rely completely on continuous innovation (see more here). At the macro level, the U.S. has succeeded after a century of innovation as evidenced by the changing narrative of language. Have the same attributes that drive innovation propagated enough into the investment industry culture?

In addition, while the trends in general openness are clear, I did notice a couple terms that showed a recent slow down or even a full reversal.

It is likely too big of a stretch to say that these cultural shifts have led to the slow down in investment innovation. However, I do think that these trends are something to watch out for at the individual firm/team level. Is there enough ‘freedom’, ‘leeway’ and ‘broadmindedness’ in your investment process? Is there a sense of ‘limitless’ opportunity in your search for alpha?

*Jackson, J.C., Gelfand, M., De, S. et al. The loosening of American culture over 200 years is associated with a creativity–order trade-off.Nat Hum Behav 3, 244–250 (2019)